- Dave & Buster's revenue fell 10.8% year-over-year, yet its EPS surpassed expectations.

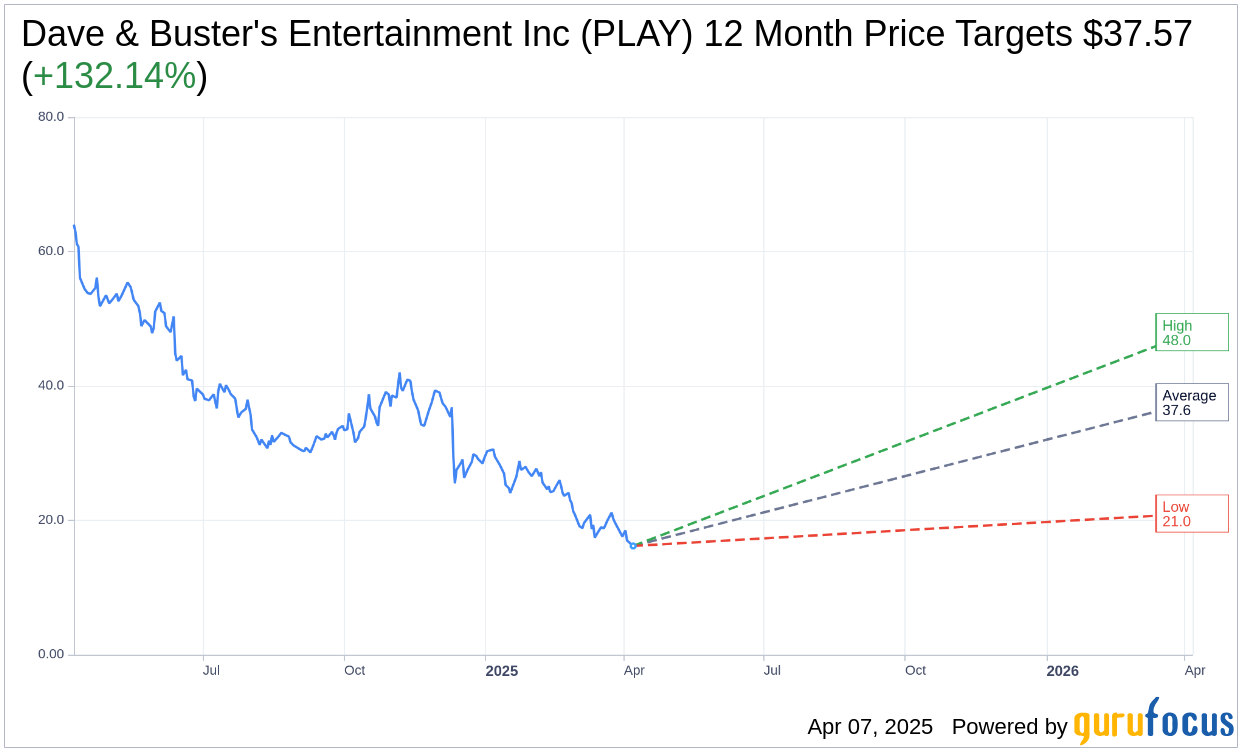

- Analysts suggest a potential upside of 132.14% for PLAY with a one-year target price averaging $37.57.

- GuruFocus estimates a significant upside potential of 277.82% based on the GF Value metric.

Dave & Buster's Entertainment Inc. (PLAY, Financial) recently reported a quarterly revenue of $534.5 million, experiencing a 10.8% decline compared to the previous year. This figure also fell short of analyst expectations by 1.91%. However, the company's earnings per share (EPS) of $0.69 surpassed estimates by 7.81%. Despite these positive earnings, the stock has faced a 12.8% decline over the past month, reflecting investor concerns.

Wall Street Analysts Forecast

According to forecasts from seven analysts, Dave & Buster's (PLAY, Financial) has an average one-year price target of $37.57. The target range is broad, with a high estimate of $48.00 and a low estimate of $21.00. This average target suggests a potential upside of 132.14% from the current stock price of $16.19. For a more comprehensive analysis, visit the Dave & Buster's Entertainment Inc (PLAY) Forecast page.

In terms of analyst recommendations, the consensus from 10 brokerage firms pegs the stock at an average recommendation of 2.6, which indicates a "Hold" status on a scale where 1 equals a Strong Buy and 5 represents a Sell.

GuruFocus Insights

According to GuruFocus estimates, the GF Value for Dave & Buster's Entertainment Inc. (PLAY, Financial) is projected to be $61.15 in one year. This indicates a substantial upside potential of 277.82% from its current price of $16.19. The GF Value is determined by analyzing the historical trading multiples of the stock, its past growth, and future performance forecasts. For more detailed insights, explore the Dave & Buster's Entertainment Inc (PLAY) Summary page.