Key Highlights:

- Johnson & Johnson (JNJ, Financial) has consistently outperformed earnings expectations, marking an average surprise of 5.50% over the last two quarters.

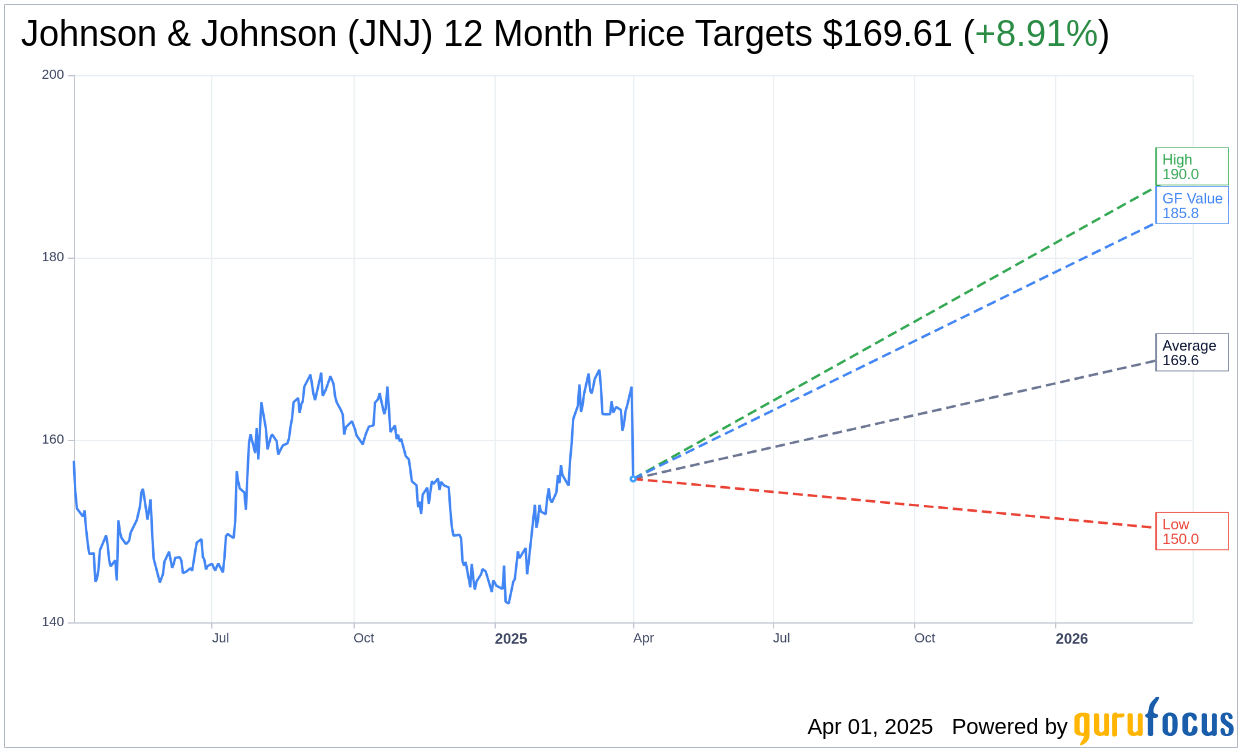

- Analysts predict an 8.91% potential upside, with a target price of $169.61.

- JNJ holds a "Outperform" consensus from analysts, with a predicted 19.29% upside in its GF Value estimate.

Earnings Performance and Projections

Johnson & Johnson (JNJ) continues to showcase its robust financial health by consistently surpassing earnings expectations. The last two quarterly reports have exceeded forecasts by an impressive average of 5.50%. In the latest quarter, JNJ posted earnings of $2.04 per share, outshining the anticipated $2.00, which reflects a commendable 2% earnings surprise. The previous quarter was equally remarkable with a 9.01% earnings surprise. With an Earnings ESP of +0.94% and a Zacks Rank #3, it appears likely that JNJ could again surpass analyst predictions.

Wall Street Analysts' Forecast

Analyst consensus on Johnson & Johnson (JNJ, Financial) remains optimistic, with 22 experts setting a one-year price target averaging $169.61. This projection encompasses a high of $190.00 and a low of $150.00. The average target suggests an expected upside of 8.91% from the current stock price of $155.74. Investors can explore more detailed projections on the Johnson & Johnson (JNJ) Forecast page.

Furthermore, Johnson & Johnson's (JNJ, Financial) performance has earned an "Outperform" rating, as reflected by a consensus recommendation score of 2.4 from 24 brokerage firms. The scale used ranges from 1 (Strong Buy) to 5 (Sell).

GF Value Estimation

GuruFocus provides its proprietary GF Value estimate for Johnson & Johnson (JNJ, Financial) at $185.78 in one year, indicating a projected upside of 19.29% from its current price of $155.735. The GF Value is a comprehensive calculation of the stock's fair trading value based on its historical trading multiples, past business growth, and projected future performance. More detailed information is available on the Johnson & Johnson (JNJ) Summary page.

Overall, Johnson & Johnson's (JNJ, Financial) consistent performance, favorable analyst outlook, and a strong GF Value estimate present a compelling case for investors considering this stock. As always, investors should conduct their own due diligence before making any investment decisions.