On December 31, 2024, Morgan Stanley executed a significant transaction involving the reduction of its holdings in Western Asset Emerging Markets Debt Fund Inc (EMD, Financial). The firm decreased its position by 6,474,245 shares at a price of $9.62 per share. This move resulted in Morgan Stanley holding a total of 3,103,090 shares, which now constitutes 5.30% of its portfolio. This strategic decision reflects Morgan Stanley's ongoing portfolio management and investment strategy adjustments.

About Morgan Stanley

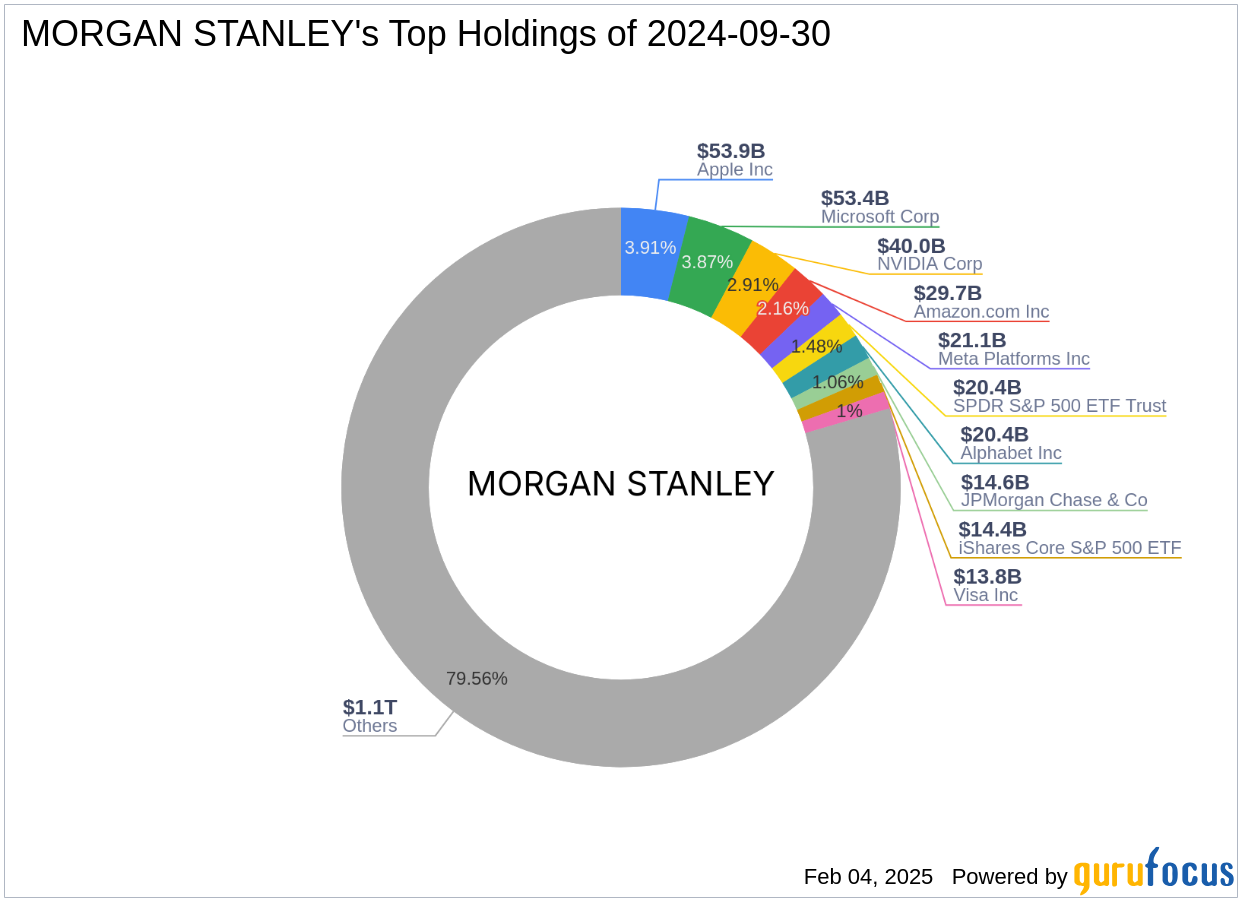

Morgan Stanley, a prominent name in the financial sector, has a rich history dating back to 1935. Originating from the legacy of JP Morgan & Co. and the Dean Witter brokerage house, the firm has evolved significantly over the decades. Known for pioneering financial innovations, Morgan Stanley developed one of the first computer models for financial analysis in 1962 and the first automated trade processing system in 1984. The firm went public in 1986 and has since expanded globally, operating in 42 countries with over 1,300 offices and 60,000 employees. Morgan Stanley's investment philosophy is rooted in providing comprehensive financial services through its Institutional Securities Group, Wealth Management, and Investment Management divisions. The firm is renowned for its top holdings in technology and financial services sectors, including Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial).

Details of the Stock Transaction

The recent transaction saw Morgan Stanley reducing its stake in EMD by 6,474,245 shares, with the shares traded at $9.62 each. This adjustment reflects a strategic decision to reallocate resources within its extensive portfolio. Despite the reduction, EMD still represents a notable 5.30% of Morgan Stanley's holdings. Such transactions are part of the firm's broader strategy to optimize its investment portfolio in response to market conditions and investment opportunities.

Overview of Western Asset Emerging Markets Debt Fund Inc

Western Asset Emerging Markets Debt Fund Inc is a non-diversified closed-end management investment company. Its primary investment objective is to seek high current income, with a secondary goal of capital appreciation. The fund focuses on investing in emerging market debt securities, offering investors exposure to potentially high-yielding opportunities in developing economies. As of the latest data, EMD has a market capitalization of $574.5 million and a stock price of $9.83.

Financial Metrics and Performance of EMD

EMD's financial performance is characterized by a price-to-earnings (PE) ratio of 8.15 and a [GF-Score](https://www.gurufocus.com/term/gf-score/EMD) of 38/100, indicating potential challenges in future performance. The fund's [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/EMD) is ranked 3/10, while its [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/EMD) stands at 2/10. Despite these rankings, EMD has shown a revenue growth of 15.10% over the past three years. The fund's [Momentum Rank](https://www.gurufocus.com/term/rank-momentum/EMD) is relatively strong at 8/10, suggesting some positive investor sentiment.

Implications of the Transaction

Morgan Stanley's decision to reduce its stake in EMD could be driven by several factors, including the fund's current financial metrics and broader market conditions. The [Piotroski F-Score](https://www.gurufocus.com/term/fscore/EMD) of 5 indicates moderate financial health, while the [Altman Z score](https://www.gurufocus.com/term/zscore/EMD) is not available, suggesting potential caution in financial stability. The transaction may also reflect Morgan Stanley's strategic shift towards other investment opportunities that align more closely with its long-term objectives.

Conclusion

This transaction highlights Morgan Stanley's dynamic approach to portfolio management, balancing risk and opportunity in a complex market environment. While the reduction in EMD shares may impact the fund's immediate performance, it aligns with Morgan Stanley's broader strategy of optimizing its investment portfolio. For Western Asset Emerging Markets Debt Fund Inc, the transaction could influence its market perception and future performance, depending on how it navigates the evolving financial landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.