Silicon Laboratories Inc (SLAB, Financial) released its 8-K filing on February 4, 2025, detailing its financial performance for the fourth quarter of 2024. The company, a leader in secure, intelligent wireless technology, focuses on semiconductors, software, and system solutions for the Internet of Things (IoT), Internet infrastructure, industrial control, consumer, and automotive markets. Operating in a single segment of mixed-signal analog intensive products, Silicon Laboratories Inc (SLAB) primarily generates revenue from its Industrial & Commercial category, with significant operations in the United States, China, Taiwan, and other global markets.

Performance Overview and Challenges

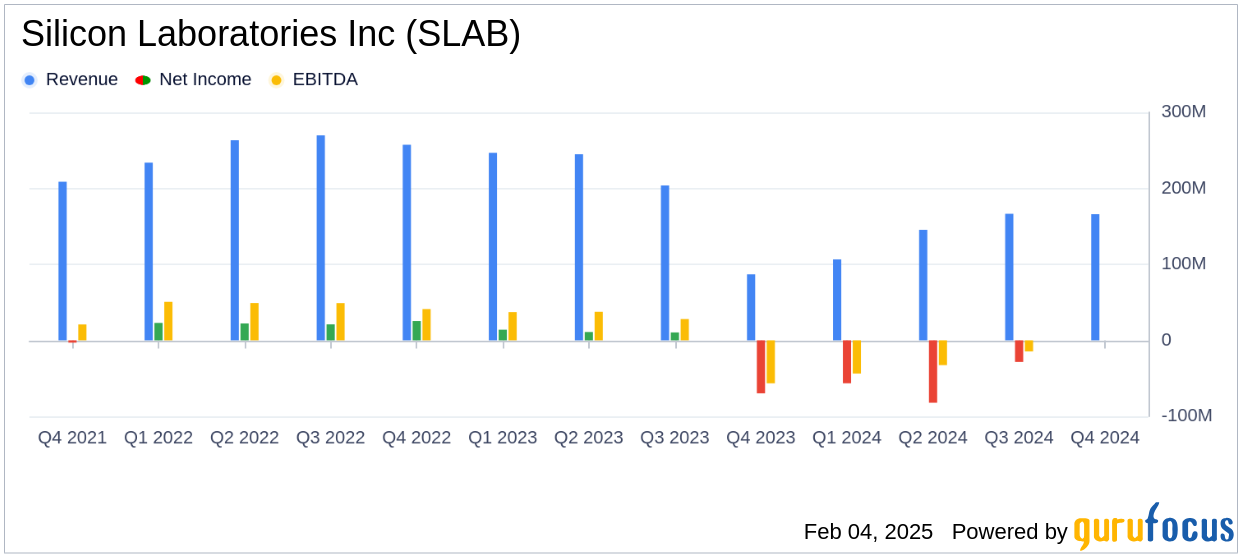

For the fourth quarter of 2024, Silicon Laboratories Inc (SLAB, Financial) reported revenue of $166 million, aligning with analyst estimates of $166.08 million. The company's GAAP diluted loss per share was $(0.73), which is better than the estimated loss of $(0.79) per share. This performance is crucial as it reflects the company's ability to manage costs and maintain revenue streams amidst challenging market conditions.

Despite the positive earnings per share outcome, the company faces challenges, including a sequential decline of 8% in Industrial & Commercial revenue, which totaled $89 million. However, the Home & Life segment showed resilience with an 11% sequential increase, reaching $78 million. These mixed results highlight the need for strategic adjustments to bolster the Industrial & Commercial segment.

Financial Achievements and Industry Significance

Silicon Laboratories Inc (SLAB, Financial) achieved a GAAP gross margin of 54.3% and a non-GAAP gross margin of 54.6%. The non-GAAP operating loss was $7 million, significantly lower than the GAAP operating loss of $29 million. These margins are vital for a semiconductor company, as they indicate efficient cost management and the ability to sustain profitability in a competitive industry.

Detailed Financial Metrics

The company's income statement reveals a net loss of $23.8 million for the quarter, with operating expenses totaling $118.9 million. The balance sheet shows total assets of $1.22 billion, with cash and cash equivalents increasing to $281.6 million from $227.5 million at the end of 2023. This increase in liquidity is a positive indicator of the company's financial health.

| Financial Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Revenue | $166 million | $86.8 million |

| GAAP Gross Margin | 54.3% | N/A |

| Non-GAAP Gross Margin | 54.6% | N/A |

| Net Loss | $(23.8) million | $(69.8) million |

| Cash and Cash Equivalents | $281.6 million | $227.5 million |

Analysis and Outlook

Silicon Laboratories Inc (SLAB, Financial) has demonstrated resilience by achieving revenue growth and managing losses effectively. The company's strategic focus on IoT and wireless technology positions it well for future growth, especially as design wins in key areas ramp up. The guidance for the first quarter of 2025 indicates expected revenue growth between $170 million and $185 million, with a GAAP diluted loss per share projected between $(0.75) and $(1.05).

“The Silicon Labs team executed well to close out 2024, with fourth quarter revenue nearly doubling from the same quarter one year ago,” said Matt Johnson, President and Chief Executive Officer at Silicon Labs.

Overall, Silicon Laboratories Inc (SLAB, Financial) is navigating industry challenges while capitalizing on growth opportunities in the IoT sector. Investors and stakeholders will be keenly watching the company's ability to sustain its momentum and address the challenges in its Industrial & Commercial segment.

Explore the complete 8-K earnings release (here) from Silicon Laboratories Inc for further details.