Key Highlights:

- Salesforce boosts its quarterly dividend by 4%, strengthening its financial strategy.

- Despite a 10.82% stock decline, innovative partnerships enhance Salesforce's market positioning.

- Analysts predict a potential 55.79% upside for Salesforce shares.

Salesforce (CRM, Financial) recently demonstrated astute financial management by announcing a 4% hike in its quarterly dividend. This move underscores their commitment to delivering value amidst challenging market conditions. At the same time, Salesforce has entered a partnership with Deloitte to advance AI-powered solutions. However, despite these strategic developments, the share price experienced a 10.82% decline, reflecting broader market pressures. Over the past five years, Salesforce has achieved a return exceeding 56%, largely driven by their innovative product initiatives.

Wall Street Analysts Forecast

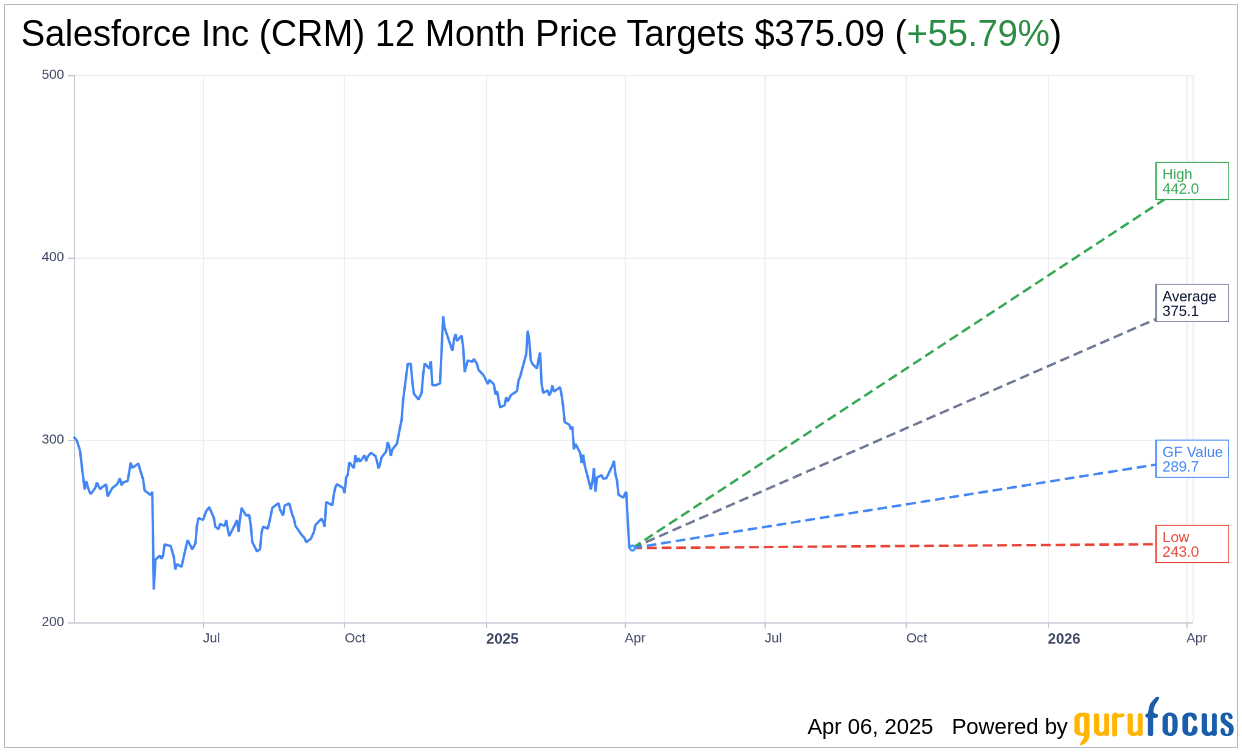

Wall Street analysts have set an average one-year price target of $375.09 for Salesforce Inc (CRM, Financial), with estimates ranging from a high of $442.00 to a low of $243.00. This suggests a potential upside of 55.79% from the current stock price of $240.76. For more detailed forecast data, visit the Salesforce Inc (CRM) Forecast page.

The consensus from 53 brokerage firms places Salesforce at a 2.1 average brokerage recommendation, indicating an "Outperform" status. This rating is based on a scale where 1 represents a Strong Buy and 5 signifies a Sell.

According to GuruFocus estimates, the projected GF Value for Salesforce Inc (CRM, Financial) in the next year is $289.73. This estimate points to a potential upside of 20.34% from the current trading price of $240.76. The GF Value reflects what GuruFocus deems as the fair trading value of Salesforce's stock, calculated by analyzing historical trading multiples, past business growth, and future performance forecasts. For more comprehensive data, explore the Salesforce Inc (CRM) Summary page.