On January 31, 2025, TRUIST FINANCIAL CORP (Trades, Portfolio) executed a strategic transaction involving the reduction of its holdings in Federated Hermes MDT Large Cap Core ETF (FLCC, Financial). The firm decreased its position by 12,059 shares, trading at a price of $29.35 per share. This move reflects a calculated adjustment in the firm's investment strategy, impacting its portfolio composition. Following this transaction, TRUIST FINANCIAL CORP (Trades, Portfolio) holds 153,847 shares of FLCC, which now constitutes 0.01% of its overall portfolio. This decision aligns with the firm's ongoing evaluation of market conditions and investment opportunities.

Profile of TRUIST FINANCIAL CORP (Trades, Portfolio)

TRUIST FINANCIAL CORP (Trades, Portfolio), headquartered at 214 North Tryon Street, Charlotte, NC, is a prominent entity in the financial sector. The firm is known for its robust investment philosophy, focusing primarily on the technology and financial services sectors. With an equity value of $63.84 billion, TRUIST FINANCIAL CORP (Trades, Portfolio) manages a diverse portfolio, including top holdings such as iShares U.S. Treasury Bond ETF (GOVT, Financial), iShares Core S&P 500 ETF (IVV, Financial), SPDR S&P 500 ETF Trust (SPY, Financial), Apple Inc (AAPL, Financial), and Microsoft Corp (MSFT, Financial). The firm's strategic approach is characterized by a keen eye on technological advancements and financial market trends.

Details of the Transaction

The recent transaction involved a reduction of 12,059 shares in FLCC, executed at a price of $29.35 per share. This adjustment resulted in a 7.27% decrease in the firm's holdings of the ETF. Despite this reduction, FLCC remains a part of TRUIST FINANCIAL CORP (Trades, Portfolio)'s portfolio, albeit with a minimal impact, representing just 0.01% of the total portfolio. The decision to reduce the stake may reflect the firm's strategic reallocation of resources or a response to market dynamics.

Overview of Federated Hermes MDT Large Cap Core ETF

Federated Hermes MDT Large Cap Core ETF (FLCC, Financial) is a financial instrument with a market capitalization of $11.953 million. As of the latest data, the ETF is trading at $29.51 per share. Key financial metrics for FLCC include a price-to-earnings (PE) ratio of 20.84 and a GF Value of $23.11, resulting in a Price to GF Value ratio of 1.28. These figures suggest that the ETF is currently trading above its intrinsic value, as calculated by GuruFocus's proprietary method.

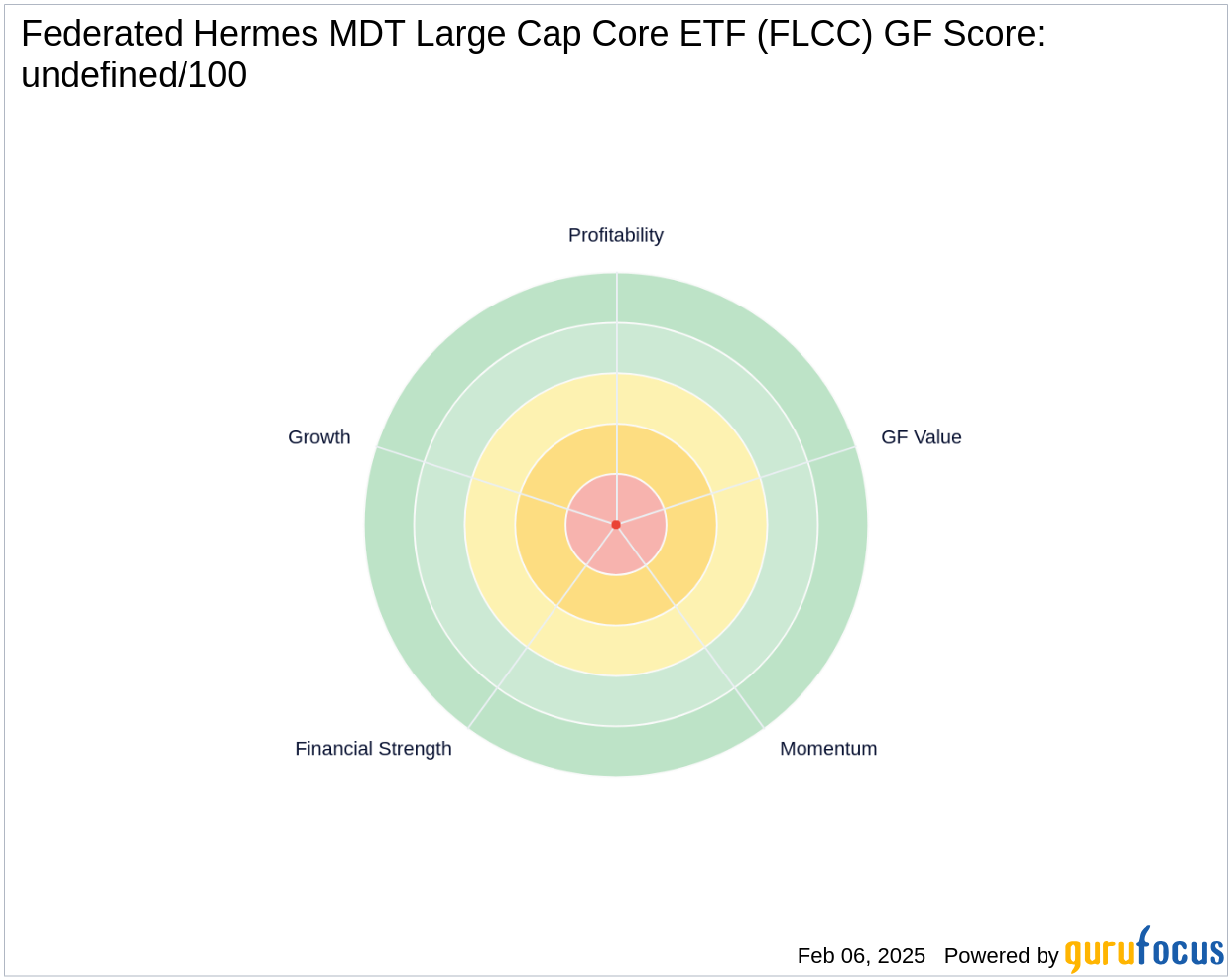

Financial Performance and Valuation

FLCC's financial performance is reflected in its GF Score of 80/100, indicating a likely average performance. The ETF boasts a strong Profitability Rank and Growth Rank of 8/10, while its balance sheet is rated at 6.5/10. These metrics suggest a solid financial foundation, with potential for steady growth and profitability. The Operating Margin growth of 3.80% and revenue growth of 14.07% over three years further underscore its financial health.

Market Performance and Indicators

In terms of market performance, FLCC has experienced a year-to-date price change of 5.13% and a stock gain of 0.55% since the transaction. Momentum indicators, such as the Relative Strength Index (RSI) and momentum index values, suggest a stable market position. The ETF's Altman Z score of 9.98 and interest coverage of 66.37 further highlight its financial resilience and ability to meet obligations.

Conclusion

TRUIST FINANCIAL CORP (Trades, Portfolio)'s decision to reduce its stake in FLCC reflects a strategic portfolio adjustment, potentially driven by market evaluations or a shift in investment focus. For value investors, the ETF's current valuation and performance metrics, including its GF Score and profitability indicators, offer insights into its potential as a stable investment. As the market evolves, monitoring FLCC's financial and market performance will be crucial for assessing its long-term viability within a diversified investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.