On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) made a strategic move by acquiring an additional 1,478,479 shares of the iShares MSCI Germany ETF (EWG, Financial). This transaction increased BlackRock's total holdings in the ETF to 2,540,915 shares. The acquisition was executed at a trade price of $31.82 per share, reflecting BlackRock's confidence in the potential of the German market. This move positions the ETF as a significant component of BlackRock's portfolio, now representing 9.40% of the firm's total holdings.

BlackRock, Inc. (Trades, Portfolio): A Leader in Global Investment

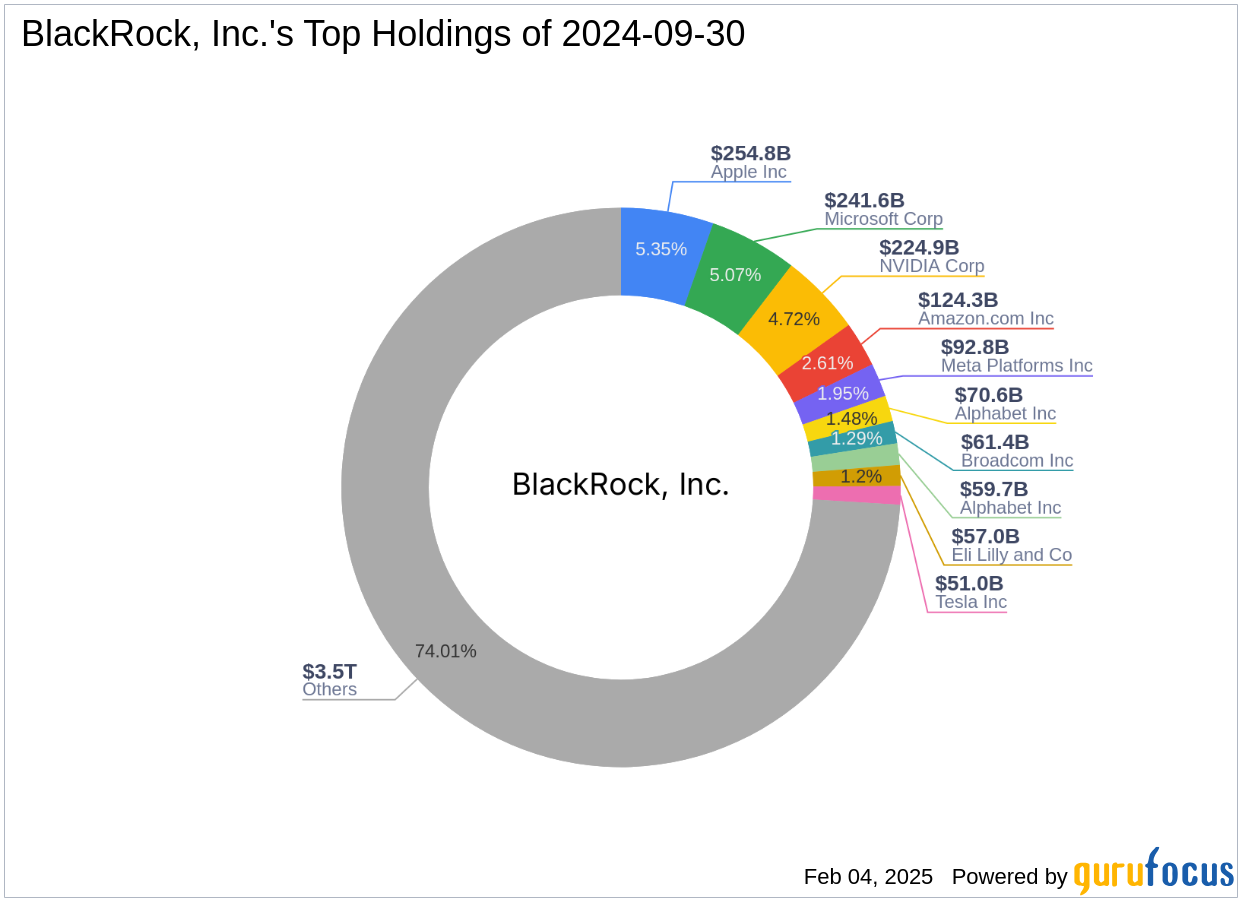

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is a leading global investment firm known for its comprehensive investment strategies and robust portfolio management. The firm is renowned for its investment philosophy, which emphasizes long-term growth and value creation. BlackRock's top holdings include major technology and financial services companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). These holdings underscore BlackRock's focus on sectors with strong growth potential and technological innovation.

Understanding the iShares MSCI Germany ETF (EWG, Financial)

The iShares MSCI Germany ETF (EWG) is designed to track the performance of the German equity market. With a market capitalization of $928.464 million and a current stock price of $34.39, the ETF offers investors exposure to a diverse range of German companies. The ETF's price-to-earnings (PE) ratio stands at 17.16, and its GF Value is calculated at 26.44, resulting in a Price to GF Value ratio of 1.30. This indicates that the ETF is currently trading above its intrinsic value, suggesting a potential overvaluation.

Impact of the Transaction on BlackRock's Portfolio

The acquisition of additional shares in the iShares MSCI Germany ETF has a notable impact on BlackRock's portfolio. With the ETF now accounting for 9.40% of the firm's holdings, it reflects BlackRock's strategic focus on the German market. Since the transaction, the ETF has experienced a gain of 8.08%, indicating positive market performance and validating BlackRock's investment decision. This move aligns with BlackRock's broader strategy of diversifying its portfolio across various international markets.

Financial Metrics and Performance Indicators

The iShares MSCI Germany ETF boasts a [GF-Score](https://www.gurufocus.com/term/gf-score/EWG) of 74/100, suggesting a likelihood of average performance. The ETF's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/EWG) is rated at 6/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/EWG) is 7/10, indicating solid profitability metrics. The [Growth Rank](https://www.gurufocus.com/term/rank-growth/EWG) is 6/10, reflecting moderate growth potential. These metrics provide a comprehensive overview of the ETF's financial health and performance prospects.

Market and Valuation Considerations

While the iShares MSCI Germany ETF shows promising growth indicators, investors should exercise caution due to outdated GF Valuation data. The ETF's 3-year revenue growth is 7.27%, and its EBITDA growth is 8.32%, highlighting its capacity for sustained growth. The [Operating Margin](https://www.gurufocus.com/term/operating-margin/EWG) growth of 2.28% further supports its profitability potential. However, the [Altman Z score](https://www.gurufocus.com/term/zscore/EWG) of 3.45 suggests moderate financial stability, warranting careful consideration of market conditions.

Conclusion: Strategic Implications for BlackRock

BlackRock's strategic addition of shares in the iShares MSCI Germany ETF underscores the firm's commitment to diversifying its portfolio and capitalizing on international market opportunities. The ETF's current market position, coupled with its growth potential, aligns with BlackRock's investment philosophy of long-term value creation. As the ETF continues to perform well, it may offer BlackRock a robust avenue for growth and portfolio enhancement in the future.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.