Coliseum Capital Management, LLC (Trades, Portfolio), a prominent investment firm, has recently executed a significant transaction involving Purple Innovation Inc (PRPL, Financial). On March 12, 2025, the firm added 13,600,617 shares of Purple Innovation Inc to its portfolio. This strategic move highlights the firm's continued interest in the company, potentially signaling confidence in its future prospects.

Transaction Details and Impact

The recent acquisition by Coliseum Capital Management, LLC (Trades, Portfolio) increased its position in Purple Innovation Inc by 29.03%. The shares were acquired at a price of $0.7055, which impacted the firm's portfolio by 0.78%. This transaction brings the firm's total holdings in Purple Innovation Inc to 60,455,908 shares, representing a significant 49.90% of the firm's holdings in the traded stock. The current position of Purple Innovation Inc in the firm's portfolio stands at 3.49%.

Coliseum Capital Management, LLC (Trades, Portfolio): A Strategic Investor

Based in Stamford, Connecticut, Coliseum Capital Management, LLC (Trades, Portfolio) is renowned for its strategic investments, particularly in the consumer cyclical and industrial sectors. The firm manages an equity portfolio valued at $1.21 billion, with top holdings in companies such as Gildan Activewear Inc (GIL, Financial) and GMS Inc (GMS, Financial). The firm's investment philosophy focuses on identifying undervalued opportunities with potential for significant growth. This approach is evident in its diverse portfolio, which includes 14 stocks across various sectors.

About Purple Innovation Inc

Purple Innovation Inc, a USA-based company, specializes in comfort technology products, including mattresses, pillows, and other related items. The company operates an omni-channel distribution model, offering its products through e-commerce, retail partners, and showrooms. Since its IPO on October 29, 2015, Purple Innovation has been a key player in the furnishings, fixtures, and appliances industry, despite facing some financial challenges in recent years.

Financial Metrics and Valuation

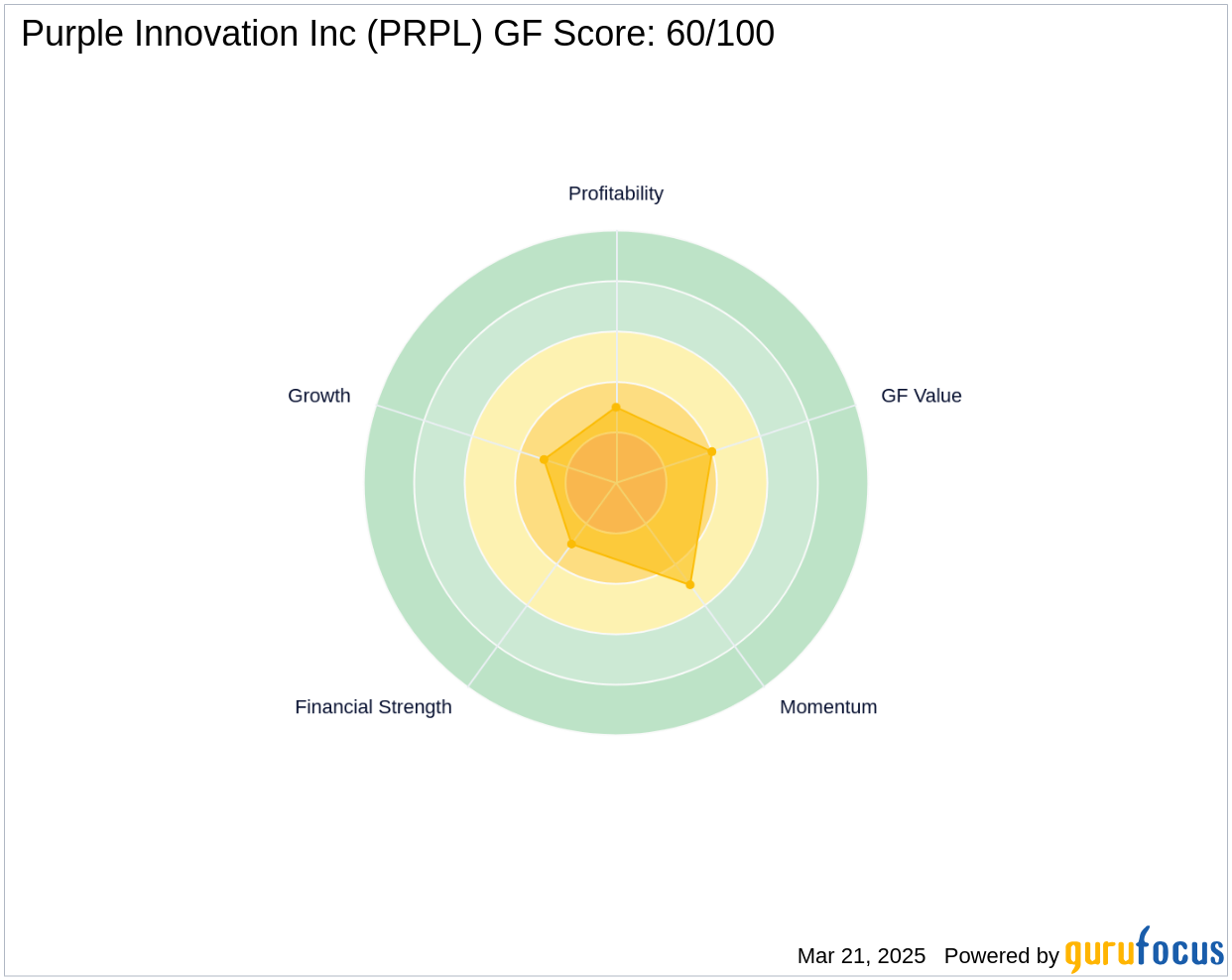

With a market capitalization of $91.876 million, Purple Innovation Inc's stock is currently priced at $0.8543, reflecting a 21.09% gain since the transaction. However, the GF Valuation suggests a "Possible Value Trap," with a GF Value of 1.56 and a Price to GF Value ratio of 0.55. This indicates that while the stock may appear undervalued, investors should exercise caution. The company's GF Score of 60/100 suggests poor future performance potential.

Performance and Growth Indicators

Purple Innovation Inc has faced several challenges, including a negative return on equity (ROE) of -165.63% and a revenue growth decline of 25% over the past three years. The company's Profitability Rank and Growth Rank are both 3/10, indicating struggles in maintaining profitability and growth. Despite these hurdles, the firm's increased stake suggests a belief in the company's potential for a turnaround or strategic value.

Risk Assessment and Market Position

The stock's Z Score of -1.61 indicates financial distress, while the Cash to Debt ratio stands at 0.18, reflecting limited financial flexibility. Despite these challenges, Coliseum Capital Management, LLC (Trades, Portfolio)'s increased investment in Purple Innovation Inc may indicate confidence in the company's ability to overcome its current difficulties and capitalize on future opportunities.

Transaction Analysis

This transaction by Coliseum Capital Management, LLC (Trades, Portfolio) highlights a strategic decision to increase its stake in Purple Innovation Inc, despite the company's current financial challenges. The firm's significant investment could be interpreted as a vote of confidence in Purple Innovation's potential for recovery and growth. As the stock has already seen a 21.09% gain since the transaction, it will be interesting to observe how this investment impacts both the firm's portfolio and Purple Innovation's market performance in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.