On January 30, 2025, Thomas Herman, Vice President and Chief Financial Officer of Calamos Advisors LLC, purchased 23,190 shares of Calamos Strategic Total Return Fund (CSQ, Financial). Following this transaction, the insider now owns a total of 23,190 shares in the company.

Calamos Strategic Total Return Fund (CSQ) is a closed-end fund that seeks total return through a combination of capital appreciation and current income. The fund invests in a diversified portfolio of equities, convertible securities, and high-yield corporate bonds.

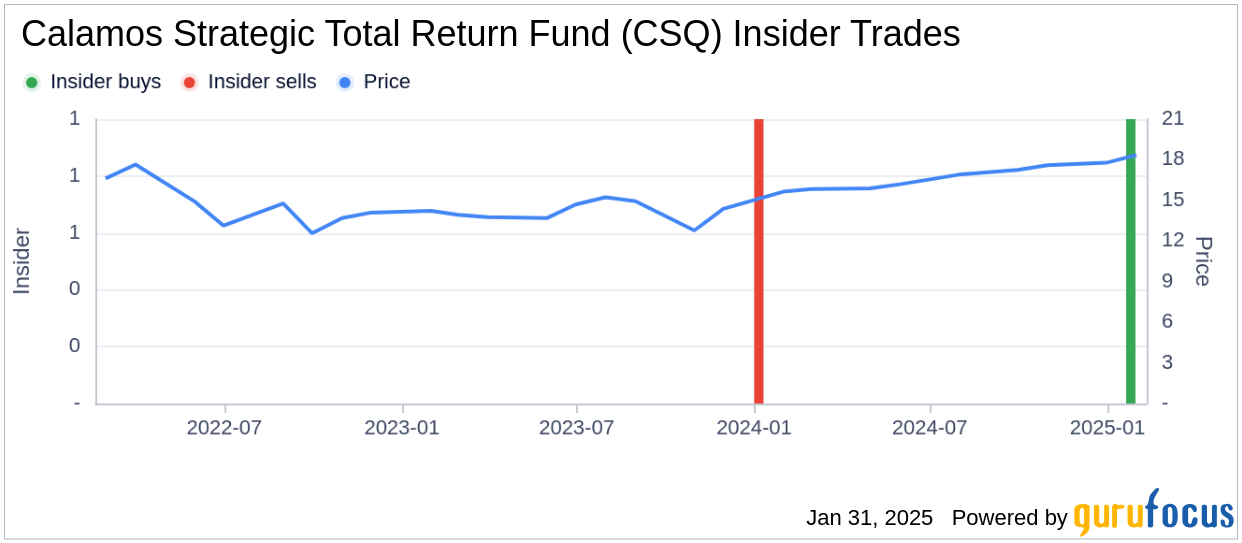

The insider transaction history for Calamos Strategic Total Return Fund indicates that there has been one insider buy and zero insider sells over the past year. This recent purchase by Thomas Herman marks the only insider buy within this timeframe.

On the day of the purchase, shares of Calamos Strategic Total Return Fund were trading at $18.31 each, resulting in a market cap of $2.942 billion. The fund's price-earnings ratio stands at 3.42, which is lower than the industry median of 10.05 and also below the company's historical median price-earnings ratio.

This insider buying activity by Thomas Herman, who has purchased a total of 23,190 shares over the past year and sold none, may be of interest to investors monitoring insider trends and the valuation metrics of Calamos Strategic Total Return Fund.

On the day of the purchase, shares of Calamos Strategic Total Return Fund were trading at $18.31 each, resulting in a market cap of $2.942 billion. The fund's price-earnings ratio stands at 3.42, which is lower than the industry median of 10.05 and also below the company's historical median price-earnings ratio.

This insider buying activity by Thomas Herman, who has purchased a total of 23,190 shares over the past year and sold none, may be of interest to investors monitoring insider trends and the valuation metrics of Calamos Strategic Total Return Fund.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.