Market Overview

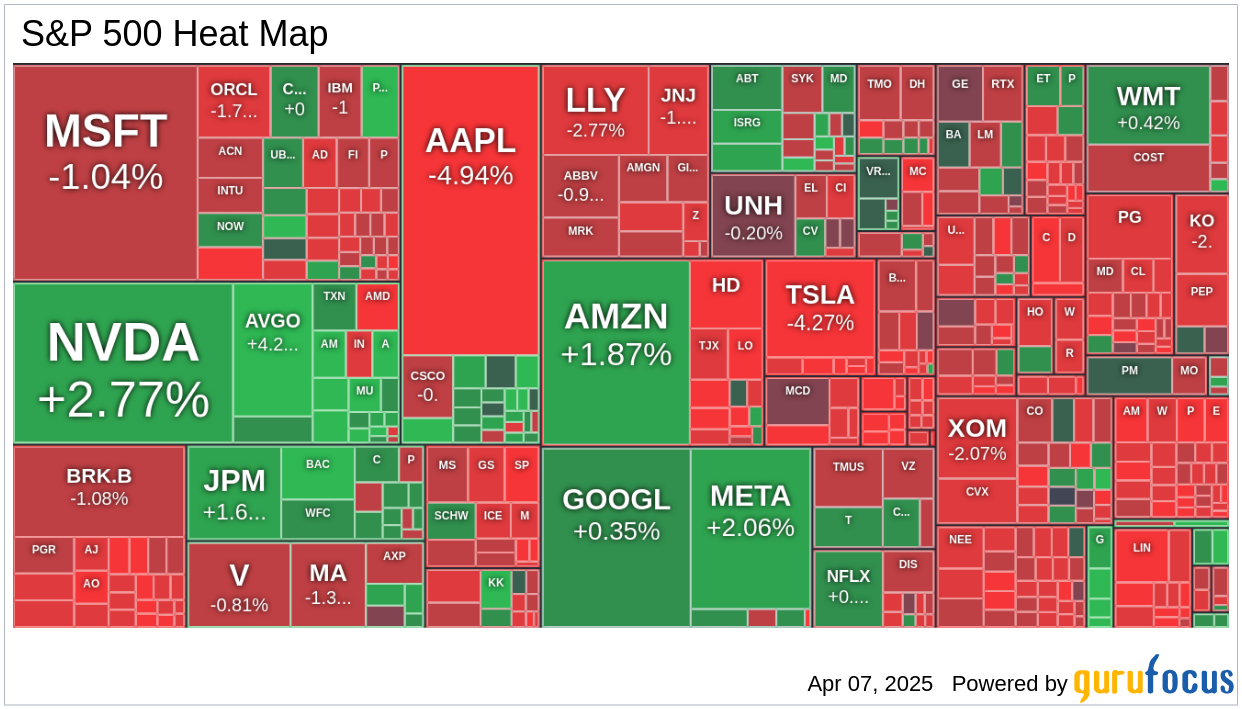

The stock market experienced significant volatility during the first session of the week, with trading occurring on above-average volume. The S&P 500 index ( ) ended the day down by 0.2%, having fluctuated more than 400 points between its intraday high and low. Initially, the index was down 4.7% shortly after the market opened but later surged to a high of 3.4%.

) ended the day down by 0.2%, having fluctuated more than 400 points between its intraday high and low. Initially, the index was down 4.7% shortly after the market opened but later surged to a high of 3.4%.

Nasdaq Composite Performance

The Nasdaq Composite, which was down more than 800 points at its lowest, managed to close 0.1% higher. This recovery was driven by a rebound in mega-cap stocks and chipmakers.

Tariff News and Market Reaction

The initial recovery from session lows was sparked by a false report suggesting that NEC Director Kevin Hassett mentioned President Trump was considering a 90-day pause on tariffs, excluding China. The White House labeled this report as fake news. Subsequently, President Trump announced plans to impose an additional 50% tariff on Chinese imports starting Wednesday if China does not revoke its 34% tariff on U.S. imports. This announcement led to increased selling, but major indices remained above their worst levels of the session.

