Exploring the Investment Moves of Jerome Dodson (Trades, Portfolio) in Q1 2025

Jerome Dodson (Trades, Portfolio) recently submitted the N-PORT filing for the first quarter of 2025, providing insights into his investment moves during this period. Jerome L. Dodson is the Founder and President of Parnassus Investments. He was the lead Portfolio Manager of the Parnassus Fund and the Parnassus Asia Fund and the sole Portfolio Manager of the Parnassus Endeavor Fund (now the Parnassus Value Equity Fund (Trades, Portfolio)) until he stopped managing money for the firm at the end of 2020, though he remains Chairman of the Board. Prior to founding Parnassus Investments in 1984, he served as President and Chief Executive Officer of Continental Savings of America from 1976 to 1982, where he started the "Solar T-Bill" program to finance solar energy installations and also developed innovative programs to finance low and moderate income housing. Mr. Dodson received his bachelor's degree in political science from the University of California, Berkeley and his master's degree in business administration from Harvard Business School. Affiliated Managers Group gained control of Parnassus in mid-2021 after acquiring a majority stake in the firm. The Parnassus Mid Cap Growth Fund invests in U.S. mid-cap companies with long-term competitive advantages, quality management teams and good ESG practices. It also looks for companies that are gaining market share and have long runways for growth through established business models and proven financials. It also avoids highly leveraged companies and those associated with the production of fossil fuels, tobacco, alcohol and certain other industries.

Summary of New Buy

Jerome Dodson (Trades, Portfolio) added a total of 9 stocks, among them:

- The most significant addition was AppLovin Corp (APP, Financial), with 68,447 shares, accounting for 2.49% of the portfolio and a total value of $18.14 million.

- The second largest addition to the portfolio was SanDisk Corp (SNDK, Financial), consisting of 329,563 shares, representing approximately 2.15% of the portfolio, with a total value of $15.69 million.

- The third largest addition was BILL Holdings Inc (BILL, Financial), with 333,734 shares, accounting for 2.1% of the portfolio and a total value of $15.32 million.

Key Position Increases

Jerome Dodson (Trades, Portfolio) also increased stakes in a total of 2 stocks, among them:

- The most notable increase was The Trade Desk Inc (TTD, Financial), with an additional 179,642 shares, bringing the total to 383,458 shares. This adjustment represents a significant 88.14% increase in share count, a 1.35% impact on the current portfolio, with a total value of $20.98 million.

- The second largest increase was PTC Inc (PTC, Financial), with an additional 14,083 shares, bringing the total to 106,415. This adjustment represents a significant 15.25% increase in share count, with a total value of $16.49 million.

Summary of Sold Out

Jerome Dodson (Trades, Portfolio) completely exited 4 of the holdings in the first quarter of 2025, as detailed below:

- Fortinet Inc (FTNT, Financial): Jerome Dodson (Trades, Portfolio) sold all 249,593 shares, resulting in a -2.82% impact on the portfolio.

- Ross Stores Inc (ROST, Financial): Jerome Dodson (Trades, Portfolio) liquidated all 123,305 shares, causing a -2.23% impact on the portfolio.

Key Position Reduces

Jerome Dodson (Trades, Portfolio) also reduced positions in 12 stocks. The most significant changes include:

- Reduced Trane Technologies PLC (TT, Financial) by 45,050 shares, resulting in a -50.86% decrease in shares and a -1.99% impact on the portfolio. The stock traded at an average price of $361.35 during the quarter and has returned -10.18% over the past 3 months and -8.29% year-to-date.

- Reduced Atlassian Corp (TEAM, Financial) by 50,043 shares, resulting in a -39.57% reduction in shares and a -1.46% impact on the portfolio. The stock traded at an average price of $263.86 during the quarter and has returned -19.72% over the past 3 months and -20.04% year-to-date.

Portfolio Overview

At the first quarter of 2025, Jerome Dodson (Trades, Portfolio)'s portfolio included 42 stocks, with top holdings including 4.87% in Equifax Inc (EFX, Financial), 4.4% in Old Dominion Freight Line Inc (ODFL, Financial), 3.96% in JB Hunt Transport Services Inc (JBHT, Financial), 3.66% in Broadridge Financial Solutions Inc (BR, Financial), and 3.4% in MercadoLibre Inc (MELI, Financial).

