On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) made a significant move in the stock market by acquiring an additional 383,435 shares of i-80 Gold Corp. This transaction was executed at a price of $0.485 per share, bringing BlackRock's total holdings in i-80 Gold Corp to 19,106,395 shares. This acquisition marks a strategic addition to BlackRock's portfolio, reflecting the firm's ongoing interest in the metals and mining sector. The transaction has positioned i-80 Gold Corp to comprise 4.90% of BlackRock's holdings in the stock, indicating a substantial commitment to this Canadian gold and silver producer.

BlackRock, Inc. (Trades, Portfolio): A Leading Investment Firm

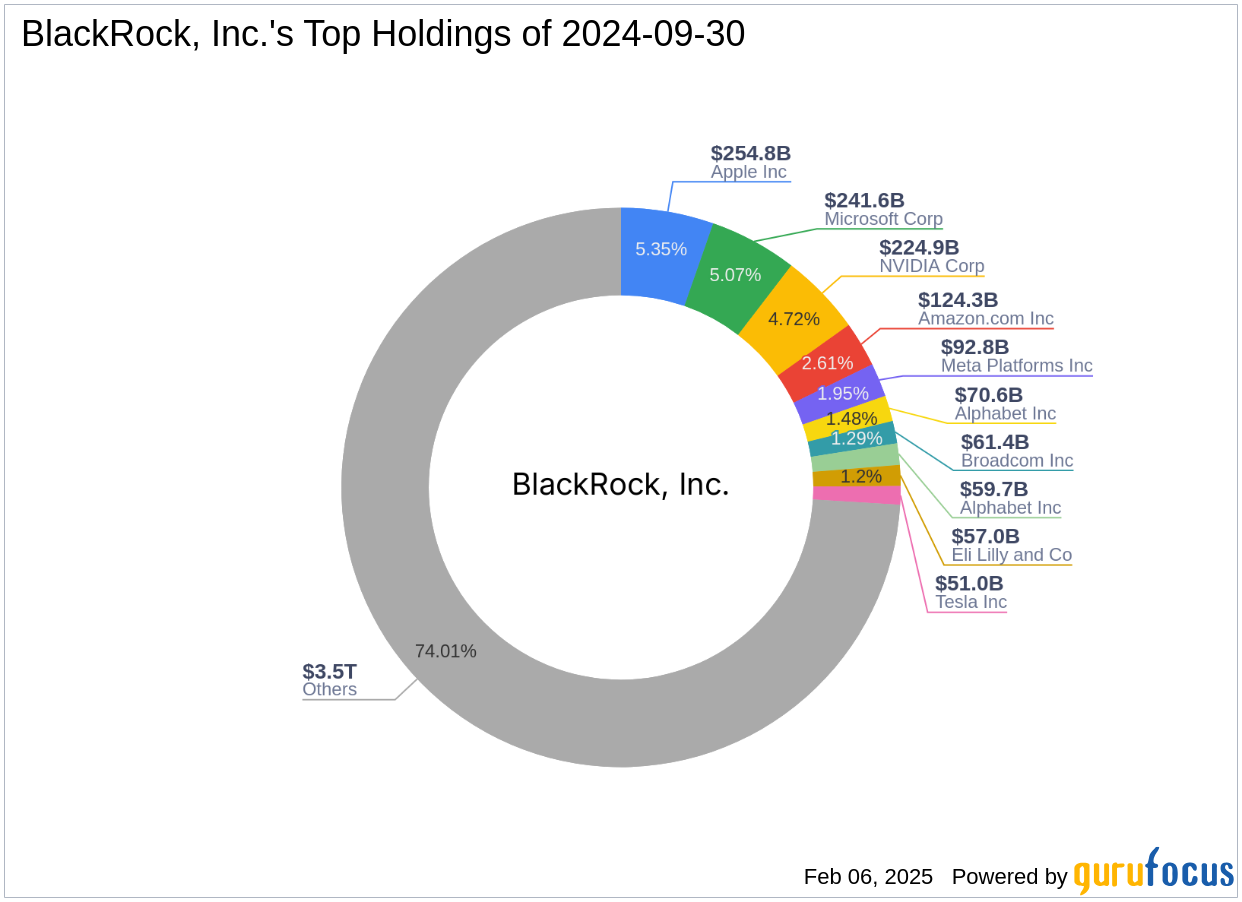

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a globally recognized investment firm known for its extensive portfolio and strategic investment philosophy. With an equity of $4,761.16 trillion, BlackRock is a dominant player in the financial services sector. The firm's investment strategy is characterized by a focus on long-term growth and value, with top holdings in major technology and financial services companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). This diverse portfolio underscores BlackRock's commitment to maintaining a balanced and robust investment strategy.

i-80 Gold Corp: A Canadian Gold and Silver Producer

i-80 Gold Corp is a well-financed Canadian company engaged in the exploration, development, and production of gold, silver, and poly-metallic deposits. The company's principal assets include the Ruby Hill Mine, Lone Tree Mine, Granite Creek Mine, and McCoy-Cove Project. Since its IPO on April 21, 2021, i-80 Gold Corp has been actively expanding its operations and asset base. Despite facing challenges in the market, the company remains focused on leveraging its resources to enhance production capabilities and shareholder value.

Financial Metrics and Valuation of i-80 Gold Corp

As of February 6, 2025, i-80 Gold Corp has a market capitalization of $242.280 million. The company's financial health is reflected in its current GF Score of 25/100, indicating potential challenges in achieving long-term performance. The stock's Profitability Rank is 1/10, and its Financial Strength is ranked 3/10, suggesting areas for improvement. The company's Altman Z score of -0.28 highlights potential financial distress, while its Piotroski F-Score of 4 indicates moderate financial health.

Impact of the Transaction on BlackRock's Portfolio

The acquisition of additional shares in i-80 Gold Corp has strategically enhanced BlackRock's portfolio, with the stock now representing 4.90% of the firm's holdings in the company. This move aligns with BlackRock's investment philosophy of diversifying its portfolio across various sectors, including metals and mining. The addition of i-80 Gold Corp shares is expected to provide BlackRock with exposure to the potential upside in the gold and silver markets, while also balancing the risks associated with the sector.

Stock Performance and Market Sentiment

Since the transaction, i-80 Gold Corp's stock has experienced a 16.74% gain, reflecting positive market sentiment. The stock's Momentum Rank is 2/10, indicating a need for improvement in market momentum. The Relative Strength Index (RSI) values, including a 14-day RSI of 52.01, suggest a neutral market sentiment. Despite these challenges, the stock's recent performance indicates potential for future growth, driven by strategic initiatives and market conditions.

Conclusion and Implications for Value Investors

BlackRock, Inc. (Trades, Portfolio)'s acquisition of additional shares in i-80 Gold Corp underscores the firm's strategic approach to portfolio diversification and long-term value creation. For value investors, this transaction highlights the potential opportunities in the metals and mining sector, particularly in companies with strong asset bases and growth potential. While i-80 Gold Corp faces financial challenges, its recent stock performance and strategic initiatives offer a glimpse of potential upside. As the market continues to evolve, value investors should closely monitor developments in this sector to identify opportunities for growth and value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.