On December 31, 2024, Wolverine Asset Management LLC made a significant move by reducing its stake in Alchemy Investments Acquisition Corp 1 (ALCY, Financial). The firm decreased its holdings by 590,142 shares, representing an 87.01% reduction in its position. This transaction was executed at a traded price of $10.94 per share, impacting Wolverine's portfolio by -0.13%. Following this reduction, Wolverine Asset Management LLC now holds 88,071 shares of ALCY, which constitutes 0.02% of its portfolio.

Wolverine Asset Management LLC: A Brief Profile

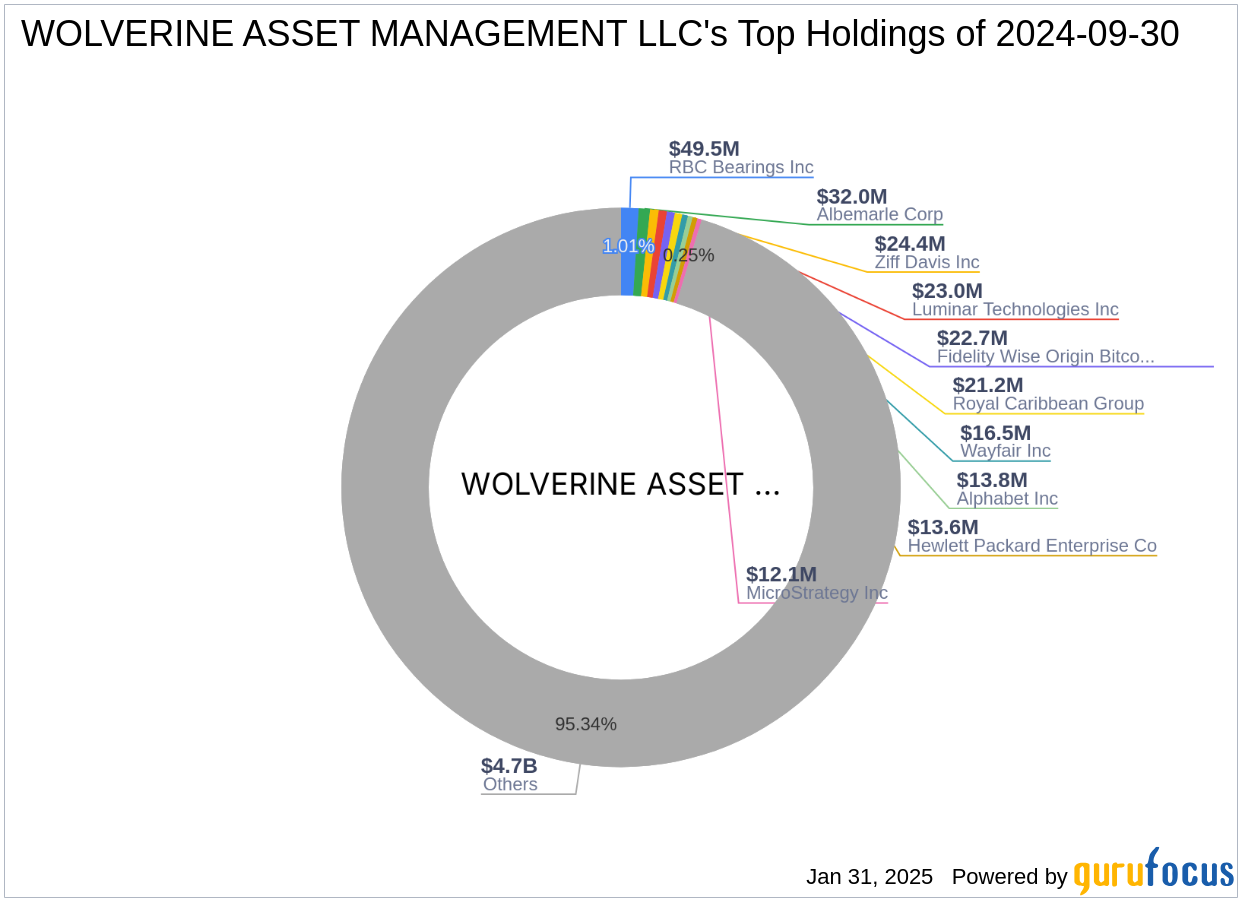

Wolverine Asset Management LLC is a prominent investment firm based in Chicago, Illinois, with its headquarters located at 175 West Jackson. The firm manages a substantial equity portfolio valued at $4.92 billion. While the specific investment philosophy of Wolverine Asset Management is not detailed, its top holdings include Ziff Davis Inc (ZD, Financial), RBC Bearings Inc (RBC, Financial), and Luminar Technologies Inc (LAZR, Financial). The firm primarily invests in the Financial Services and Industrials sectors, showcasing a diversified approach to asset management.

About Alchemy Investments Acquisition Corp 1

Alchemy Investments Acquisition Corp 1 is a blank check company based in the USA, having gone public on June 26, 2023. The company has a market capitalization of $50.582 million. As a special purpose acquisition company (SPAC), Alchemy Investments Acquisition Corp 1 is designed to facilitate mergers, acquisitions, or similar business combinations. The current stock price stands at $11.16, with a price-to-earnings ratio of 29.37. Since its IPO, the stock has experienced an 8.88% increase, with a year-to-date price change of 2.01%.

