On March 21, 2025, Fund 1 Investments, LLC (Trades, Portfolio) made a strategic move by acquiring an additional 33,686 shares of Tile Shop Holdings Inc (TTSH, Financial) at a price of $6.50 per share. This transaction increased the firm's total holdings in Tile Shop Holdings to 12,667,953 shares, representing a 0.27% change in their position. The acquisition reflects a 7.1% allocation of the firm's portfolio to this stock, which now constitutes 28.37% of the firm's holdings in Tile Shop Holdings. This move indicates a continued confidence in the potential of Tile Shop Holdings by Fund 1 Investments, LLC (Trades, Portfolio).

Overview of Fund 1 Investments, LLC (Trades, Portfolio)

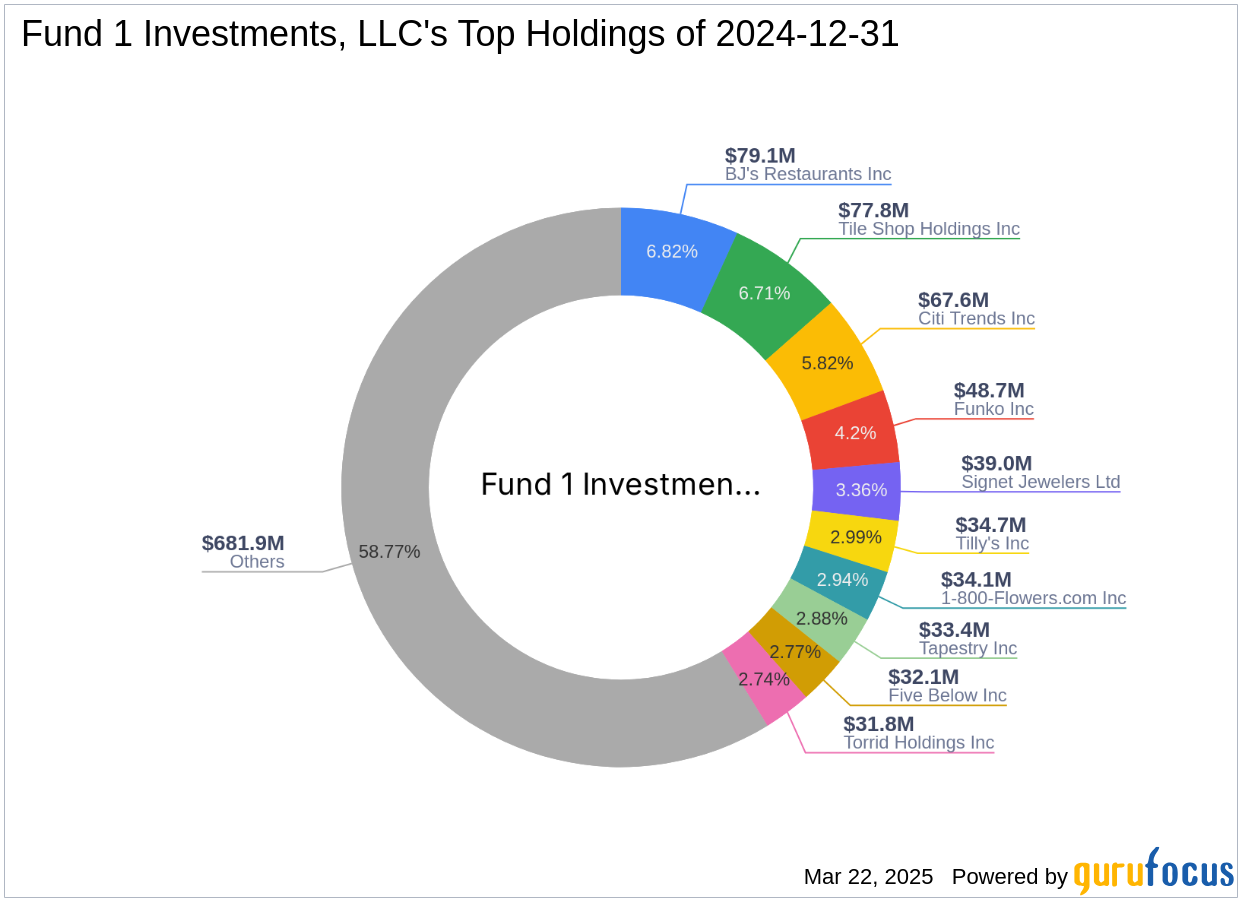

Fund 1 Investments, LLC (Trades, Portfolio) is an investment firm based in Rincon, Puerto Rico. The firm manages a diverse portfolio comprising 70 stocks with a total equity value of $1.16 billion. While the firm's specific investment philosophy is not disclosed, its top holdings include BJ's Restaurants Inc (BJRI, Financial), Citi Trends Inc (CTRN, Financial), Tile Shop Holdings Inc (TTSH, Financial), Signet Jewelers Ltd (SIG, Financial), and Funko Inc (FNKO, Financial). The firm's investment focus is primarily on the Consumer Cyclical and Communication Services sectors, indicating a strategic preference for industries with potential for growth and consumer engagement.

About Tile Shop Holdings Inc

Tile Shop Holdings Inc is a specialty retailer in the United States, offering a wide range of natural stone and man-made tiles, along with setting and maintenance materials and related accessories. The company caters to a diverse clientele, including consumers, contractors, designers, and home builders. With a market capitalization of $289.383 million, Tile Shop Holdings has been publicly traded since its IPO on November 19, 2010. The current stock price stands at $6.48, slightly below the recent acquisition price.

Financial Metrics and Valuation

Tile Shop Holdings Inc is currently trading with a price-to-earnings ratio of 106.72, indicating a high valuation relative to its earnings. The stock is considered modestly overvalued with a GF Value of $5.74, resulting in a price to GF Value ratio of 1.13. Year-to-date, the stock has experienced a price change of -6.49%. The company's GF Score is 76/100, suggesting likely average performance in the long term.

Performance and Growth Analysis

Over the past three years, Tile Shop Holdings has seen a revenue growth of 2.90%, while its EBITDA and earnings have declined by -19.80% and -44.30%, respectively. The company's Profitability Rank is 7/10, but its Growth Rank is lower at 3/10, reflecting challenges in achieving consistent growth.

Balance Sheet and Financial Health

Tile Shop Holdings has a Balance Sheet Rank of 6/10, with a cash to debt ratio of 0.15, indicating limited liquidity. The company's interest coverage ratio is 12.79, suggesting it can comfortably meet its interest obligations.

Market Position and Momentum

Despite its financial challenges, Tile Shop Holdings has a strong Momentum Rank of 10/10, with a 14-day RSI of 40.42, indicating potential for upward price movement. The stock's momentum index over the past six months is 14.20, reflecting positive market sentiment.

Transaction Analysis

The recent acquisition by Fund 1 Investments, LLC (Trades, Portfolio) highlights the firm's confidence in Tile Shop Holdings' potential for recovery and growth. This transaction, while modest in impact, reinforces the firm's commitment to its existing investment strategy. As the largest shareholder, First Eagle Investment (Trades, Portfolio) Management, LLC's position remains undisclosed, but the continued interest from Fund 1 Investments, LLC (Trades, Portfolio) may signal a positive outlook for Tile Shop Holdings in the eyes of institutional investors.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.