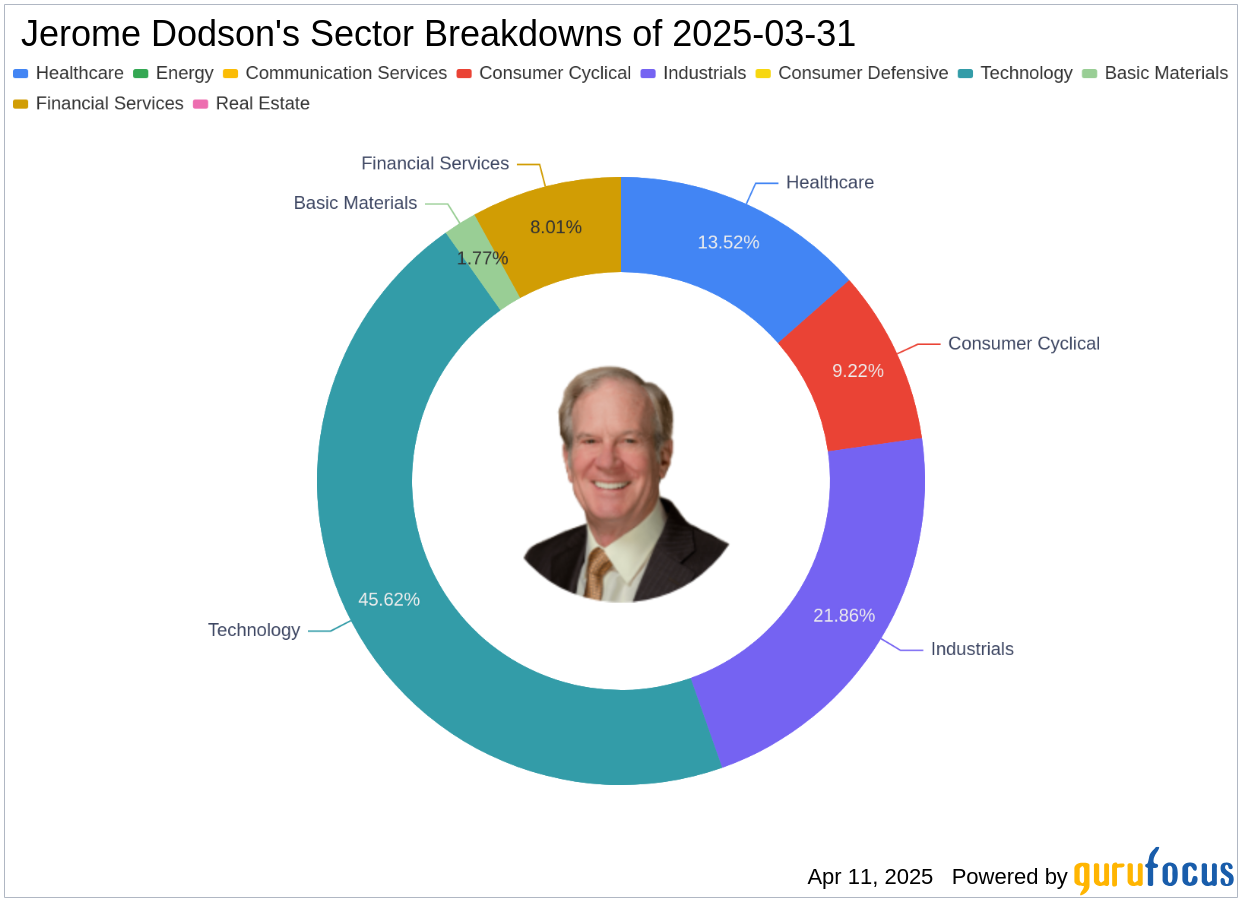

The holdings are mainly concentrated in 6 of the 11 industries: Technology, Industrials, Healthcare, Consumer Cyclical, Financial Services, and Basic Materials.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.