On December 31, 2024, Vanguard Group Inc executed a significant transaction by acquiring an additional 4,517,272 shares of Workday Inc. This purchase was made at a trade price of $258.03 per share, reflecting Vanguard's strategic interest in expanding its holdings in the software company. This acquisition increased Vanguard's total holdings in Workday Inc to 20,142,800 shares, which now represents 9.41% of the firm's portfolio. The transaction had a portfolio impact of 0.02%, indicating a calculated move to enhance its investment strategy.

Vanguard Group Inc: A Profile of Investment Excellence

Founded in 1975 by John C. Bogle, Vanguard Group Inc is renowned for its client-owned structure and cost-efficient investment strategies. The firm is a pioneer in the mutual funds industry, emphasizing low-cost index mutual funds to maximize returns for investors. Vanguard's philosophy revolves around cutting costs and eliminating sales commissions, which has allowed it to offer competitive returns. Over the years, Vanguard has expanded globally, offering a diverse range of financial products and services to over 20 million clients. The firm's top holdings include major technology companies such as Apple Inc, Amazon.com Inc, and Microsoft Corp.

Workday Inc: A Leader in Cloud-Based Solutions

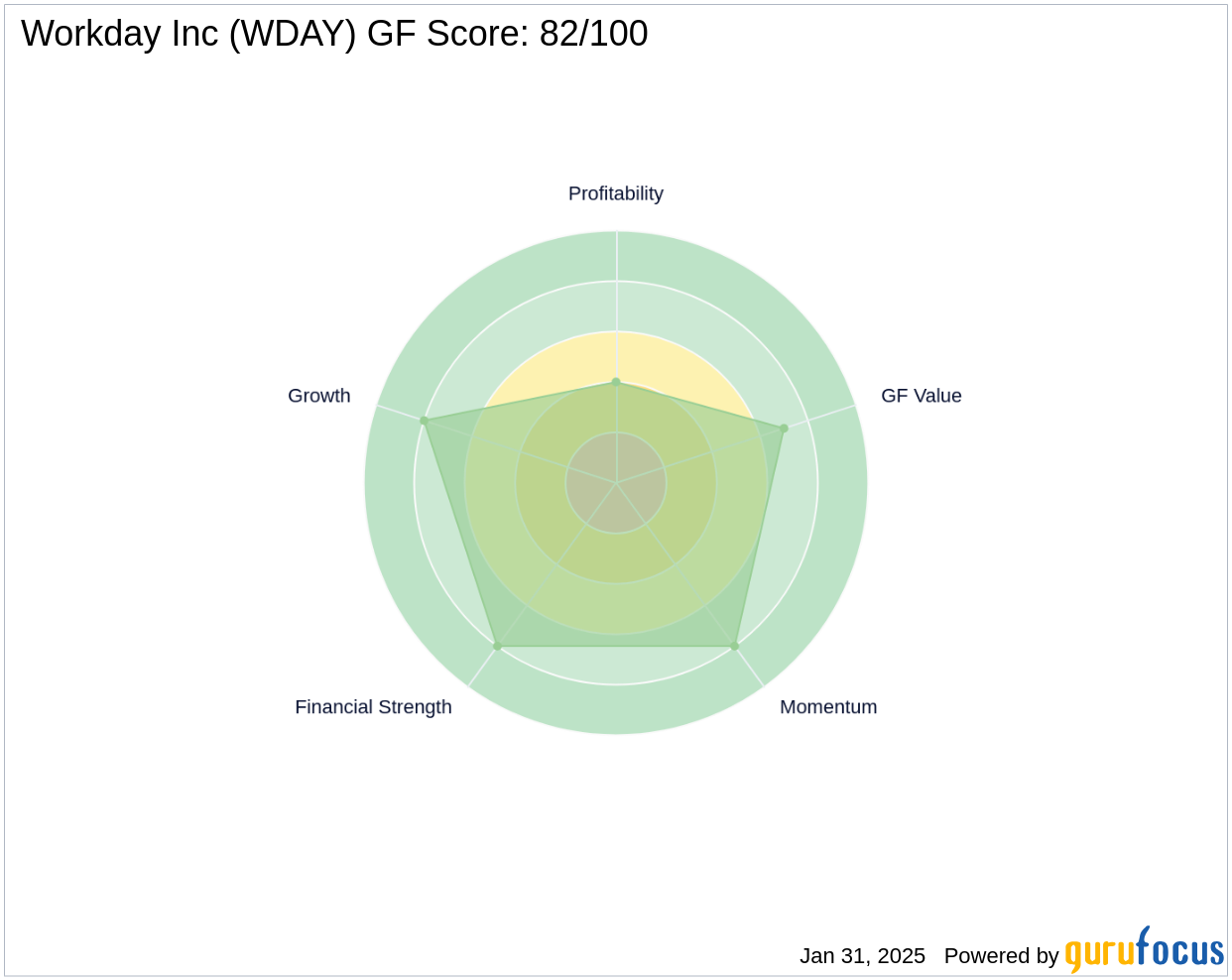

Workday Inc, established in 2005, is a prominent software company based in the USA, specializing in human capital management and financial management solutions. Known for its cloud-only software offerings, Workday has a market capitalization of $70.67 billion. The company has demonstrated robust growth, with a year-to-date price change of 5.49% and a significant IPO price change of 452.89%. Workday's financial metrics indicate a [GF-Score](https://www.gurufocus.com/term/gf-score/WDAY) of 82/100, suggesting good outperformance potential. The company's balance sheet is strong, with a [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/WDAY) rank of 8/10.

Transaction Details and Strategic Implications