Treasury Market Reversal

One factor that helped keep equity indices above session lows was a reversal in the Treasury market. Recently, market rates have been declining due to safe-haven interest, but today saw a jump in yields. The 10-year yield increased by 17 basis points to 4.16%, and the 2-year yield rose by six basis points to 3.73%.

Year-to-Date Performance

- Dow Jones Industrial Average: -10.8% YTD

- S&P 500: -13.9% YTD

- S&P Midcap 400: -16.1% YTD

- Russell 2000: -18.8% YTD

- Nasdaq Composite: -19.2% YTD

Economic Data

Today's economic data was limited to consumer credit, which saw a decrease of $0.8 billion in February, contrary to the consensus expectation of a $15.1 billion increase. This follows a downwardly revised increase of $8.9 billion in January, initially reported at $18.1 billion. The key takeaway is that February marked the third contraction in consumer credit over the last four months.

Today's News

Nvidia (NVDA, Financial) has finalized its acquisition of artificial intelligence startup Lepton AI, a move valued at hundreds of millions of dollars. Lepton AI, known for reselling Nvidia's graphics processing units as a cloud service, will see its co-founders remain with Nvidia post-acquisition. This strategic move positions Nvidia strongly against competitors like Together AI, which has also been active in the GPU rental space.

BlackRock CEO Larry Fink highlighted the potential for further market declines due to tariff-related recession fears but emphasized the opportunity to acquire undervalued stocks. Fink's comments came amid a volatile market session that saw major indices initially drop sharply before recovering some losses.

Tilray (TLRY, Financial) is set to report its Q3 earnings, with expectations of a slight loss per share but an increase in revenue. The company's diversification into the alcohol sector has helped revenue growth, though challenges remain, including potential NASDAQ delisting and integration issues from recent acquisitions.

Charles Schwab's Trading Activity Index ("STAX") showed a decline as clients moved away from equities in March, opting instead for fixed income and ETFs. This shift occurred amid policy uncertainties and disappointing economic data, contributing to a broader market slump.

Apple (AAPL, Financial) is increasing its shipment of iPhones from India to the U.S. as a temporary measure to mitigate the impact of high tariffs on Chinese goods. This move comes amid ongoing trade tensions and Apple's efforts to secure tariff exemptions.

Walgreens Boots Alliance (WBA, Financial) will announce its Q2 earnings, with investor attention focused on its $10 billion privatization deal with Sycamore Partners. The deal, expected to close later this year, could see shareholders receiving additional proceeds from asset sales.

US Steel (X, Financial) saw a significant stock jump after President Trump ordered a national security review of its planned sale to Nippon Steel. This review could lead to potential approval of the sale, previously blocked under the Biden administration.

The Magnificent Seven companies are feeling the impact of global economic slowdowns and trade tensions, with nearly half of their earnings derived from international markets. Apollo Asset Management noted these firms' vulnerability due to their significant overseas revenue streams.

Small-cap stocks have entered a bear market amid tariff-induced market turmoil. However, Morgan Stanley sees potential opportunities within this sector, particularly for companies with strong return on equity and momentum.

LyondellBasell Industries (LYB, Financial) faced a downgrade from UBS to Sell, citing a challenging outlook for chemical demand and ongoing global overcapacity. The firm's cost advantage has narrowed, impacting its earnings potential.

Palantir Technologies (PLTR, Financial) rebounded slightly, leading gains among enterprise software stocks. Despite a recent decline, the company's rapid revenue and cash flow scaling present a promising investment opportunity.

GuruFocus Stock Analysis

- Tariff Shock: The 5 Stocks That Could Save Your Portfolio This Year by Khac Phu Nguyen

- Novo Nordisk's $1B Power Play: Can Brazil Make or Break the Ozempic Empire? by Khac Phu Nguyen

- This Obesity Drug Just Crushed Expectations -- And Sent One Biotech Stock Soaring 14.5% by Khac Phu Nguyen

- Wall Street Panics as Trump Triggers $6.6 Trillion Meltdown by Khac Phu Nguyen

- Trump's Tariff Nuke: The Trade War Just Went Full Throttle by Khac Phu Nguyen