On September 30, 2024, Barclays PLC executed a notable transaction by acquiring 2,159,334 shares of PlayAGS Inc at a price of $11.39 per share. This strategic move increased Barclays' total holdings in PlayAGS to 2,368,765 shares, representing 0.01% of the firm's portfolio. The transaction reflects Barclays' ongoing interest in diversifying its investments within the gaming industry, particularly in companies with potential for growth and innovation.

Barclays PLC: A Historical Overview

Barclays PLC is a renowned British financial services firm with a rich history dating back to 1690. Originally established by John Freame and Thomas Gould as goldsmith bankers, the firm has evolved through numerous mergers and acquisitions. Today, Barclays is a global entity with over 50 million customers, $2 trillion in assets, and operations in more than 50 countries. The firm is listed on both the London Stock Exchange and the New York Stock Exchange, and it continues to be a significant player in the financial sector.

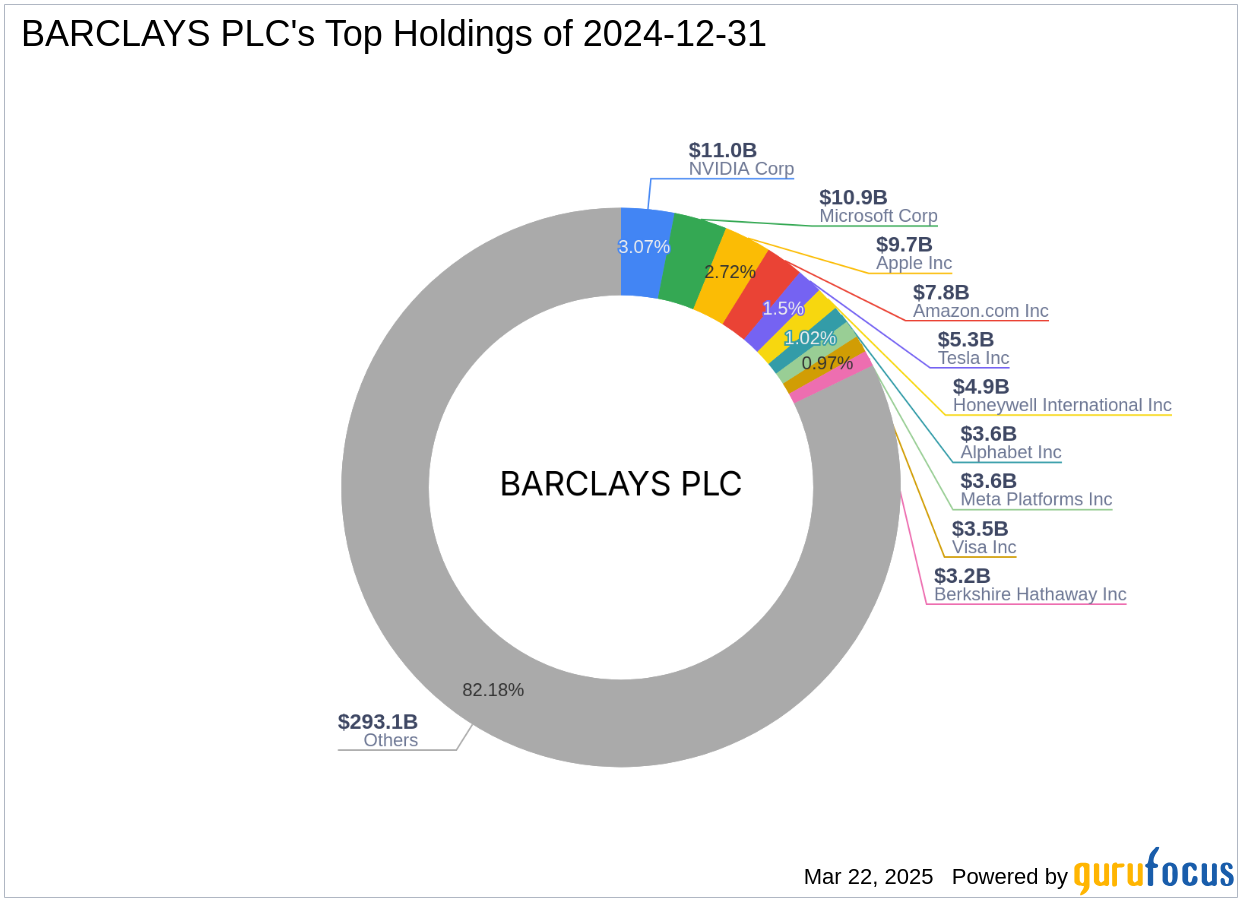

Investment Strategy and Portfolio Insights

Barclays' investment philosophy emphasizes a focus on technology and consumer cyclical sectors. The firm's portfolio includes major holdings in industry giants such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial). This strategic focus is indicative of Barclays' commitment to investing in companies that are at the forefront of technological innovation and consumer trends.

Understanding PlayAGS Inc

PlayAGS Inc is a prominent designer and supplier of gaming products and services, primarily catering to the gaming industry. The company operates through three key segments: Electronic Gaming Machines (EGM), Interactive, and Table Products. PlayAGS generates the majority of its revenue from the EGM segment, which includes video slot titles and EGM cabinets. The company's products are widely used in casinos and gaming locations, with a significant market presence in the United States.

Financial Metrics and Valuation of PlayAGS Inc

As of the latest data, PlayAGS Inc has a market capitalization of $500.465 million and a stock price of $12.13. The company's price-to-earnings (PE) ratio stands at 10.19, while the [GF Value](https://www.gurufocus.com/term/gf-value/AGS) is calculated at $8.56, indicating that the stock is significantly overvalued. The [GF Score](https://www.gurufocus.com/term/gf-score/AGS) of 72/100 suggests that the stock is likely to have average performance in the long term.

Performance and Growth Indicators

Since the transaction, PlayAGS Inc's stock has experienced a 6.5% gain. However, the stock has seen a -28.65% change since its IPO in 2018. Despite this, the company has demonstrated a revenue growth of 11.60% over the past three years, supported by a strong [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/AGS) of 9/10. These metrics highlight the company's potential for future growth, albeit with some volatility.

Implications of Barclays' Transaction

The acquisition of PlayAGS Inc shares by Barclays PLC has a minimal impact on the firm's overall portfolio, with the stock representing just 0.01% of the total holdings. However, the transaction underscores Barclays' interest in the gaming sector and its potential for growth. Despite the stock being considered significantly overvalued according to [GF Valuation](https://www.gurufocus.com/term/rank-gf-value/AGS) metrics, Barclays' investment may signal confidence in the company's long-term prospects.

Conclusion

In summary, Barclays PLC's strategic addition of PlayAGS Inc shares reflects the firm's ongoing commitment to diversifying its portfolio and exploring growth opportunities within the gaming industry. For value investors, the current valuation and growth prospects of PlayAGS Inc present both challenges and opportunities. As the market continues to evolve, investors will need to weigh the potential risks and rewards associated with this investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.