On February 3, 2025, Pacific Coast Oil Trust (ROYTL, Financial) released its 8-K filing, announcing that there will be no cash distribution to its unitholders based on the net profits generated during November 2024. The Trust, formed to hold net profits and royalty interests in certain California oil and gas properties, continues to face significant financial and operational challenges.

Company Overview

Pacific Coast Oil Trust is a statutory trust established to manage net profits and royalty interests in oil and natural gas properties in California. These properties include both producing and non-producing interests located in the Santa Maria Basin and the Los Angeles Basin.

Financial Performance and Challenges

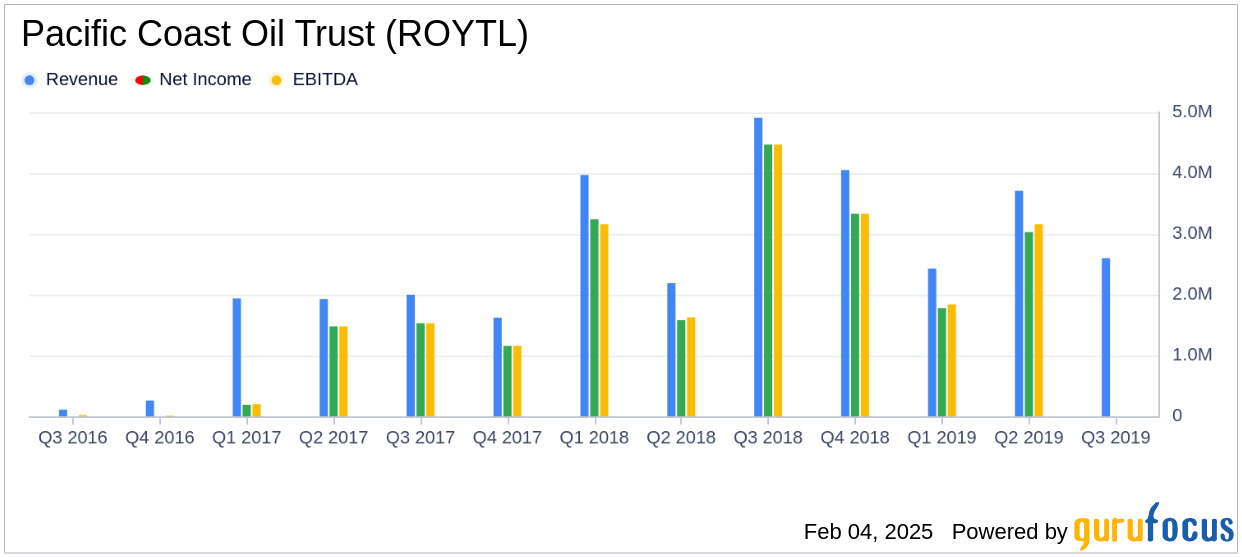

The Trust reported operating income of approximately $0.8 million for the Developed Properties, with revenues of $2.6 million and lease operating expenses of $1.9 million. Despite this, the Trust faces a cumulative net profits deficit of $19.1 million for the Developed Properties and $114,000 for the Remaining Properties. The Trust's financial struggles are compounded by administrative expenses and outstanding debt to Pacific Coast Energy Company LP (PCEC), making future distributions unlikely.

Legal and Operational Hurdles

The Trust is embroiled in legal disputes, including a whistleblower complaint against PCEC and ongoing arbitration proceedings. These legal challenges, along with operational constraints such as the termination of the Phillips 66 pipeline Connection Agreement, have adversely affected production and financial performance.

Financial Metrics and Implications

The Trust's financial statements reveal a significant reliance on loans from PCEC to cover administrative expenses, with approximately $9.4 million owed to PCEC. The Trust's ability to generate sufficient cash flow to cover its obligations remains a critical concern, with asset retirement obligations further impacting potential distributions.

| Underlying Properties | Sales Volumes (Boe) | Average Price (per Boe) |

|---|---|---|

| Developed Properties | 38,971 | $66.16 |

| Remaining Properties | 12,810 | $62.60 |

Analysis and Outlook

The Trust's financial health is precarious, with ongoing legal and operational challenges exacerbating its difficulties. The lack of cash distributions and the significant net profits deficit highlight the Trust's struggle to generate sustainable income. The Trust's future hinges on resolving legal disputes, managing asset retirement obligations, and finding alternative transportation solutions for its oil production.

For more detailed insights and updates on Pacific Coast Oil Trust's financial performance and strategic direction, visit Pacific Coast Oil Trust's official website.

Explore the complete 8-K earnings release (here) from Pacific Coast Oil Trust for further details.