The recent acquisition by Vanguard Group Inc has increased its stake in Workday Inc to 20,142,800 shares. This move represents a strategic addition to Vanguard's portfolio, with the shares now accounting for 9.41% of the firm's total holdings. The transaction's impact on the portfolio was 0.02%, reflecting a calculated approach to enhancing Vanguard's investment in the software sector. Workday's current valuation is considered fairly valued, with a GF Value of $265.46 and a price-to-GF value ratio of 1.00.

Workday Inc's Financial Performance and Growth Prospects

Workday Inc has shown impressive financial performance, with a three-year revenue growth of 14.50%. The company's [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/WDAY) is 4/10, and it has a [Growth Rank](https://www.gurufocus.com/term/rank-growth/WDAY) of 8/10, indicating strong growth potential. Workday's [Operating Margin](https://www.gurufocus.com/term/operating-margin/WDAY) growth remains stable, and its [Altman Z score](https://www.gurufocus.com/term/zscore/WDAY) of 6.31 suggests financial stability. The company's [interest coverage](https://www.gurufocus.com/term/interest-coverage/WDAY) ratio of 3.68 further supports its ability to meet financial obligations.

Market Performance and Other Notable Investors

Workday Inc has experienced a year-to-date price change of 5.49%, reflecting its resilience in the market. The company's stock has shown a significant IPO price change of 452.89%, highlighting its growth since going public. Besides Vanguard, other notable investors such as Steve Mandel (Trades, Portfolio), Ken Fisher (Trades, Portfolio), and Joel Greenblatt (Trades, Portfolio) also hold shares in Workday Inc. Hotchkis & Wiley Capital Management LLC is the largest guru holding the most shares of Workday Inc, indicating strong institutional interest in the company.

Conclusion: Analyzing the Transaction's Impact

Vanguard Group Inc's recent acquisition of Workday Inc shares underscores its strategic focus on the software sector. The transaction's minimal portfolio impact of 0.02% suggests a calculated approach to enhancing its investment strategy. Workday's strong financial metrics and growth prospects make it an attractive addition to Vanguard's portfolio. As Workday continues to demonstrate robust growth and financial stability, Vanguard's increased stake positions the firm to benefit from potential future gains in the software industry.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.