- Acushnet Holdings Corp (GOLF, Financial) shows a consistent increase in earnings per share, growing by 14% annually over three years.

- The company maintains stability with 3.2% revenue growth and aligned shareholder interests, thanks to significant insider stock holdings.

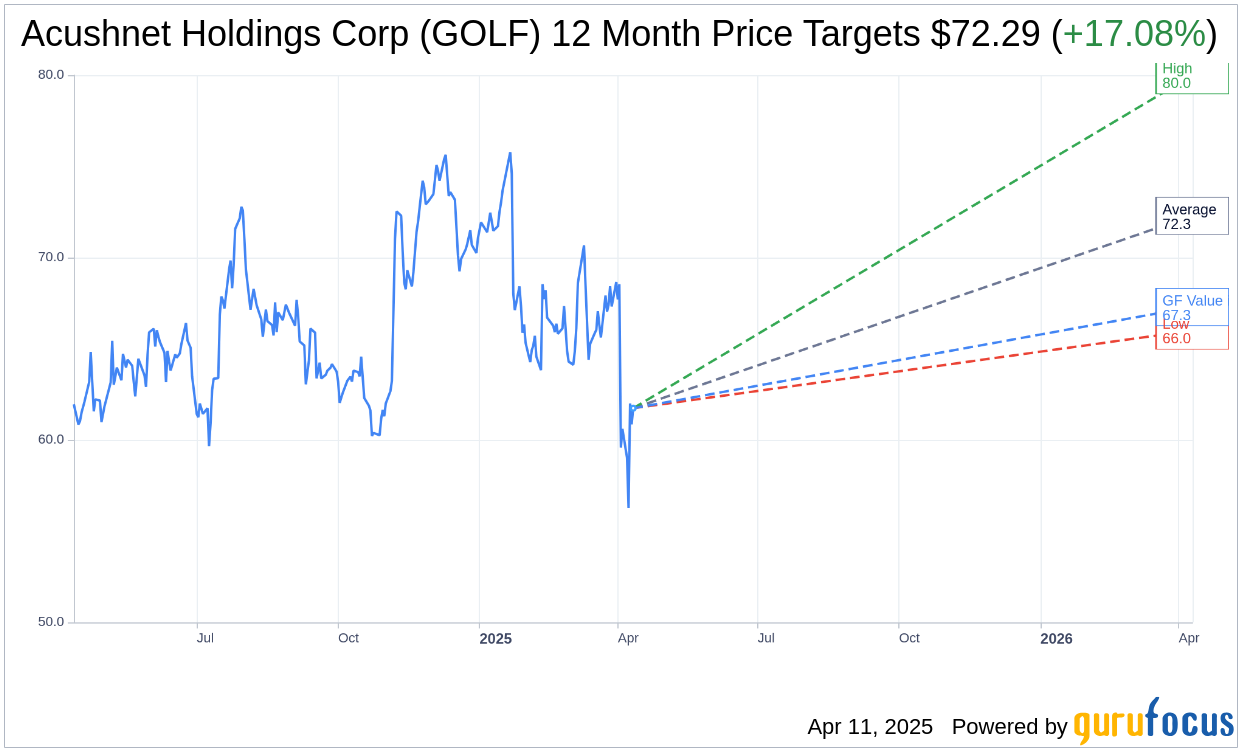

- Wall Street analysts predict a potential upside of over 17%, with a price target range between $66.00 and $80.00.

Acushnet Holdings Corp (NYSE: GOLF) continues to exhibit strong financial performance with a notable 14% annual increase in earnings per share (EPS) over the past three years. This growth reflects the company's solid financial health and strategic management practices.

Revenue Growth and Shareholder Alignment

Over the past year, Acushnet has seen its revenue grow by 3.2%, reaching $2.5 billion, while successfully maintaining stable Earnings Before Interest and Taxes (EBIT) margins. This balance between growth and stability is crucial for long-term investor confidence. Notably, insiders hold $109 million in company stock, which ensures their interests are well-aligned with those of the shareholders.

Stock Price Targets and Analyst Recommendations

According to the latest analysis from seven Wall Street analysts, Acushnet Holdings Corp (GOLF, Financial) is poised for a promising future, with an average one-year price target of $72.29. This target suggests a significant upside potential of 17.08% from the current stock price of $61.74. The price targets range from a high of $80.00 to a low of $66.00. Investors can find more detailed estimate data on the Acushnet Holdings Corp (GOLF) Forecast page.

The consensus recommendation from eight brokerage firms places Acushnet Holdings Corp (GOLF, Financial) at an average rating of 2.8, which corresponds to a "Hold" on the rating scale where 1 signifies a Strong Buy and 5 denotes a Sell. This rating suggests a cautious approach among analysts, recommending that investors maintain their positions.

GF Value and Future Outlook

GuruFocus projects the estimated GF Value for Acushnet Holdings Corp (GOLF, Financial) to be $67.29 in one year. This estimation indicates a potential upside of 8.99% from the current market price of $61.74. The GF Value is GuruFocus' proprietary measure of what a stock is worth, based on historical valuation multiples, previous business growth, and expected future performance. For more comprehensive insights, visit the Acushnet Holdings Corp (GOLF) Summary page.