Lucid Diagnostics Inc (LUCD, Financial) released its 8-K filing on March 25, 2025, providing a comprehensive update on its business operations and financial performance for the fourth quarter and full year ending December 31, 2024. Lucid Diagnostics Inc, a commercial-stage medical diagnostics technology company, focuses on patients with gastroesophageal reflux disease (GERD) who are at risk of developing esophageal precancer and cancer. The company's flagship products include EsoCheck and EsoGuard.

Performance Overview and Challenges

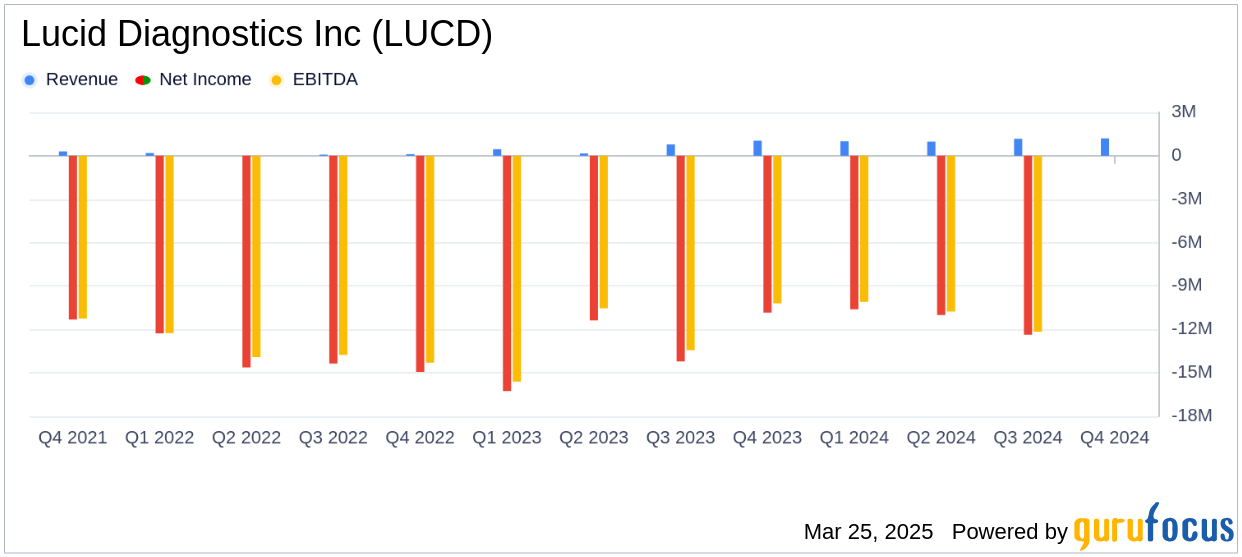

Lucid Diagnostics Inc reported EsoGuard revenue of $1.2 million for the fourth quarter of 2024, falling short of the analyst estimate of $1.42 million. The company processed a record 4,042 EsoGuard tests in the quarter, marking a 45% sequential increase and an 84% annual increase. Despite these operational achievements, the revenue shortfall highlights the challenges in converting increased test processing into proportional revenue growth.

Financial Achievements and Industry Impact

The company secured its first agreement to pay for EsoGuard under state biomarker legislation and executed over 20 new cash-pay concierge medicine contracts. These strategic moves are crucial for expanding revenue channels and achieving broader payor coverage, which is vital for sustaining growth in the competitive medical diagnostics industry.

Financial Statements and Key Metrics

For the three months ended December 31, 2024, Lucid Diagnostics Inc reported operating expenses of approximately $13.6 million, including $1.2 million in stock-based compensation expenses. The GAAP net loss attributable to common stockholders was approximately $11.5 million, or $(0.20) per common share, which is below the estimated earnings per share of -0.19. The non-GAAP adjusted loss was approximately $10.9 million, or $(0.19) per common share, aligning with analyst expectations.

The company had cash and cash equivalents of $22.4 million as of December 31, 2024. Including the first quarter 2025 common stock financing, the pro forma cash position is approximately $36.9 million, providing a solid financial runway for future operations.

Analysis and Future Outlook

Lucid Diagnostics Inc's performance in the fourth quarter of 2024 underscores the importance of strategic initiatives in expanding market reach and enhancing revenue streams. The company's efforts to secure insurance coverage and expand sales channels are critical steps towards achieving sustainable growth. However, the revenue shortfall against analyst estimates indicates the need for continued focus on converting operational successes into financial performance.

Overall, Lucid Diagnostics Inc is positioned to capitalize on its innovative diagnostic solutions, but must navigate the challenges of market adoption and revenue conversion to meet investor expectations and drive long-term value.

Explore the complete 8-K earnings release (here) from Lucid Diagnostics Inc for further details.