- Sarepta Therapeutics (SRPT, Financial) receives an analyst upgrade from H.C. Wainwright, boosting investor confidence.

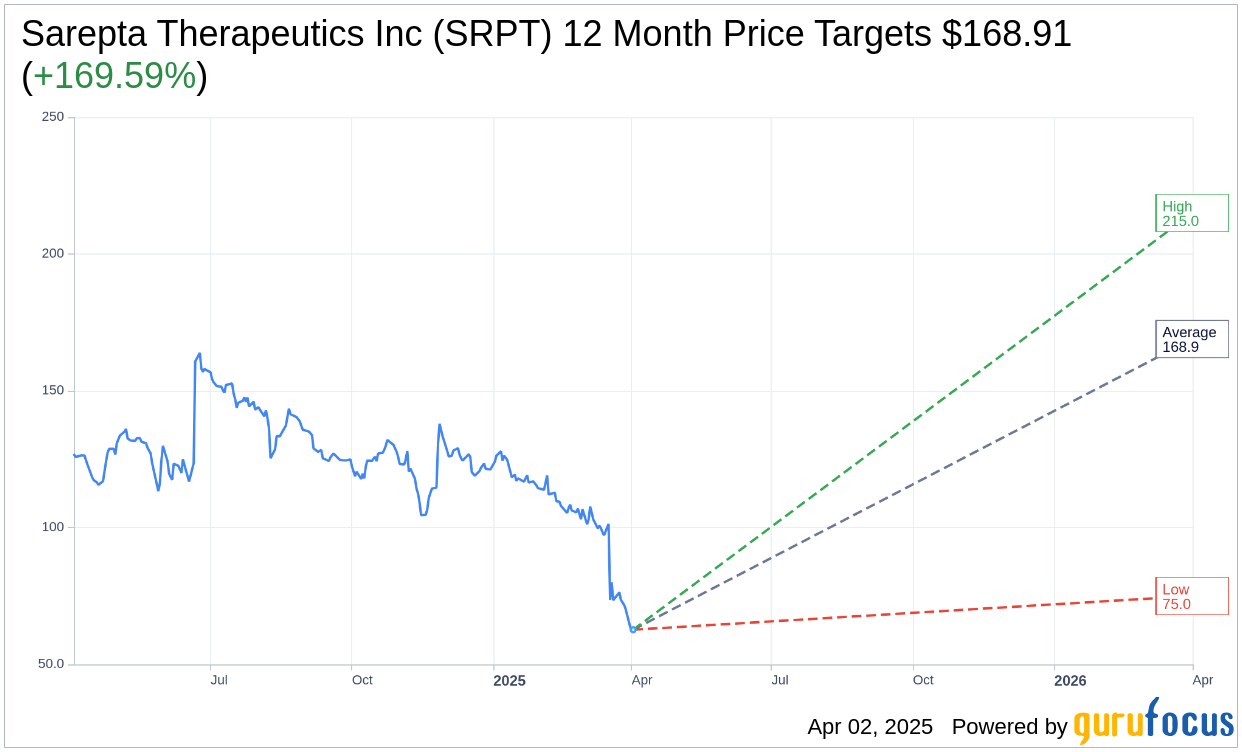

- Wall Street analysts foresee substantial growth with a projected price target upside of 169.59%.

- GuruFocus' GF Value suggests a potential upside of 251.11% over the current stock price.

Sarepta Therapeutics (SRPT) has captured investor attention, receiving an upgrade from H.C. Wainwright. The firm's outlook improved from "Sell" to "Neutral," signaling a potential turnaround. This upgrade reflects anticipated strong performance in their 1Q25 earnings, propelling the stock upward by 2.6% in afternoon trading. Although there are lingering concerns about Elevidys sales due to a patient death incident in late 2025, the company remains optimistic. Recent approvals are set to positively impact the forthcoming earnings, with analysts maintaining a 12-month price target of $75 per share.

Wall Street Analysts Forecast

Investors are keen on the insights provided by 22 analysts, who have set one-year price targets for Sarepta Therapeutics Inc (SRPT, Financial). The average target price stands at $168.91, with forecasts ranging between a high of $215.00 and a low of $75.00. Such forecasts imply a significant upside potential of 169.59% from the current trading price of $62.66. For a deeper dive into these projections, visit the Sarepta Therapeutics Inc (SRPT) Forecast page.

The consensus from 24 brokerage firms underscores optimism, with an average brokerage recommendation pegged at 1.9, indicating an "Outperform" status. This rating, derived from a scale where 1 denotes a Strong Buy and 5 a Sell, highlights a positive sentiment around the stock's future performance.

Assessing the GF Value

GuruFocus provides a compelling perspective with its estimated GF Value for Sarepta Therapeutics Inc (SRPT, Financial), projecting a value of $219.99 over the next year. This estimate suggests a remarkable upside of 251.11%, based on the current price of $62.655. The GF Value is a proprietary metric that reflects what the stock should ideally be trading at, derived from historical multiples, past growth, and future business performance forecasts. For more comprehensive data, consider exploring the Sarepta Therapeutics Inc (SRPT) Summary page.