Citi analyst Christopher Allen has revised the price target for BlackRock (BLK, Financial), reducing it from $1,200 to $1,100. Despite this adjustment, Allen maintains a Buy rating on the stock. This revision follows the firm's recent adjustments after BlackRock's first-quarter report.

Allen points out that BlackRock remains strategically positioned in the current market climate. The company's strength lies in its expansive exchange-traded fund (ETF) platform and a robust connection to the fixed income sector. Additionally, BlackRock's growing alternatives platform further supports its favorable outlook.

Overall, the analyst suggests that these elements contribute positively to BlackRock's potential performance in the coming periods, justifying the continued Buy recommendation despite the slight reduction in the target price.

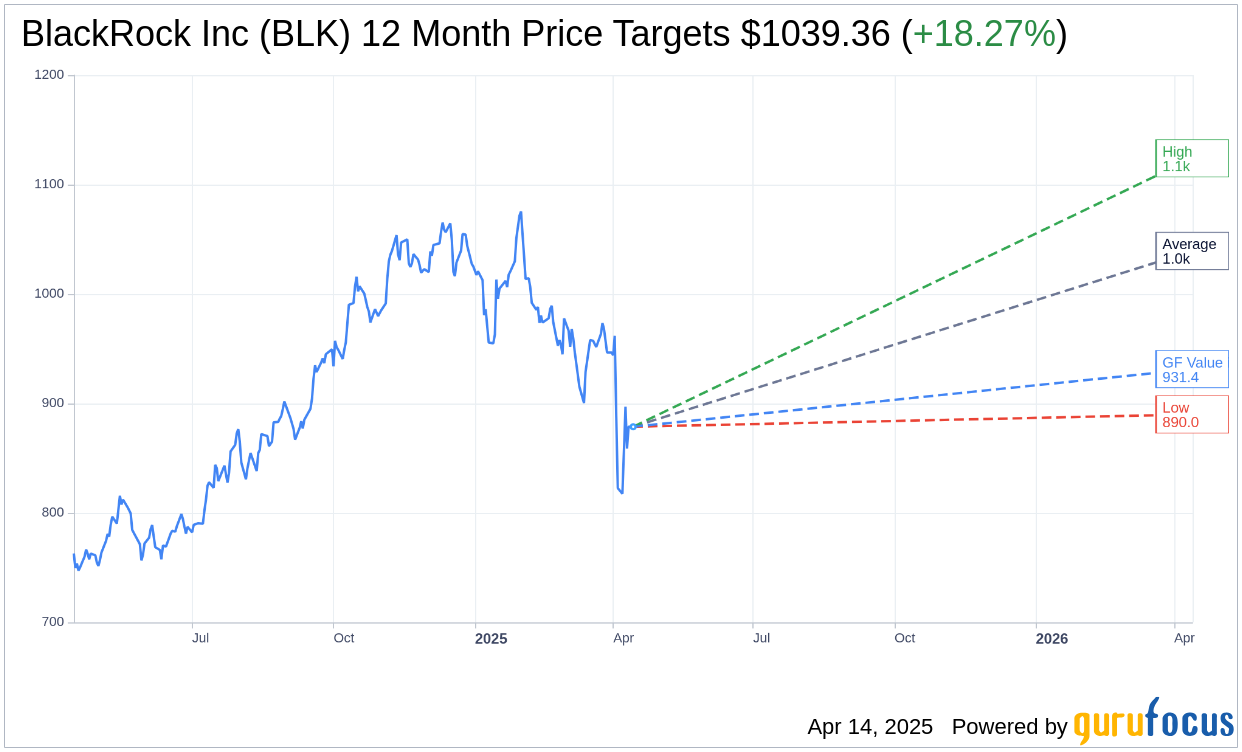

Wall Street Analysts Forecast

Based on the one-year price targets offered by 15 analysts, the average target price for BlackRock Inc (BLK, Financial) is $1,039.36 with a high estimate of $1,124.00 and a low estimate of $890.00. The average target implies an upside of 18.27% from the current price of $878.78. More detailed estimate data can be found on the BlackRock Inc (BLK) Forecast page.

Based on the consensus recommendation from 18 brokerage firms, BlackRock Inc's (BLK, Financial) average brokerage recommendation is currently 1.9, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for BlackRock Inc (BLK, Financial) in one year is $931.40, suggesting a upside of 5.99% from the current price of $878.78. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the BlackRock Inc (BLK) Summary page.