1: Introduction

Kinross Gold (NYSE: KGC) reported its fourth-quarter and full-year 2024 results on February 12, 2025. This article updates my Gurufocus article from December 9, 2024, in which I analyzed the third quarter of 2024.

Kinross Gold is a reliable gold mining company. It is an excellent choice for savvy investors but has some general caveats. Thus, I have listed Kinross Gold as one of my top choices for secure gold investments, which also include Newmont Corporation (NEM, Financial), Barrick Gold (GOLD, Financial), Agnico Eagle Mines (AEM, Financial), and Pan American Silver (PAAS, Financial).

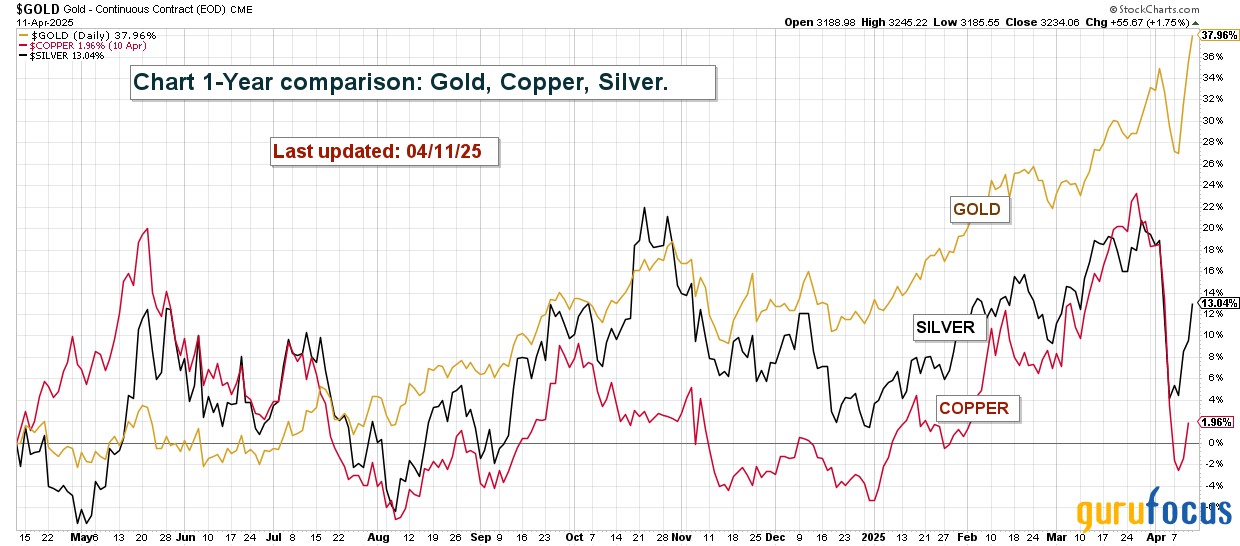

Let's examine the one-year chart to compare their performances, which are rapidly increasing again due to the impact of US tariffs.

KGC has performed exceptionally well, significantly outpacing its peers. Over the past year, the company's value has nearly doubled, increasing by almost 125%. Analyzing the fundamentals reveals that this growth is justified, but we may have reached a temporary limit.

One negative is that although the company generates strong free cash flow and expects further positive developments in production and costs, it currently pays a modest quarterly dividend of $0.03 per share, resulting in a yield of only 1.03%. Given what is currently happening, this situation is likely to persist for several quarters.

Additionally, since Kinross Gold is a Canadian company, non-Canadian shareholders will face a 25% automatic deduction from the dividend received, known as the Canadian non-resident withholding tax. In contrast, only Newmont Corporation, a U.S. company, is not subject to the withholding tax. Here is the comparison of dividend yields (before withholding tax) among my five selected gold mining companies. Dividend were valid on 04/07/25.

Free cash flow has consistently been a reliable indicator of the cash available for dividends. With gold prices recently reaching new highs—currently above $3,235 per Troy ounce—it is surprising that dividends in this industry have remained low, especially compared to the oil sector. KGC is offering a net dividend yield below 1%, which is disappointing considering its free cash flow generation. This situation explains why the stock quickly sells off when the market turns unfavorable. Insufficient dividend yield pushes savvy investors toward better investments, especially when they have a large gain.

