BlackRock's Recent Acquisition in MSP Recovery Inc

On December 31, 2024, BlackRock, Inc. (Trades, Portfolio), a leading investment firm, executed a significant transaction by acquiring an additional 99,029 shares of MSP Recovery Inc. This acquisition was made at a price of $2.27 per share, bringing BlackRock's total holdings in MSP Recovery to 146,363 shares. This move reflects BlackRock's strategic interest in MSP Recovery, a company operating in the healthcare recovery and data analytics sector. The transaction has positioned MSP Recovery to represent 6.90% of BlackRock's holdings in the stock, indicating a notable commitment to this investment.

About BlackRock, Inc. (Trades, Portfolio)

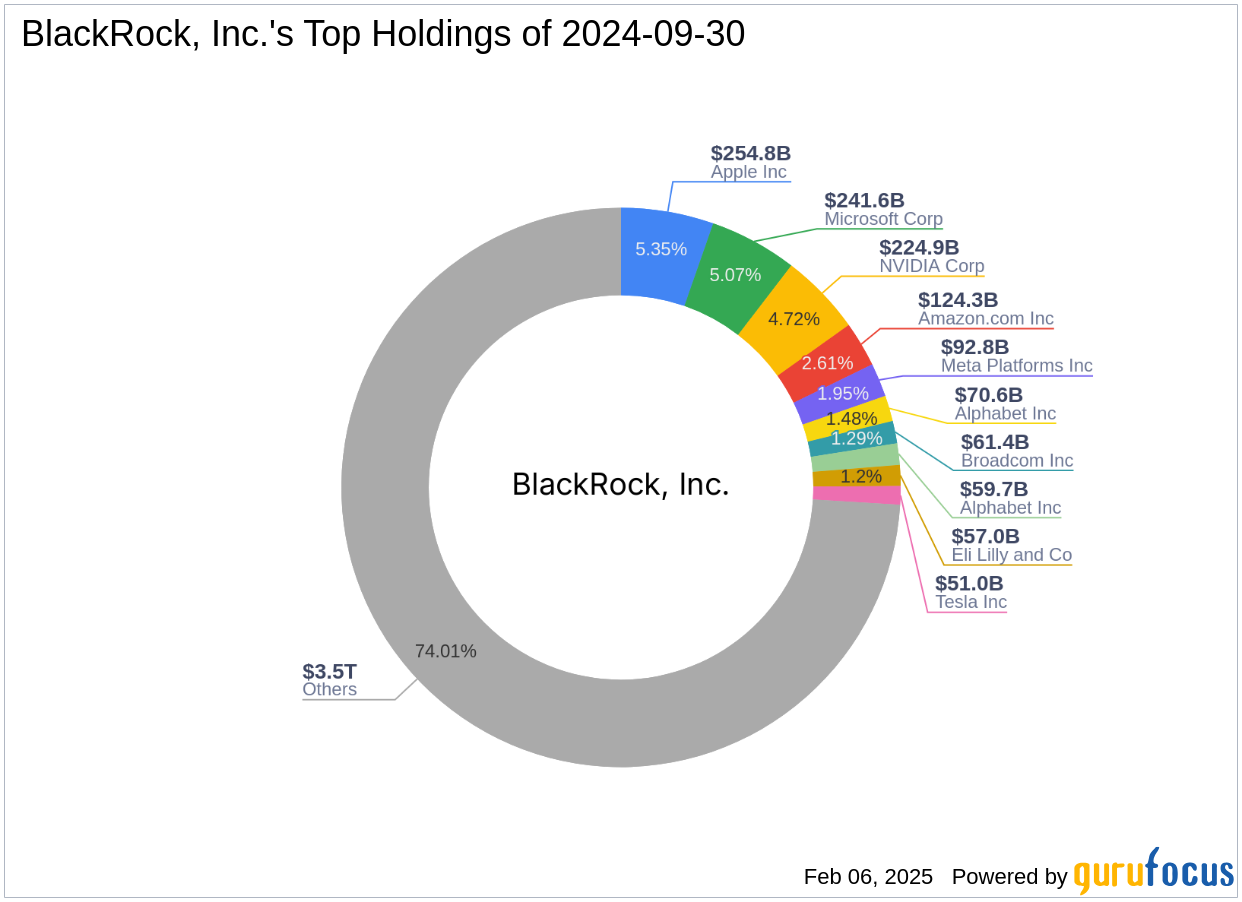

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a prominent global investment management firm known for its extensive portfolio and strategic investments. With a focus on technology and financial services sectors, BlackRock's investment philosophy emphasizes long-term growth and value creation. The firm holds significant equity in major companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). BlackRock's total equity stands at an impressive $4,761.16 trillion, underscoring its influence and reach in the investment world.

Understanding MSP Recovery Inc.

MSP Recovery Inc is a healthcare recovery and data analytics company based in the USA. The company operates primarily through two business lines: Claims Recovery and Chase to Pay Services. MSP Recovery provides innovative, data-driven solutions to address inefficiencies in the healthcare reimbursement system, aiming to secure recoveries against responsible parties. The company's platform offers comprehensive compliance solutions to recover claims where the law places primary payment responsibility on another payer, positioning itself as a key player in the healthcare industry.

Financial Metrics and Valuation of MSP Recovery Inc.

MSP Recovery Inc currently has a market capitalization of $3.742 million, with a stock price of $1.77. Despite the lack of GF Valuation data, the company's financial performance indicators present a challenging picture. The [GF Score](https://www.gurufocus.com/term/gf-score/MSPR) is a low 10/100, indicating potential concerns about future performance. The company's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/MSPR) and [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/MSPR) are also low, with ranks of 2/10 and 1/10, respectively. These metrics suggest that MSP Recovery is facing significant financial hurdles.

Implications of BlackRock's Investment

BlackRock's decision to increase its stake in MSP Recovery Inc, despite the company's challenging financial metrics, raises intriguing questions about the firm's strategic intentions. With MSP Recovery now representing 6.90% of BlackRock's holdings in the stock, this move could indicate a belief in the company's potential for turnaround or growth. The investment may also reflect BlackRock's confidence in MSP Recovery's business model and its ability to capitalize on opportunities within the healthcare sector.

Market Performance and Future Outlook

MSP Recovery Inc's stock performance has been underwhelming, with a year-to-date price change of -26.56% and a significant decline of -99.95% since its IPO. The company's growth prospects appear limited, as indicated by its low [Growth Rank](https://www.gurufocus.com/term/rank-growth/MSPR) of 0/10 and poor financial health. The [Altman Z score](https://www.gurufocus.com/term/zscore/MSPR) of -1.08 further highlights potential financial distress. Despite these challenges, BlackRock's investment could signal a long-term strategic play, betting on the company's ability to navigate its current difficulties.

Conclusion

In summary, BlackRock, Inc. (Trades, Portfolio)'s recent acquisition of additional shares in MSP Recovery Inc underscores a strategic investment decision amidst the company's financial challenges. While MSP Recovery's current financial standing presents concerns, BlackRock's increased stake may reflect a calculated risk, anticipating future growth or recovery. For value investors, this transaction highlights the importance of considering both the potential risks and rewards when evaluating investment opportunities in companies facing financial headwinds.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.