- Polestar achieves a notable 76% year-over-year growth in Q1 2025 retail sales.

- Shares dip by 4.1% in premarket trading despite positive sales data.

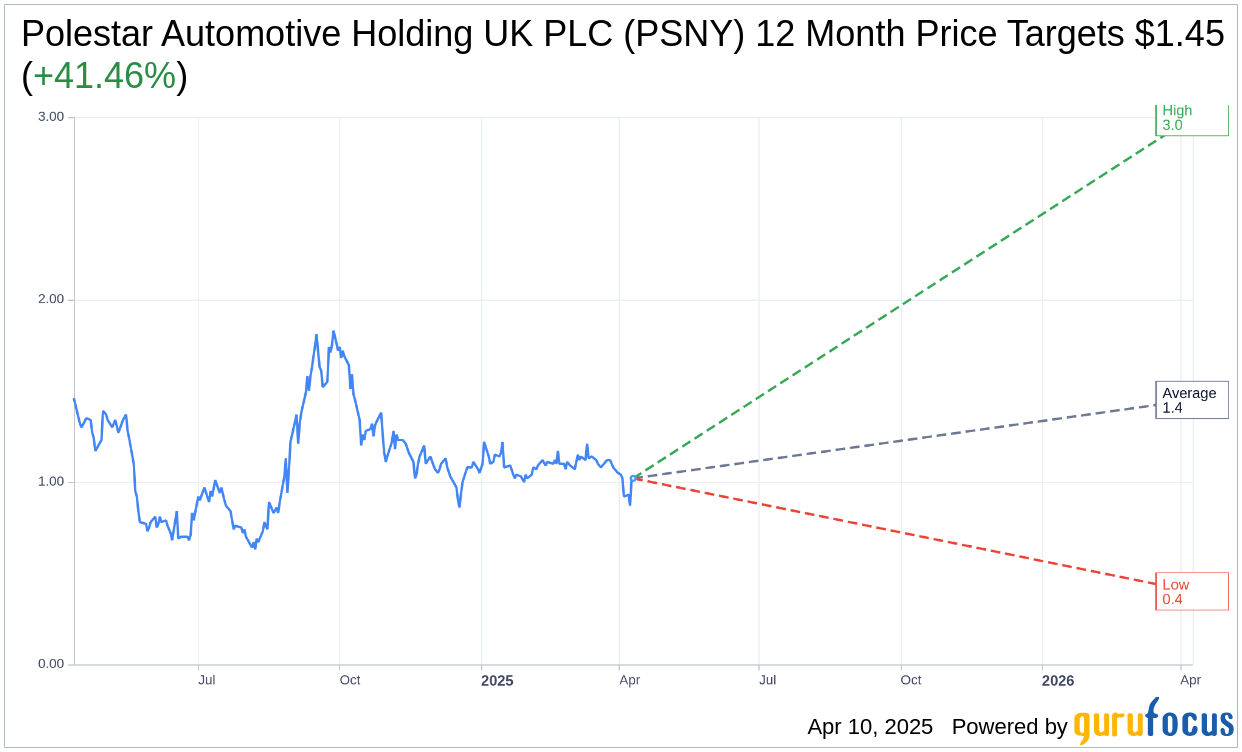

- Analysts forecast a potential 41.46% upside with current price estimates.

Polestar Automotive Holding UK PLC (PSNY, Financial) made headlines with an impressive 76% increase in retail sales during Q1 2025, totaling 12,304 units. This momentum is consistent with the previous quarter, Q4 2024, largely fueled by the popularity of new models and a strategic shift towards a direct selling model. Investors can anticipate the full release of Polestar's 2024 financial results by April 2025. Despite this robust sales growth, Polestar shares experienced a 4.1% decline in premarket trading on Thursday, reflecting market volatility.

Wall Street Analysts' Price Forecast

The consensus among 7 Wall Street analysts suggests that Polestar's average one-year price target stands at $1.45. This figure highlights a potential upside of 41.46% from the current share price of $1.03, with high estimates reaching $3.00 and low estimates at $0.40. Investors can access more comprehensive forecast data through the Polestar Automotive Holding UK PLC (PSNY, Financial) Forecast page.

In terms of brokerage recommendations, Polestar holds an average rating of 3.6 from 7 firms, classified as "Underperform." The rating system spans from 1 to 5, where 1 indicates a Strong Buy, and 5 represents a Sell recommendation. Investors should consider these insights when making informed decisions about Polestar's stock potential.