Transaction Overview

On March 21, 2025, SYLEBRA CAPITAL LLC (Trades, Portfolio) made a strategic decision to reduce its holdings in 8x8 Inc (NASDAQ: EGHT). The firm sold 102,149 shares at a trade price of $2.17 per share. This transaction resulted in a -0.01% change in the firm's portfolio position. Despite this reduction, SYLEBRA CAPITAL LLC (Trades, Portfolio) still holds a significant 14,187,327 shares, representing 10.77% of its total holdings in 8x8 Inc.

Profile of SYLEBRA CAPITAL LLC (Trades, Portfolio)

Based in Palo Alto, California, SYLEBRA CAPITAL LLC (Trades, Portfolio) is a prominent investment firm with a total equity of $2.67 billion. The firm has a diversified portfolio with top holdings in companies such as Impinj Inc (PI, Financial), Paycom Software Inc (PAYC, Financial), RingCentral Inc (RNG, Financial), Elastic NV (ESTC, Financial), and PureCycle Technologies Inc (PCT, Financial). SYLEBRA CAPITAL LLC (Trades, Portfolio) primarily focuses on the technology and industrial sectors, although its specific investment philosophy is not publicly detailed.

About 8x8 Inc

8x8 Inc is a software company that provides contact-center-as-a-service and unified-communications-as-a-service solutions. The company serves approximately 2.5 million users, offering a unified platform that facilitates omnichannel communication across voice, video, text, chat, and contact centers. With a market capitalization of $294.994 million, 8x8 Inc generates the majority of its revenue from the United States. The company's revenue streams are categorized into service revenue and other revenue.

Financial Metrics and Valuation

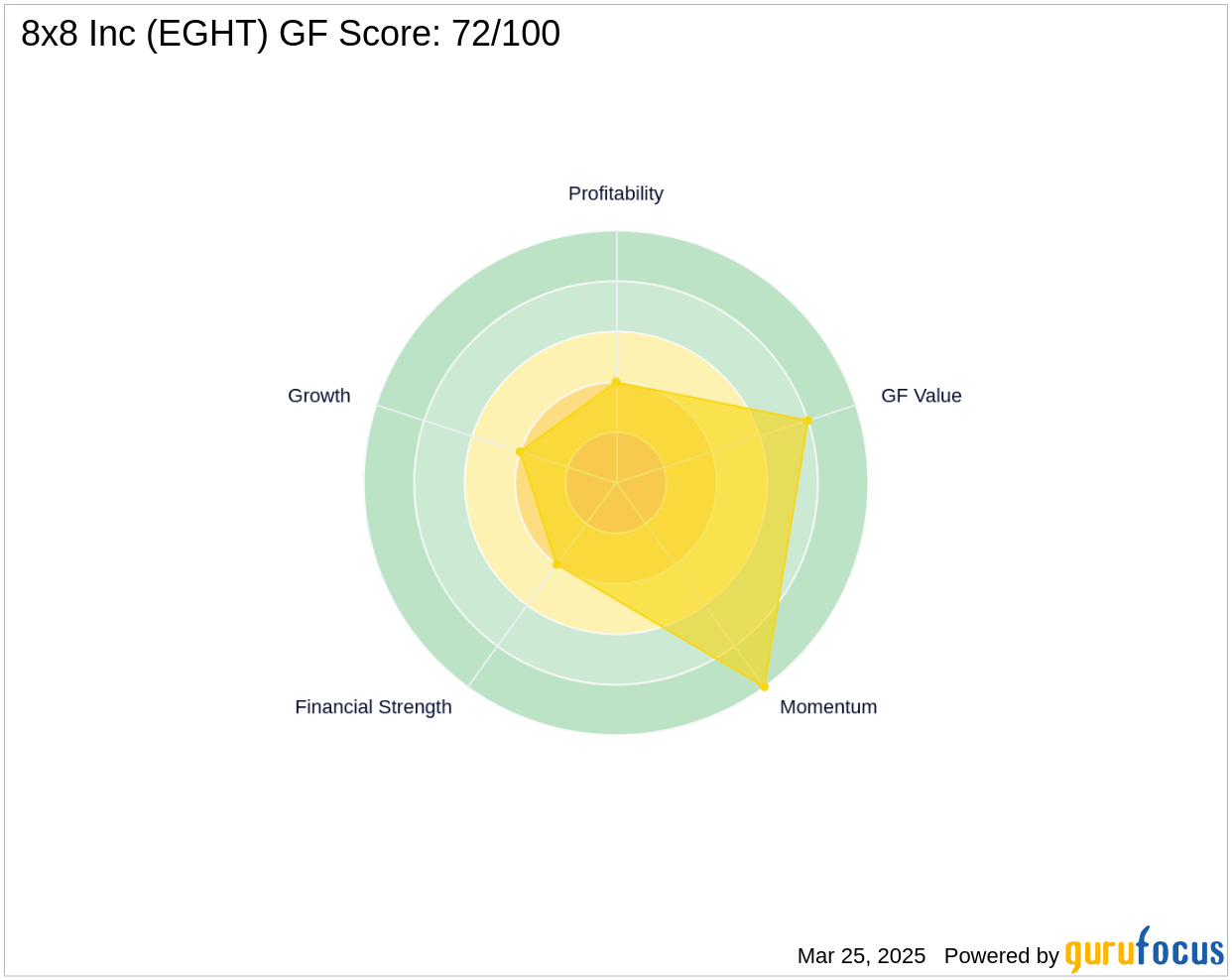

As of the latest data, 8x8 Inc's stock is priced at $2.24, which is considered modestly undervalued with a GF Value of $2.94. The price to GF Value ratio stands at 0.76, indicating a potential buying opportunity. However, the stock has experienced a year-to-date price decline of -15.79%. The company's GF Score is 72/100, suggesting likely average performance in the long term.

Performance and Growth Indicators

8x8 Inc's financial health is reflected in its Balance Sheet Rank of 4/10, Profitability Rank of 4/10, and Growth Rank of 4/10. The company shows strong momentum with a Momentum Rank of 10/10. Over the past three years, 8x8 Inc has achieved a revenue growth rate of 10.20% and an impressive Operating Margin growth of 37.90%.

Risk and Stability Assessment

Despite its growth, 8x8 Inc faces potential financial challenges, as indicated by its Z Score of -0.41, which suggests possible financial distress. The company's F Score is 4, and it has a cash to debt ratio of 0.25. Additionally, the return on equity (ROE) is -42.11%, and the return on assets (ROA) is -6.01%, highlighting areas of concern regarding profitability and asset utilization.

Conclusion

The recent reduction in shares by SYLEBRA CAPITAL LLC (Trades, Portfolio) reflects a minor adjustment in its portfolio, with a negligible impact of -0.01%. For 8x8 Inc, the current financial metrics and market conditions suggest a mixed outlook. While the company shows potential for growth, as evidenced by its strong momentum and operating margin improvements, the financial stability indicators raise caution. Investors should consider these factors when evaluating the future performance of 8x8 Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.