Summary:

- Jefferies maintains a "Buy" rating for Microsoft (MSFT, Financial) but adjusts the price target to $500 from $550.

- AI-driven growth continues to bolster Microsoft's future potential, particularly in Azure and Microsoft 365.

- Analysts project a significant upside potential, with the average target price suggesting a 38.97% increase.

Jefferies Supports Microsoft with Adjusted Price Target

Jefferies has reaffirmed its "Buy" stance on Microsoft (NASDAQ: MSFT), although it has recalibrated the price target from $550 to $500. This adjustment reflects current market conditions. Nonetheless, the future seems promising for Microsoft as AI-driven advancements in its Azure cloud services and Microsoft 365 offerings signal robust growth potential.

Wall Street Analysts' Expectations

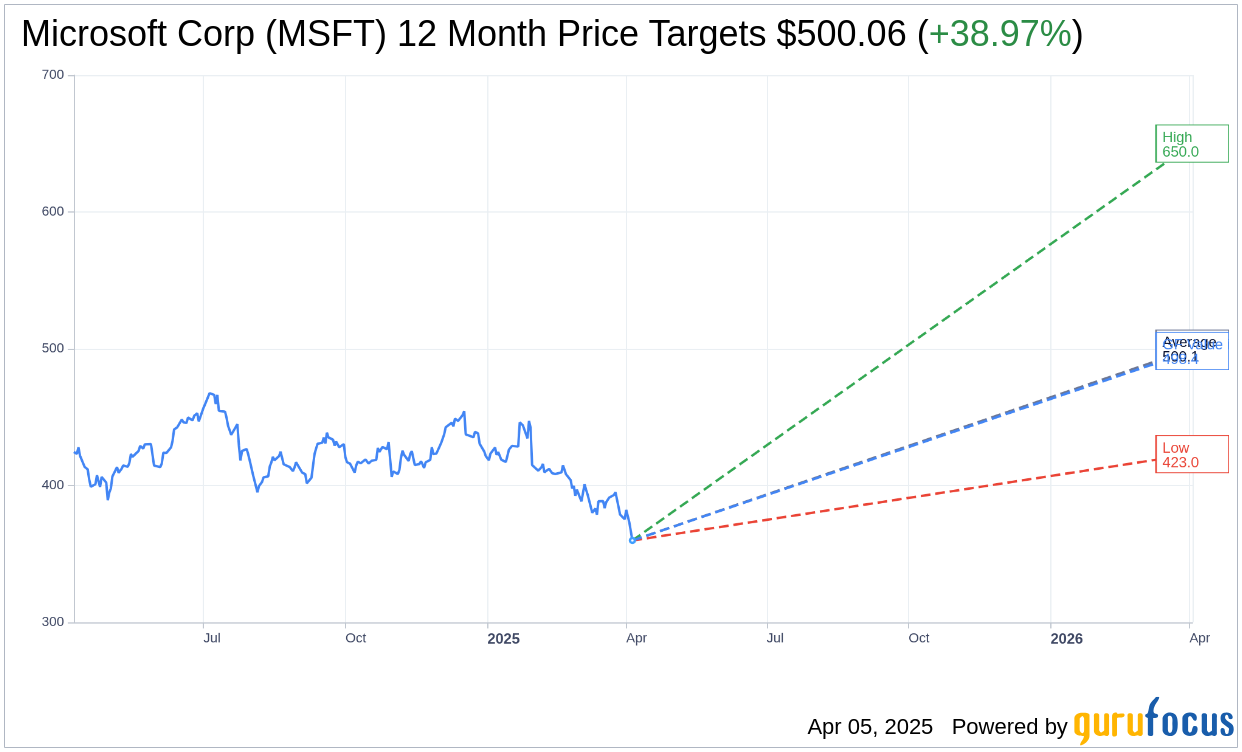

According to projections from 49 analysts, the average one-year price target for Microsoft Corp (MSFT, Financial) stands at $500.06. This includes a possible high of $650.00 and a low of $423.00. The average target price indicates a potential upside of 38.97% from the current trading price of $359.84. For more in-depth estimates, visit the Microsoft Corp (MSFT) Forecast page.

Market Sentiment and GF Value

Based on insights from 60 brokerage firms, Microsoft Corp's (MSFT, Financial) consensus rating is currently 1.8, which suggests an "Outperform" status on the analyst scale, ranging from 1 (Strong Buy) to 5 (Sell).

GuruFocus estimates the GF Value for Microsoft Corp (MSFT, Financial) to be $498.41 in a year, presenting an upside of 38.51% from the present price of $359.84. This GF Value reflects GuruFocus' assessment of the fair trading value derived from historical trading multiples, past growth patterns, and anticipated business performance. For further details, please visit the Microsoft Corp (MSFT) Summary page.