Kinross Gold reported a free cash flow of $1.371 billion for 2024 and $453.8 million for 4Q24. Additionally, with an average gold price projected between $2,850 and $2,900 per ounce for 1Q25, free cash flow is expected to reach a new record next quarter. Below is Kinross Gold's quarterly free cash flow history.

However, this net cash-generating company does not prioritize its shareholders, and I don't understand why. The company's explanation seems quite obscure and not entirely logical.

Kinross Gold has also paused its share buyback program, which began in March 2025. The company stated that this decision aims to maintain a net leverage ratio below 1.7:1 to prevent rating downgrades, avoid major operational disruptions, and lessen the impact of significant declines in gold prices.

Kinross plans to reintroduce the buyback program later this year, although further details have not been provided.

KGC's dividend payments are significantly lower than its peers and should be raised to at least 2.75%, compared to the current rate of 1.03% (net around 0.75% after Canadian withholding tax) that they pay in 4Q24.

It is worth noting that KGC's peers are also facing challenges in this sensible area. I have consistently voiced my dissatisfaction with most of them for their constant inaction towards their shareholders. The average dividend yield for my five gold picks is 1.68% (net closer to 1% after withholding tax), which is extremely low compared to 4.55% NET for my six oil picks (see chart below).

Note: Except for NEM, all the gold companies mentioned above will impose a 25% Canadian withholding tax on US shareholders.

As we examine the six oil picks in the chart below, remember that all of them—except TotalEnergies (TTE)—will not be subject to dividend withholding taxes. US shareholders are buying American Deposit Shares (ADS) for BP and SHEL, which are British companies and are not subject to withholding tax. Let's have a look at dividends for oil stocks, which are even higher today after the sell-off.

2: Gold Production. The numbers are strong and align with the company's guidance for 2024.

Kinross Gold reported a total production of 514,355 ounces, with its attributable gold equivalent production reaching 501,209 ounces. The company sold 517,980 ounces during the period referenced as 4Q24. Kinross confirmed that it met its production and cost guidance for 2024.

Kinross owns 70% of the Manh Choh mine, primarily responsible for decreased gold-attributable production. Below is the history of yearly gold equivalent output and revenue.

Kinross Gold operates seven mines globally. Four of these mines are located in the USA: Fort Knox in Alaska, which also processes ore from Manh Choh, and Round Mountain and Bald Mountain, both in Nevada. Additionally, the company has one mine in Brazil (Paracatu, an open-pit mine), one in Chile (La Coipa, which is expected to produce until early 2026 only), and the Tasiat open-pit mine in Mauritania, West Africa, which is the less appealing in terms of safe jurisdiction.

In December 2021, Kinross acquired the Great Bear project, including open-pit and underground mining operations in Ontario, Canada. The project is expected to commence commercial production in 2029, and its projected annual production will exceed 500,000 ounces of gold during the initial eight years.

The following chart presents the gold-equivalent production figures for each mine in 4Q24.

Gold production attributable in 4Q24 decreased significantly from the previous quarter, as shown in the chart below:

Kinross Gold has adjusted its forecast for gold equivalent production to approximately 2.0 million ounces per year for the next three years (2025–2027), which is slightly lower than previous estimates. Production is expected to increase only after the Great Bear mine begins commercial operations in 2029. Kinross Gold indicated an all-in-sustaining costs AISC of $1,510 per GEO. AISC was the highest that I have recorded, as you can see in the chart below:

In my opinion, to achieve a gold production of at least 2.0 million ounces after 2025, the company should consider acquiring one or two producing mines or potentially a promising small gold-producing company, such as Alamo Gold (AGI), Eldorado Gold (EGO), or B2Gold (BTG), in 2025.

The company is in a strong cash position and could leverage its stock price to negotiate a favorable all-stock deal. However, this type of acquisition is never good news for actual shareholders because the stock will tank on the news.

3: 4Q24 Results: A solid quarter.

Kinross reported revenues of $1.416 billion for the quarter, a 26.9% increase from the equivalent quarter in 2023.

The company reported net earnings of $275.6 million, or $0.22 per share, up from $65.4 million, or $0.06 per share, in 4Q23. However, adjusted net earnings totaled $240.0 million, or $0.20 per share, which did not meet expectations.

