Key Takeaways:

- SoFi Technologies (SOFI, Financial) is poised to announce its Q1 2025 results soon, with a webcast available for investors.

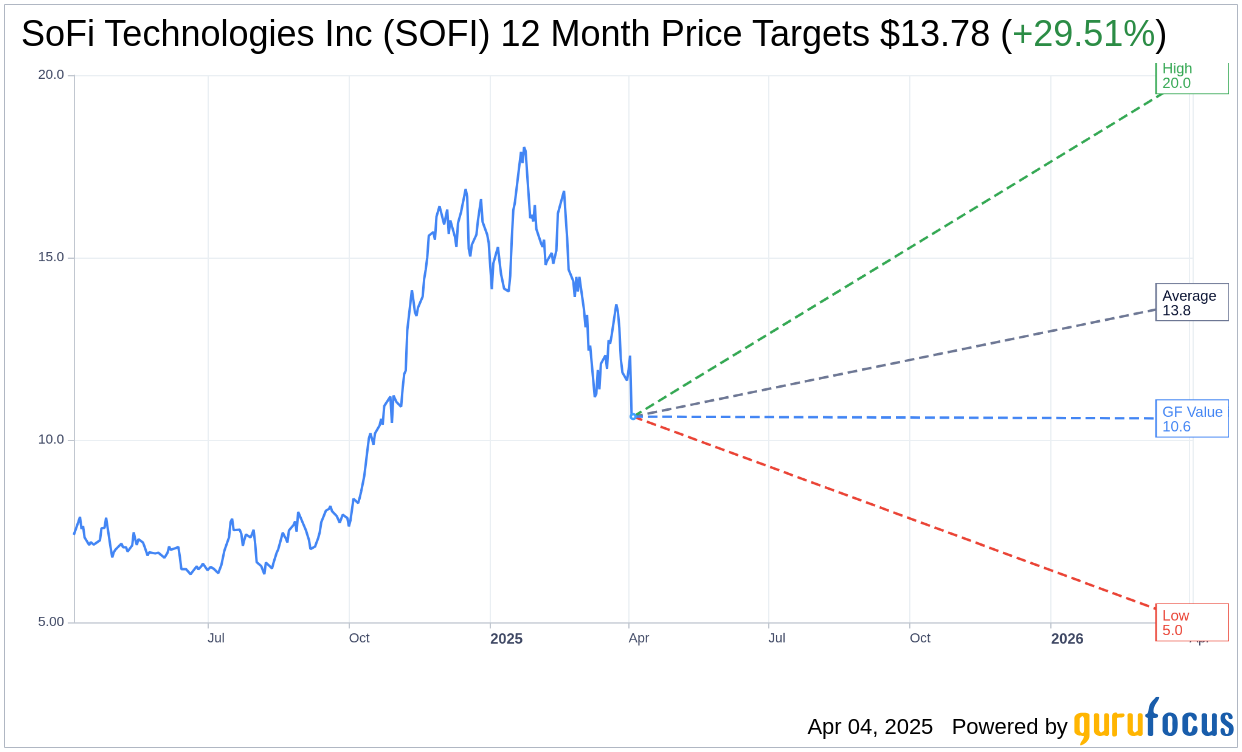

- Analyst consensus projects a potential upside of nearly 30% for SOFI shares.

- Current GuruFocus metrics suggest SOFI is trading close to its estimated fair value.

SoFi Technologies Inc (SOFI) is gearing up to release its first-quarter 2025 financial results. On April 29, 2025, at 8 a.m. Eastern Time, the company will conduct a conference call to delve into these results. For those eager to stay informed, the financial details will be made public on SoFi's investor relations website one hour prior to the call. To accommodate investors' schedules, both webcast and replay options will be accessible.

Analyst Price Target Insights

Wall Street analysts have issued one-year price targets for SoFi Technologies (SOFI, Financial) shares, providing a diverse range of estimates. On average, 15 analysts predict a target price of $13.78. Specifically, forecasts range from a high of $20.00 to a low of $5.00. Notably, this average target implies a substantial upside potential of 29.51% from SOFI's current stock price of $10.64. For more in-depth data on these estimates, visit the SoFi Technologies Inc (SOFI) Forecast page.

Brokerage Recommendations and Ratings

Turning to brokerage recommendations, 18 firms currently rate SoFi Technologies with an average recommendation score of 2.9. This score is indicative of a "Hold" status, based on a rating scale where 1 signifies a Strong Buy, and 5 denotes a Sell.

GuruFocus Evaluation

According to GuruFocus estimates, the GF Value for SoFi Technologies Inc (SOFI, Financial) over the next year is pegged at $10.59. This estimate suggests a marginal downside of 0.47% from the present stock price of $10.64. The GF Value represents GuruFocus' assessment of the stock's fair trading value. This metric is derived from historical trading multiples, past business growth, and projected future performance. For further details, please refer to the SoFi Technologies Inc (SOFI) Summary page.