Financial Metrics and Valuation

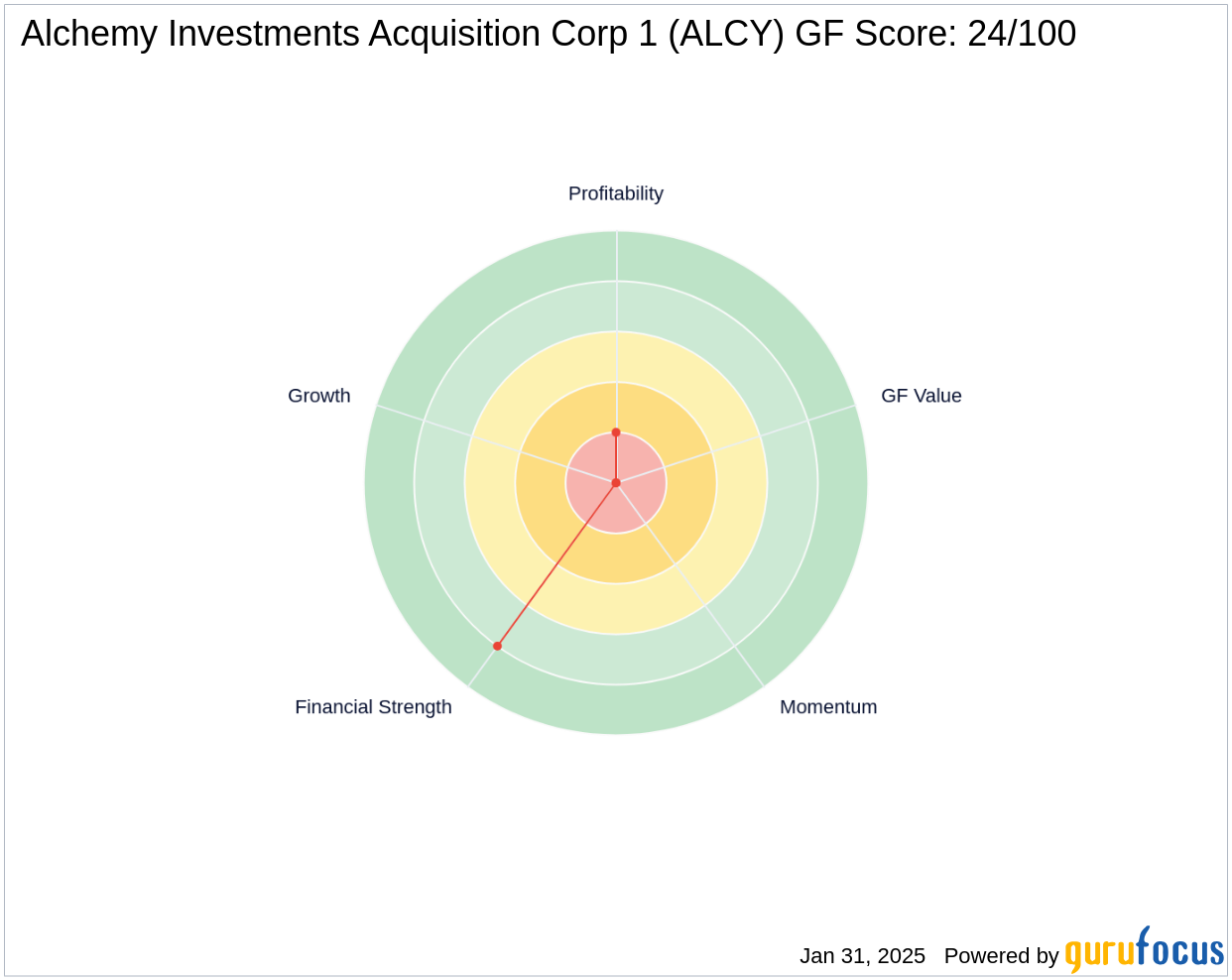

Alchemy Investments Acquisition Corp 1's financial metrics reveal a mixed picture. The company has a GF Score of 24/100, indicating poor future performance potential. The balance sheet is relatively strong with a Financial Strength rank of 8/10, but the Profitability Rank is low at 2/10, and the Growth Rank is 0/10. The company's cash to debt ratio is 0.64, and it has a return on equity (ROE) of 4.76% and a return on assets (ROA) of 4.52%. The interest coverage is not applicable, indicating potential challenges in meeting interest obligations.

Performance and Growth Indicators

Alchemy Investments Acquisition Corp 1's performance indicators suggest limited growth prospects. The company's GF Value Rank and Momentum Rank are both 0/10, reflecting a lack of momentum and undervaluation. The Piotroski F-Score is 3, indicating weak financial health. The company's Altman Z score is not available, which further complicates the assessment of its financial stability.

Conclusion: Strategic Implications

Wolverine Asset Management LLC's decision to significantly reduce its stake in Alchemy Investments Acquisition Corp 1 suggests a strategic reevaluation of its investment in the company. This move may reflect concerns about the company's future performance potential, as indicated by its low GF Score and profitability metrics. For investors, this transaction highlights the importance of closely monitoring Alchemy Investments Acquisition Corp 1's financial health and growth prospects, especially given its status as a blank check company with inherent uncertainties.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.