Key Highlights:

- Tilray Brands (TLRY, Financial) poised to release quarterly earnings soon, despite a challenging year.

- Analysts predict a significant price upside, yet potential risks linger.

- Current market challenges and diversification efforts in focus for investors.

Tilray Brands (TLRY) is gearing up to unveil its quarterly earnings this Tuesday before the market opens. Despite experiencing a substantial 53% drop in share price this year, analysts maintain a "Buy" rating for the company. This is attributed to Tilray's improved balance sheet and its strategic expansion into the alcohol industry. However, the company faces ongoing challenges in both its core cannabis and burgeoning alcohol sectors, with looming risks such as potential Nasdaq delisting and share dilution.

Wall Street Analysts' Projections

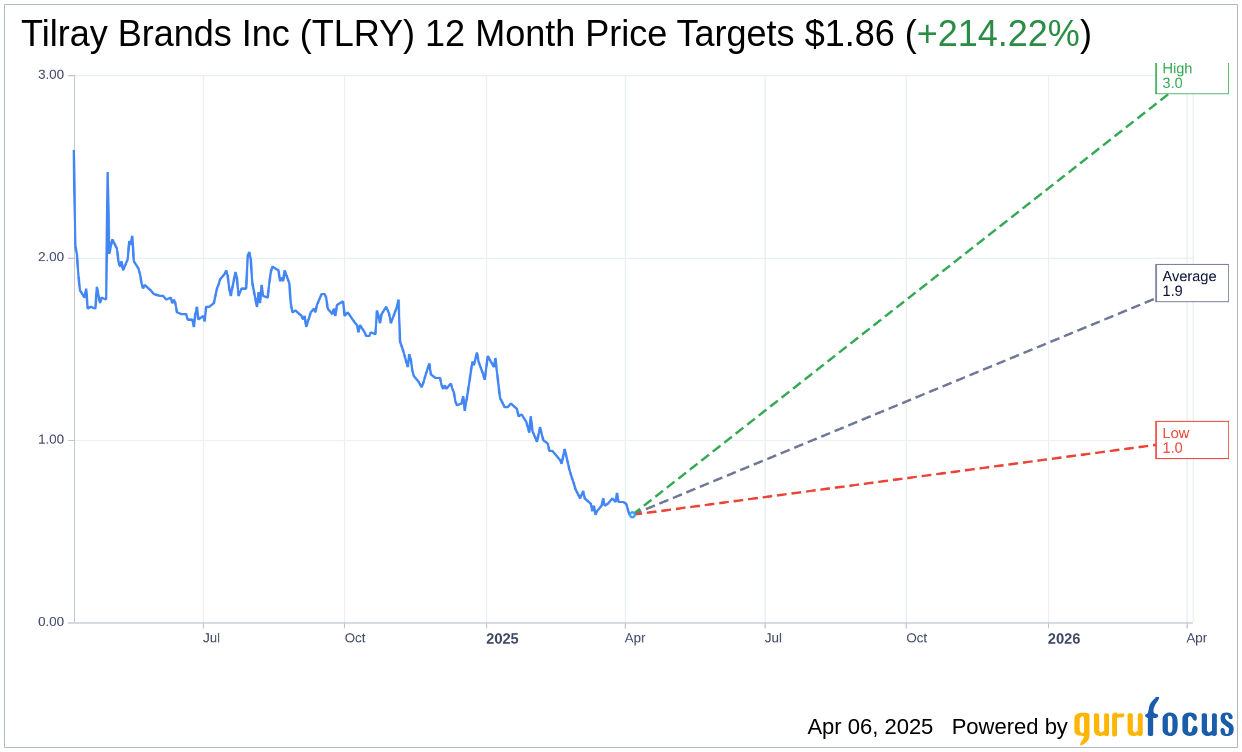

According to one-year price targets from 12 analysts, Tilray Brands Inc (TLRY, Financial) is expected to reach an average target price of $1.86. Projections range from a high of $3.00 to a low of $1.00. This average target suggests a remarkable upside of 214.22% from the current trading price of $0.59. Investors can find more in-depth estimate data on the Tilray Brands Inc (TLRY) Forecast page.

Reflecting the consensus from 13 brokerage firms, Tilray Brands Inc's (TLRY, Financial) average brokerage recommendation currently stands at 2.7, which equates to a "Hold" status. The recommendation scale spans from 1 to 5, where 1 means a Strong Buy and 5 represents a Sell.

Insights from GuruFocus

Based on estimates from GuruFocus, Tilray Brands Inc (TLRY, Financial) is projected to have a GF Value of $2.42 in one year. This implies a potential upside of 308.65% from the current price of $0.5922. The GF Value is GuruFocus' assessment of the stock's fair market value, derived from historical trading multiples, historical growth patterns, and future business performance projections. More comprehensive data is accessible on the Tilray Brands Inc (TLRY) Summary page.