On January 31, 2025, Gentex Corp (GNTX, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year ending December 31, 2024. Despite facing challenges in the automotive market, Gentex achieved a new annual sales record, although it fell short of analyst expectations for the fourth quarter.

Company Background

Founded in 1974, Gentex Corp (GNTX, Financial) initially focused on smoke-detection equipment before expanding into automotive technology. The company is renowned for its digital vision, connected car, dimmable glass, and fire protection technologies. Automotive revenue constitutes approximately 98% of its total revenue. In 2023, Gentex reported sales of about $2.3 billion, shipping 50.6 million mirrors, with a unit mix of 63% interior and 37% exterior mirrors. The company is headquartered in Zeeland, Michigan.

Fourth Quarter Performance

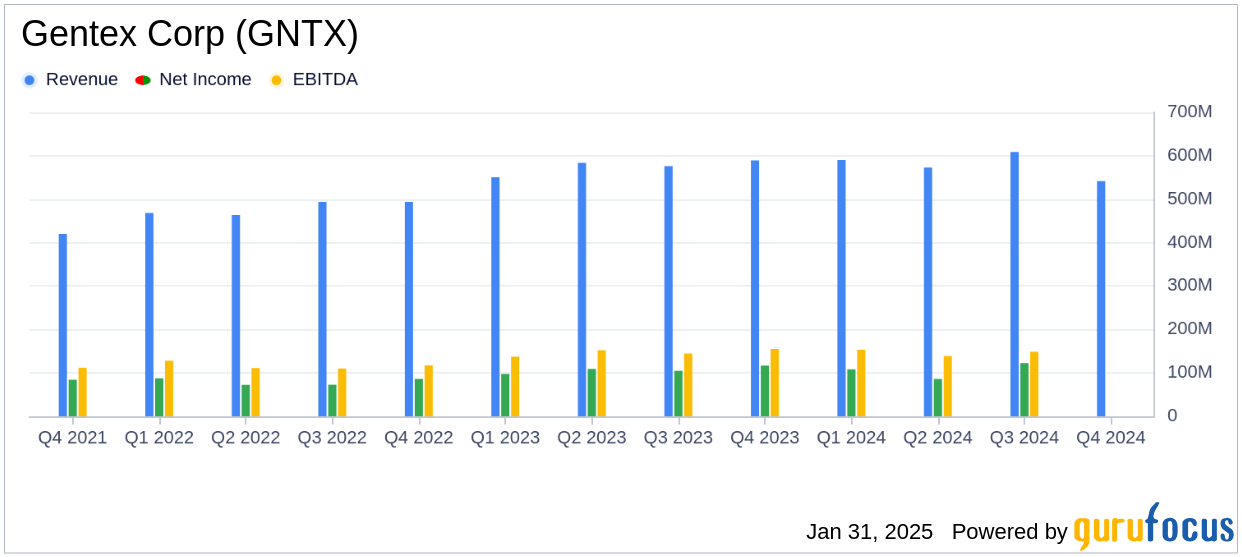

For the fourth quarter of 2024, Gentex reported net sales of $541.6 million, an 8% decrease from $589.1 million in the same period of 2023. This decline was attributed to a 6% drop in light vehicle production in key markets such as North America, Europe, and Japan/Korea. The company's earnings per diluted share were $0.39, falling short of the analyst estimate of $0.50. The gross profit margin also decreased to 32.5% from 34.5% in the previous year, primarily due to lower sales levels and an unfavorable product mix.

During the fourth quarter, there was significant weakness in our primary markets that impacted both light vehicle production volumes and product mix during the quarter," said Gentex President and CEO Steve Downing.

Annual Financial Achievements

Despite quarterly challenges, Gentex achieved a record annual net sales of $2.31 billion, a 1% increase from 2023. The company's earnings per diluted share for the year were $1.76, slightly below the estimated $1.90. The gross margin for the year was 33.3%, marginally improving from 33.2% in 2023, thanks to supplier cost reductions and lower freight costs.

Key Financial Metrics

| Metric | Q4 2024 | Q4 2023 | 2024 | 2023 |

|---|---|---|---|---|

| Net Sales | $541.6M | $589.1M | $2.31B | $2.30B |

| Gross Profit Margin | 32.5% | 34.5% | 33.3% | 33.2% |

| Net Income | $87.7M | $116.9M | $404.5M | $428.4M |

| Earnings Per Share (Diluted) | $0.39 | $0.50 | $1.76 | $1.84 |

Analysis and Outlook

Gentex's performance in 2024 highlights its resilience in a challenging automotive market. The company's ability to achieve record sales despite a decline in light vehicle production underscores its strategic focus on expanding its product offerings and enhancing its engineering capabilities. However, the decrease in quarterly earnings and gross margin indicates the impact of market volatility and product mix challenges.

Looking ahead, Gentex plans to continue investing in new technologies and product launches to drive growth. The company has set a target to achieve a gross margin of approximately 35% by the end of 2025, reflecting its commitment to operational efficiency and cost management.

Despite these challenges, the Company has been able to continue outperforming the underlying market and create year-over-year growth," concluded Downing.

Gentex's strategic initiatives and focus on innovation position it well for future growth, although it must navigate ongoing market uncertainties and production challenges. Value investors may find Gentex's commitment to shareholder returns, including share repurchases and dividends, an attractive aspect of its financial strategy.

Explore the complete 8-K earnings release (here) from Gentex Corp for further details.