Scotiabank has downgraded Chevron (CVX, Financial) from an Outperform rating to Sector Perform, adjusting its price target from $160 to $143. The financial firm anticipates that Chevron may reduce its share buyback program from an annual pace of approximately $17.5 billion to $10.0 billion in the coming quarters, reflecting a strategic shift in its capital allocation approach. In contrast, Exxon Mobil (XOM) is expected to maintain its current buyback pace, according to the firm’s analysis.

In related news, Occidental Petroleum (OXY) also saw its rating drop to Sector Perform from Outperform, with its price target cut to $40 from $60. Scotiabank attributes this downgrade to what it sees as Occidental's challenging leverage situation, exacerbated by the acquisition of CrownRock.

On a more positive note, EOG Resources (EOG) received an upgrade from Underperform to Sector Perform, although its price target was adjusted down to $130 from $150. Scotiabank highlights EOG's robust balance sheet as a key factor in its revised outlook, suggesting that investors are likely to value financial stability in a volatile market.

Wall Street Analysts Forecast

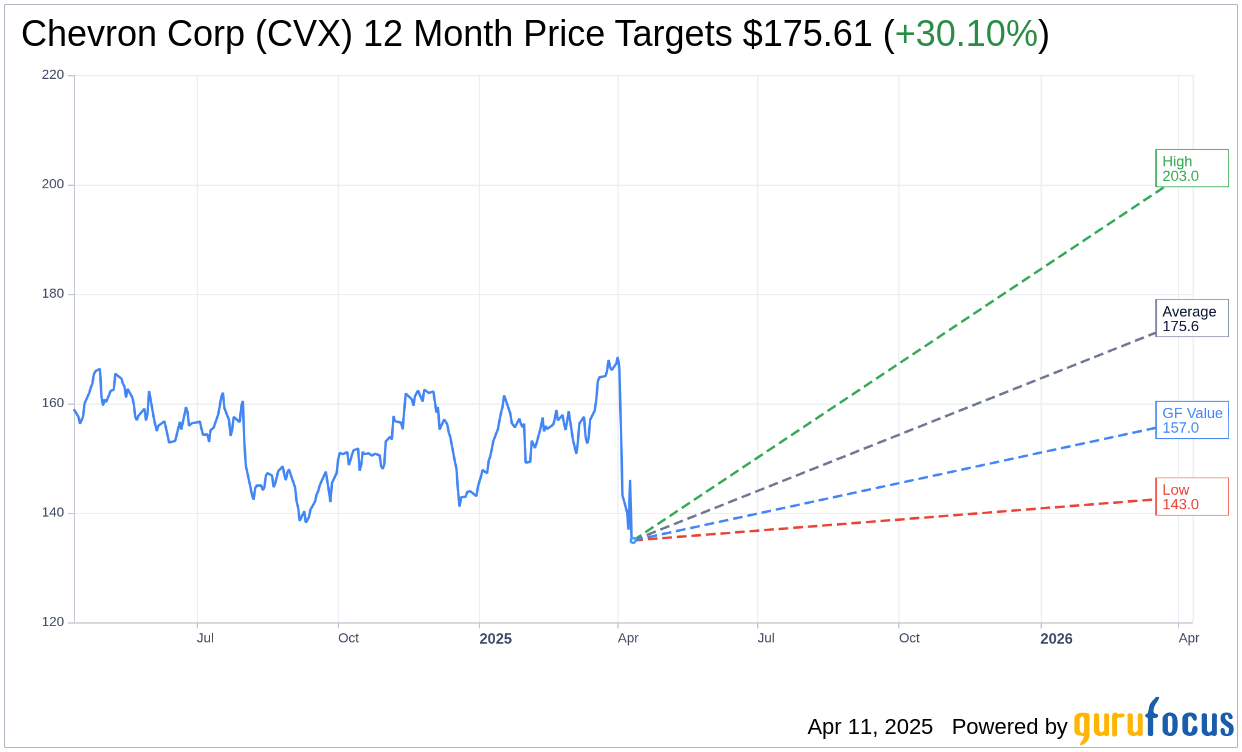

Based on the one-year price targets offered by 22 analysts, the average target price for Chevron Corp (CVX, Financial) is $175.61 with a high estimate of $203.00 and a low estimate of $143.00. The average target implies an upside of 30.10% from the current price of $134.98. More detailed estimate data can be found on the Chevron Corp (CVX) Forecast page.

Based on the consensus recommendation from 25 brokerage firms, Chevron Corp's (CVX, Financial) average brokerage recommendation is currently 2.1, indicating "Outperform" status. The rating scale ranges from 1 to 5, where 1 signifies Strong Buy, and 5 denotes Sell.

Based on GuruFocus estimates, the estimated GF Value for Chevron Corp (CVX, Financial) in one year is $157.00, suggesting a upside of 16.31% from the current price of $134.98. GF Value is GuruFocus' estimate of the fair value that the stock should be traded at. It is calculated based on the historical multiples the stock has traded at previously, as well as past business growth and the future estimates of the business' performance. More detailed data can be found on the Chevron Corp (CVX) Summary page.