Summary:

- Greenwich LifeSciences (GLSI, Financial) sees a significant 23% increase in stock value after promising trial results.

- The Phase 3 trial of the GLSI-100 vaccine shows early success in HER2-positive breast cancer treatment.

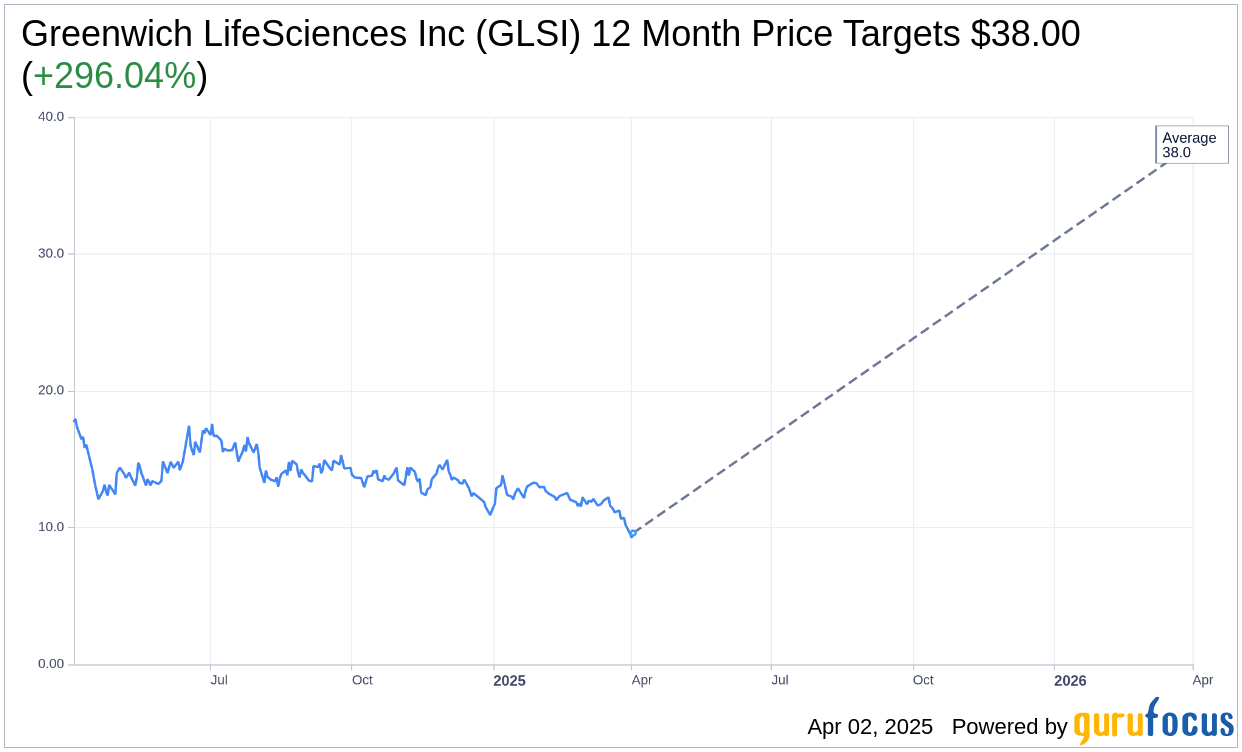

- Analysts forecast a substantial potential upside, with a price target of $38.00.

Phase 3 Trial Success Boosts GLSI Stock

Greenwich LifeSciences (GLSI) has captured investor attention with a remarkable 23% surge in premarket trading. This upswing follows the positive early immune response findings from the Phase 3 trial of their innovative breast cancer vaccine, GLSI-100. The FLAMINGO-01 trial specifically focuses on patients with HER2-positive breast cancer, a notoriously challenging subtype to treat effectively.

The company is in discussions about introducing a placebo arm to this trial. This strategic move could pave the way for GLSI-100 to penetrate broader market segments, potentially driving annual revenues to an impressive $10 billion.

Wall Street Analysts Forecast

According to the latest analysis, Greenwich LifeSciences Inc (GLSI, Financial) holds an average one-year price target of $38.00, as projected by one analyst. This forecast suggests a potential upside of 296.04% from the current trading price of $9.60. For a more comprehensive look at the estimates, visit the Greenwich LifeSciences Inc (GLSI) Forecast page.

Analyst Recommendations and Insights

In terms of analyst views, Greenwich LifeSciences Inc (GLSI, Financial) has received an average brokerage recommendation score of 2.0. This rating reflects an "Outperform" status, falling within a scale where 1 indicates Strong Buy and 5 signifies Sell. The "Outperform" recommendation suggests that analysts believe GLSI is poised for growth and offers appealing investment potential.

As investors consider GLSI, these developments and analyst forecasts underline the company's potential for significant market expansion and growth in shareholder value.