On December 31, 2024, BlackRock, Inc. (Trades, Portfolio), a leading investment firm, made a significant addition to its portfolio by acquiring 368,616 shares of Celcuity Inc. at a price of $13.09 per share. This transaction increased BlackRock's total holdings in Celcuity to 2,179,064 shares, marking a strategic move in the firm's investment strategy. The acquisition reflects BlackRock's continued interest in diversifying its portfolio and exploring opportunities within the biotechnology sector.

BlackRock, Inc. (Trades, Portfolio): A Profile of Investment Excellence

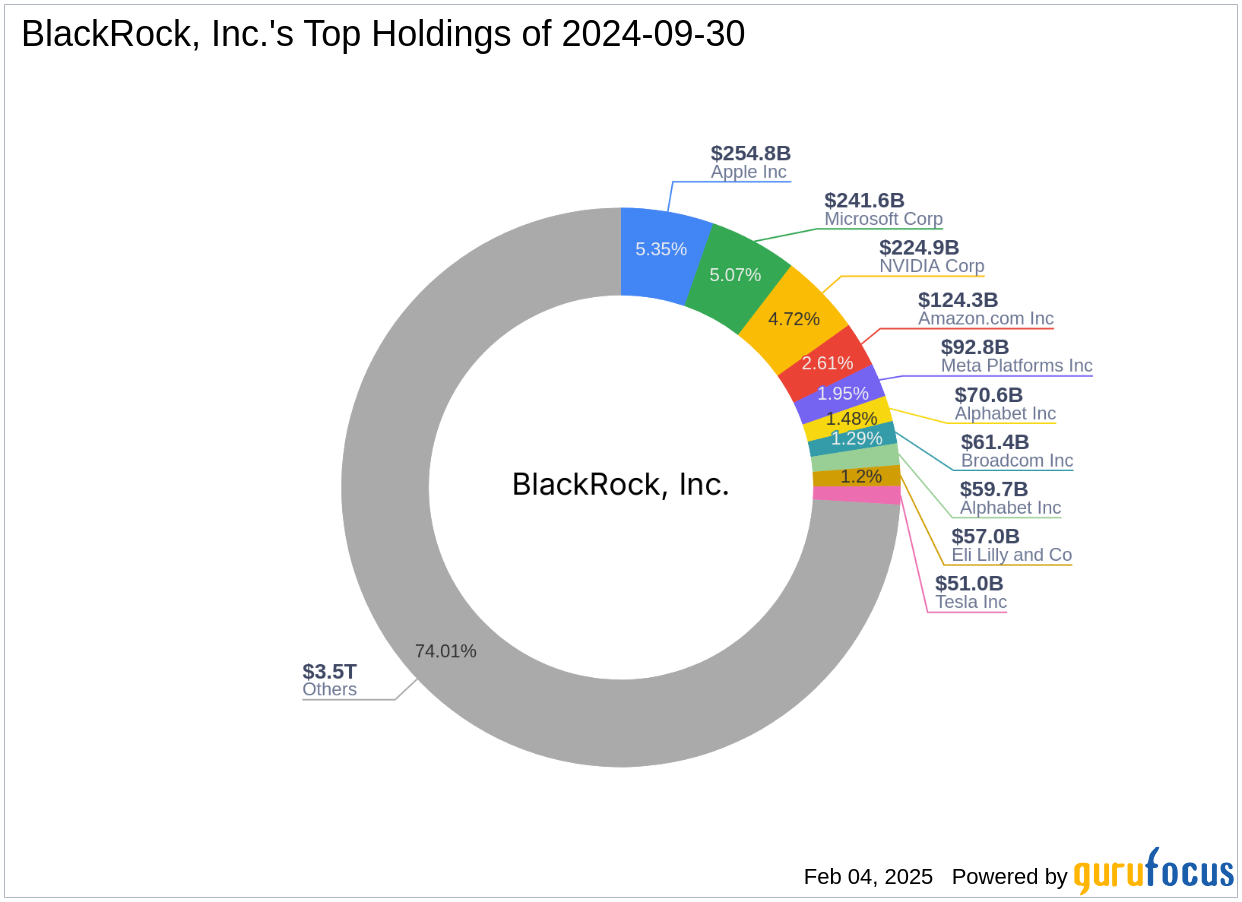

BlackRock, Inc. (Trades, Portfolio), headquartered in New York, is renowned for its robust investment philosophy and substantial equity holdings, which amount to $4,761.16 trillion. The firm is known for its strategic investments across various sectors, with a particular focus on technology and financial services. BlackRock's top holdings include major companies such as Apple Inc. (AAPL, Financial), Amazon.com Inc. (AMZN, Financial), Meta Platforms Inc. (META, Financial), Microsoft Corp. (MSFT, Financial), and NVIDIA Corp. (NVDA, Financial). This diverse portfolio underscores BlackRock's commitment to maintaining a balanced and forward-looking investment approach.

Celcuity Inc.: A Biotechnology Innovator

Celcuity Inc., based in the USA, is a clinical-stage biotechnology company focused on developing innovative treatments for oncology. The company's lead therapeutic candidate, gedatolisib, is a potent pan-PI3K and mTOR inhibitor currently undergoing a Phase 3 clinical trial. This trial, known as VIKTORIA-1, is evaluating gedatolisib in combination with fulvestrant, with or without palbociclib, in patients with HR+/HER2- advanced breast cancer. Celcuity's commitment to advancing cancer treatment positions it as a promising player in the biotechnology industry.

Impact of the Transaction on BlackRock's Portfolio

The acquisition of Celcuity shares now represents 5.90% of BlackRock's holdings in the company. While this transaction does not significantly alter the overall portfolio position, it highlights BlackRock's strategic interest in the biotechnology sector. The firm's decision to increase its stake in Celcuity suggests confidence in the company's potential for growth and innovation in cancer treatment.

Financial Metrics and Valuation of Celcuity Inc.

Celcuity Inc. currently has a market capitalization of $464.489 million, with a stock price of $12.51. The company's financial health is reflected in its GF Score of 39/100 and a Balance Sheet Rank of 6/10. Despite these metrics, Celcuity faces challenges, as indicated by its Profitability Rank of 1/10 and a 3-year EBITDA growth of -40.70%. These figures suggest that while the company has potential, it also faces significant hurdles in achieving profitability and growth.

Performance and Growth Prospects

Since the transaction, Celcuity's stock has experienced a decline of -4.43%. The company's growth challenges are further underscored by its Growth Rank of 0/10 and a Momentum Rank of 6/10. These metrics indicate that while Celcuity is actively pursuing innovative treatments, it must overcome significant obstacles to achieve sustainable growth and profitability in the competitive biotechnology sector.

Conclusion: Strategic Implications of BlackRock's Investment

BlackRock's strategic addition of Celcuity shares reflects the firm's interest in the biotechnology sector and its potential for innovation in cancer treatment. While the investment aligns with BlackRock's focus on technology and financial services, it also highlights the firm's willingness to explore opportunities in emerging sectors. As Celcuity continues to advance its clinical trials, BlackRock's investment may yield significant returns if the company's therapeutic candidates prove successful in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.