On February 6, 2025, Roblox Corp (RBLX, Financial) released its 8-K filing detailing its financial performance for the fourth quarter and full year 2024. The company, known for its online video game platform that allows users to create and monetize games, reported significant growth in revenue and bookings, despite ongoing net losses.

Company Overview

Roblox operates a unique gaming platform with 80 million daily active users, enabling young gamers to create, develop, and monetize games for others. The platform combines a game engine, publishing platform, online hosting, marketplace, and social network, generating $3.5 billion in bookings in 2023 through in-game purchases and advertising.

Financial Performance and Challenges

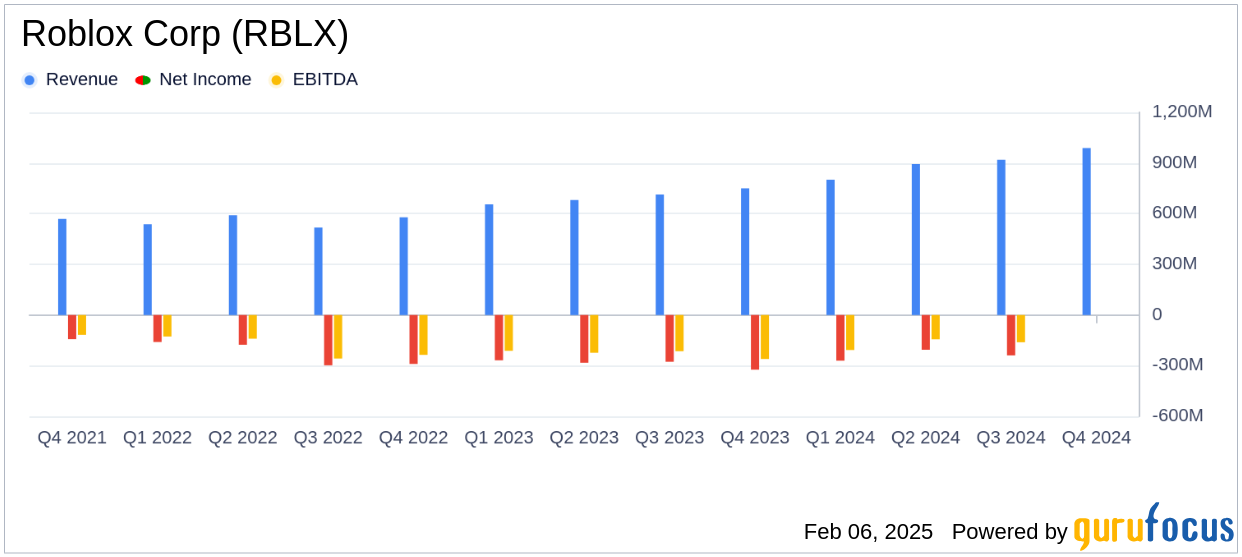

For the fourth quarter of 2024, Roblox reported revenue of $988.2 million, a 32% increase year-over-year, falling short of the estimated revenue of $1,367.49 million. However, the company's earnings per share (EPS) was a loss of $0.33, which was better than the analyst estimate of a $0.44 loss per share. The net loss attributable to common stockholders was $219.6 million.

Despite the revenue growth, Roblox continues to face challenges with profitability, as evidenced by its consolidated net loss of $221.1 million for the quarter. The company's focus on innovation and community building, while crucial for long-term growth, requires significant investment, impacting short-term profitability.

Key Financial Achievements

Roblox's financial achievements include a 21% year-over-year increase in bookings to $1,361.6 million for the fourth quarter. The company also reported a 29% increase in net cash provided by operating activities, reaching $184.5 million, and a 54% rise in free cash flow to $120.6 million. These metrics highlight Roblox's ability to generate cash flow from its core operations, which is vital for sustaining growth in the interactive media industry.

Operational Highlights

Roblox's average daily active users (DAUs) grew by 19% year-over-year to 85.3 million, while hours engaged increased by 21% to 18.7 billion. The average monthly unique payers rose by 19% to 18.9 million, with average bookings per monthly unique payer at $23.97, up 1% year-over-year. These operational metrics underscore the platform's expanding user base and engagement, crucial for future monetization opportunities.

Income Statement and Balance Sheet Insights

For the full year 2024, Roblox reported revenue of $3,602.0 million, a 29% increase from the previous year. The company's net loss attributable to common stockholders was $935.4 million, reflecting the ongoing challenge of achieving profitability. Adjusted EBITDA for the year was $180.2 million, indicating improvements in operational efficiency.

Roblox's balance sheet shows total assets of $7,175.0 million, with cash and cash equivalents, short-term investments, and long-term investments totaling $4.0 billion. The company's net liquidity stands at $3.0 billion, providing a solid financial foundation for future investments and growth initiatives.

Commentary and Future Outlook

“Roblox had a strong 2024, driven by our commitment to innovation and community. We’re building a platform that goes beyond technology—it’s about fostering genuine connections,” said David Baszucki, founder and CEO of Roblox.

“We are pleased that we delivered Q4 2024 results at or above the guidance we provided on our Q3 2024 earnings call. For FY 2024, revenue and bookings grew by 29% and 24%, respectively, year-over-year; margins improved by over 620 bps; and cash flow from operations grew by 79% to $822.3 million,” said Michael Guthrie, chief financial officer of Roblox.

Analysis and Conclusion

Roblox's strong revenue growth and increased user engagement highlight its potential in the interactive media industry. However, the company's ongoing net losses and the challenge of achieving profitability remain concerns for investors. Roblox's focus on innovation and community building is crucial for long-term success, but it requires careful management of costs and investments.

Overall, Roblox's financial results demonstrate its ability to grow its platform and user base, positioning it well for future opportunities in the gaming industry. Investors will be keen to see how the company balances growth with profitability in the coming quarters.

Explore the complete 8-K earnings release (here) from Roblox Corp for further details.