As I noted earlier, free cash flow reached $453.8 million. This free cash flow is calculated by subtracting CapEx ($288.7 million in 4Q24) from cash flow from operations ($734.5 million in 4Q24), indicating a significant year-over-year increase (free cash flow was $99.6 million in 4Q23).

Kinross Gold's debt situation in 4Q24 is solid. In 2024, the company reduced its debt by repaying $800 million. Cash, cash equivalents, and marketable securities reached $611.5 million, reflecting a 42.4% increase year over year.

Long-term debt, including current liabilities, totaled $1,235.5 million, down from $2,236.6 million the previous year. It indicates a strong debt reduction trend that began in 2022 (see chart below), along with a gradual improvement in cash reserves. We expect this trend to continue into 2025.

4: Conclusion: Is it time to take profits?

Kinross Gold had an exceptional year in 2024. With gold prices rising and surpassing $3,200 per ounce, the company will maintain a strong valuation throughout 2025, even though the stock may have reached a temporary peak after the huge correction the market experienced followed by a relief rally when tariffs were put on hold.

Determining a fair valuation for KGC from a long-term perspective is crucial. To arrive at a fair valuation, it is always important to consider proven and probable mineral reserves.

As of December 31, 2024, Kinross Gold reported total proven and probable gold reserves of approximately 32.6 million ounces and 23.7 million ounces of silver. The company did not report any copper reserves. In addition to Pan American Silver and Kinross Gold, which have significant silver reserves, especially PAAS, most other gold miners do not, and the silver they produce is classified as a by-product. I've shared the reserves for 2024 below for comparison. Kinross Gold ranks as the fourth-largest miner by gold reserves.

Kinross Gold has a total gold-to-silver ratio of 1:91.8 and total gold reserves of 32.86 million ounces, including silver. The company reported a net profit margin of 18% for 2024, an increase from 9.8% in 2023. With the gold price at $3,200 per ounce and 1,235.4 million diluted shares outstanding, the stock valuation is estimated to range between $13.5 and $14.25 per share.

This valuation is supported by all-in-sustaining costs (AISC) slightly over than $1,500 per ounce. While these costs are quite high in the industry, they still provide KGC with a significant profit margin.

Overall, the information presented suggests that Kinross Gold is currently valued appropriately and potentially overvalued based on what is going on with the tariffs. However, it may be the right time to capitalize on the strong rally KGC recently experienced and sell between 30% and 40% of your position. It is a wise move for two reasons.

While some analysts predict gold prices will reach between $3,400 and $3,500 per ounce this year, the price should retrace slightly before continuing its upward trend, as no increase can be indefinite. Gold is currently priced at $3,235 per ounce, but further gains may be limited depending on the Fed and the potential resurgence of inflation caused by the tariff policy.

Furthermore, and most importantly, Kinross Gold will have an issue with production timing. Gold production is decreasing, and the Great Bear project, which could correct this slight decrease, will start production in 2029.

The company will have to find a solution to solve this production gap issue, potentially acquiring a smaller gold producer, such as B2Gold (BTG) or Alamo Gold (AGI).

From a long-term perspective, this situation poses a significant disadvantage, especially considering that KGC's value has increased by over 90%. Many investors may be tempted to cash out, as they may be less inclined to hold onto a profitable investment that offers low returns and carries a higher risk of correction.

5: Technical Analysis: Ascending Channel.

Note: The chart has been adjusted for dividends.

Kinross Gold forms an ascending channel pattern, with resistance at $14.50 and support at $12.25. The relative strength index (RSI) is at 74, indicating a bullish trend, while an overbought situation suggests a sell signal.

Although an ascending channel is generally interpreted as a bullish pattern, it can occasionally result in a bearish breakdown or a bullish breakout. KGC started to break out powered by gold price, reaching another record, closing today at a whopping $3,235.

Selling a portion of your position above $14 and above is prudent. However, if gold prices continue to rally due to the recent crisis, KGC could rally even higher to as high as $15-$16. Please take a look at my chart above for more information.

As recent events illustrate, taking partial short-term profits using the LIFO (Last In, First Out) method is essential. Consider selling approximately half of your position for short-term trading while maintaining a core long-term investment. This strategy allows you to capitalize on potentially significant gains while earning dividends.

Warning: The technical analysis chart requires regular updates, especially after encountering a gray swan event last week.