On March 21, 2025, BlackRock, Inc. (Trades, Portfolio) made a strategic move by acquiring an additional 101,600 shares in the BlackRock ESG Capital Allocation Trust (ECAT, Financial). This transaction was executed at a price of $16.20 per share, bringing the total number of shares held by the firm to 1,181,800. Despite this addition, the transaction did not significantly alter the firm's portfolio position, maintaining a stable investment strategy.

Transaction Details and Implications

The recent acquisition by BlackRock, Inc. (Trades, Portfolio) involved a purchase of 101,600 shares at $16.20 each, reflecting a calculated investment in the BlackRock ESG Capital Allocation Trust. Post-transaction, the firm holds a total of 1,181,800 shares. This move, while substantial in terms of share volume, did not notably impact the overall portfolio position, indicating a strategic alignment with existing investment objectives rather than a shift in strategy.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Firm

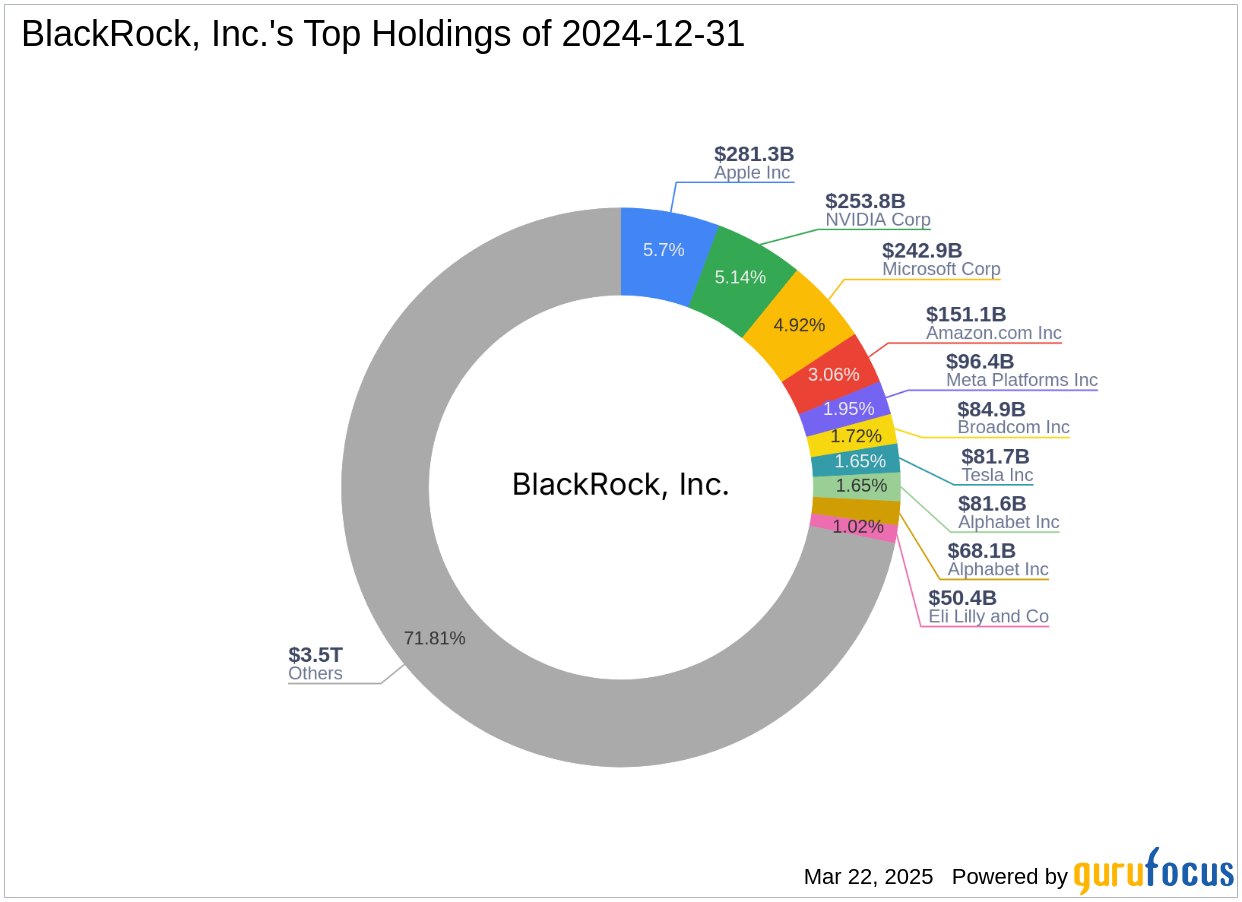

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a leading global asset management firm. While the firm's specific investment philosophy is not detailed, its top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). With an equity value of $4,939.25 trillion, BlackRock, Inc. (Trades, Portfolio) is a dominant player in the asset management sector, focusing primarily on technology and financial services.

Understanding BlackRock ESG Capital Allocation Trust

The BlackRock ESG Capital Allocation Trust is a non-diversified, closed-ended management investment company. Its primary investment objectives are to achieve total return and income through a combination of current income, gains, and long-term capital appreciation. With a market capitalization of $1.61 billion and a current stock price of $16.23, the trust is positioned within the asset management industry. The trust's GF Score is 43/100, indicating a poor potential for future performance.

Financial Metrics and Valuation Insights

BlackRock ESG Capital Allocation Trust currently holds a price-to-earnings ratio of 8.63. However, there is no available data for the GF Valuation, making it challenging to assess the intrinsic value of the stock. The year-to-date price change stands at -1.04%, while the price change since its IPO is -18.85%. These metrics suggest a cautious approach for investors considering the trust's valuation and market performance.

Performance and Growth Indicators

The trust's Profitability Rank is 2/10, reflecting challenges in generating consistent profits. However, the balance sheet is relatively strong with a rank of 8/10. Over the past three years, revenue growth has been 44.80%, and earnings growth has been 44.20%, indicating potential for future expansion despite current profitability challenges.

Market and Industry Context

Operating within the asset management industry, BlackRock ESG Capital Allocation Trust has a return on equity (ROE) of 13.13% and a return on assets (ROA) of 12.15%. The trust's momentum indicators, such as the RSI 14 Day at 43.82, suggest neutral momentum, indicating neither strong upward nor downward trends in the stock's performance.

Conclusion: Strategic Implications for BlackRock, Inc. (Trades, Portfolio)

The acquisition of additional shares in BlackRock ESG Capital Allocation Trust by BlackRock, Inc. (Trades, Portfolio) underscores the firm's commitment to its existing investment strategy. While the transaction did not significantly alter the portfolio's composition, it reflects a continued focus on asset management and ESG principles. For value investors, this move may signal BlackRock, Inc. (Trades, Portfolio)'s confidence in the trust's long-term potential, despite current performance challenges. As the firm navigates the asset management sector, strategic acquisitions like this one could play a crucial role in shaping its future growth trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.