Summary Highlights:

- Upstart Holdings Inc. (UPST, Financial) is set to release its Q1 2025 earnings on May 6, 2025.

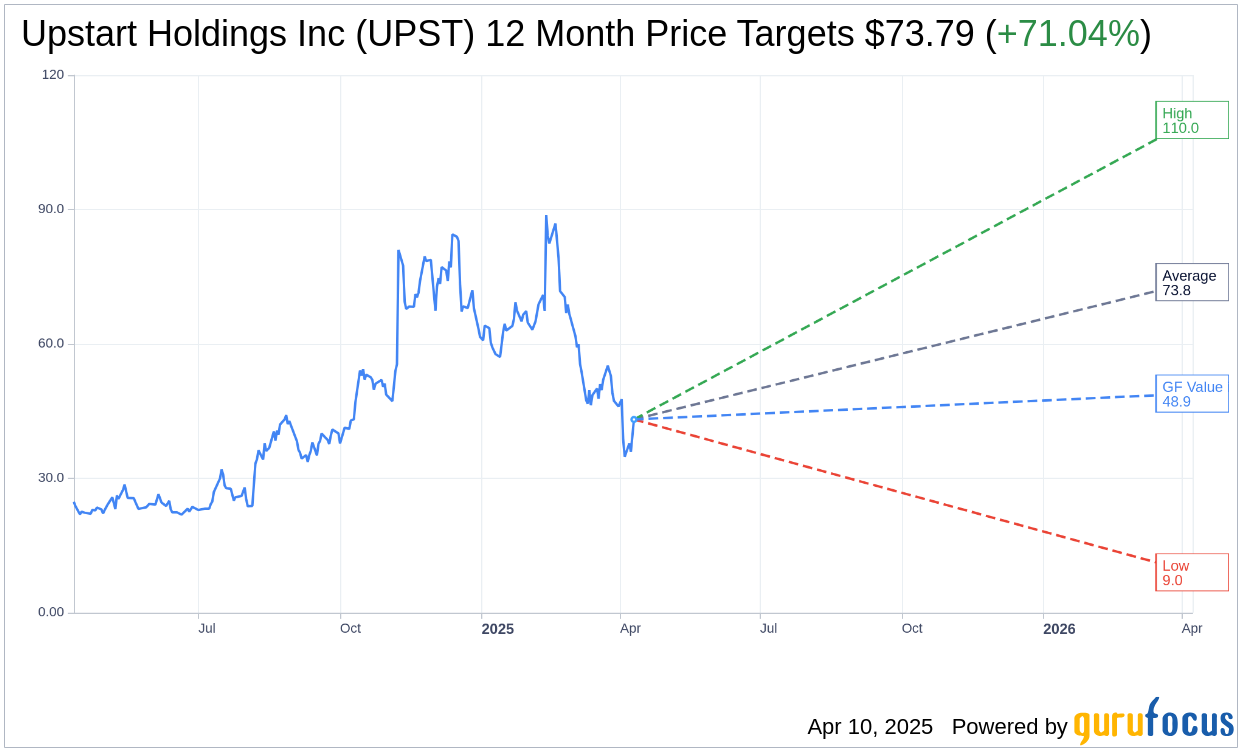

- Analysts project an average price target of $73.79, with a potential upside of 71.04%.

- The consensus recommendation is a "Hold," with a GF Value estimate of $48.91.

Upstart Holdings, Inc. (UPST), a leader in AI-driven lending marketplaces, is gearing up to unveil its financial results for the first quarter of 2025. Mark your calendars for May 6, 2025, as the company will host a conference call at 1:30 p.m. PT / 4:30 p.m. ET. For interested parties, further details are available on Upstart's investor relations website.

Wall Street Analysts Forecast

According to inputs from 14 top analysts, the average one-year price target for Upstart Holdings (UPST, Financial) stands at $73.79. Predictions range from a bullish high of $110.00 to a conservative low of $9.00. This range of forecasts translates to a substantial upside potential of 71.04% from the current share price of $43.14. For an in-depth look at estimate data, visit the Upstart Holdings Inc (UPST) Forecast page.

The current sentiment in the brokerage community is one of cautious optimism, with 15 firms assigning an average recommendation of 2.7 for UPST—indicative of a "Hold" rating. On this scale, 1 suggests a Strong Buy, while 5 signals a Sell.

GuruFocus Insights

From the perspective of GuruFocus, the projected GF Value for Upstart Holdings (UPST, Financial) in a year's time is $48.91, suggesting a moderate upside of 13.38% from the current trading price of $43.14. The GF Value is a crucial metric, reflecting what GuruFocus estimates as the stock's fair trading value. This estimation is calculated using historical trading multiples, past business growth, and future performance projections. Additional insights are available on the Upstart Holdings Inc (UPST) Summary page.

This upcoming earnings release will undoubtedly be a focal point for investors and analysts alike, presenting an opportunity to gauge the company's trajectory and performance. Stay tuned to see how Upstart aligns with these valuations and forecasts.