On January 27, 2025, Nucor Corp (NUE, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. Nucor Corp, a leading manufacturer of steel and steel products, reported a diluted earnings per share (EPS) of $1.22 for the fourth quarter, surpassing the analyst estimate of $0.65. The company also reported net sales of $7.08 billion for the quarter, exceeding the estimated revenue of $6,762.88 million.

Company Overview

Nucor Corp is a prominent player in the steel industry, producing a wide range of steel and steel products. The company operates through several segments, including steel mills, steel products, and raw materials, with the steel mills segment generating the majority of its revenue. Nucor's operations extend to international trading and sales, dealing in both its own manufactured products and those of other companies.

Performance and Challenges

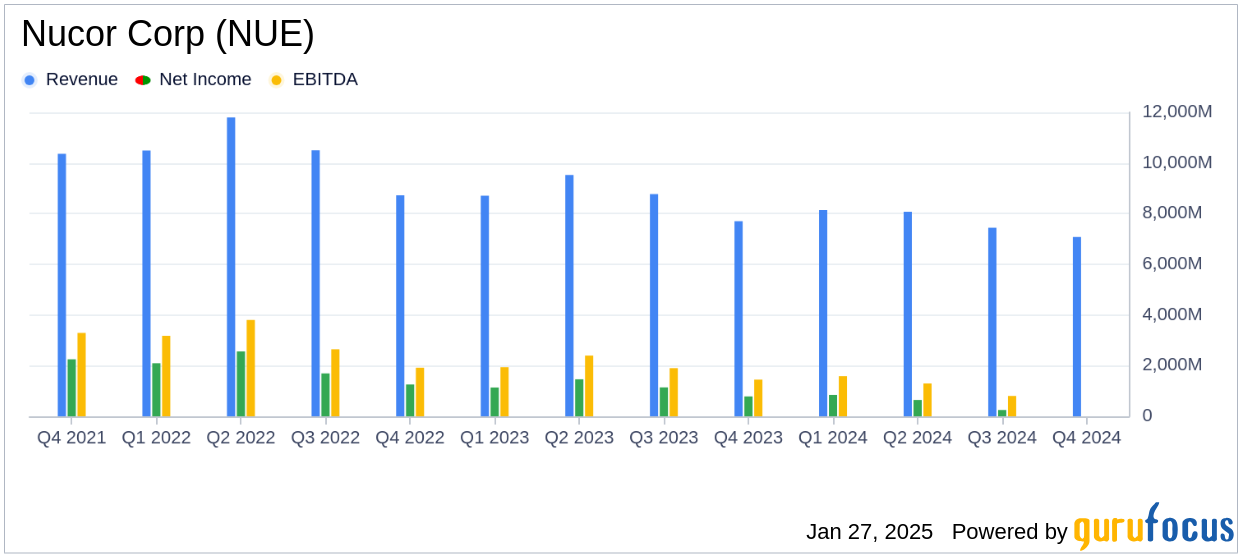

Despite a challenging market environment characterized by softened steel demand throughout 2024, Nucor Corp managed to deliver a solid performance. The company's fourth-quarter net earnings attributable to stockholders were $287 million, a notable increase from $250 million in the third quarter of 2024. However, this was a decline from the $785 million reported in the fourth quarter of 2023. The decrease in earnings year-over-year highlights the challenges faced by the company, including lower average selling prices and decreased volumes in its steel mills and steel products segments.

Financial Achievements

Nucor Corp's financial achievements in 2024 are significant, particularly in the context of the steel industry. The company reported full-year net earnings of $2.03 billion, or $8.46 per diluted share, surpassing the annual EPS estimate of $8.19. This performance underscores Nucor's resilience and ability to navigate market fluctuations. The company's EBITDA for the year stood at $4.37 billion, reflecting its strong operational efficiency.

Key Financial Metrics

In the fourth quarter of 2024, Nucor's consolidated net sales decreased by 5% from the previous quarter and by 8% from the same period in 2023. The average sales price per ton also saw a decline, dropping 3% from the third quarter and 10% from the fourth quarter of 2023. Despite these challenges, the company shipped approximately 6,058,000 tons to outside customers, marking a 2% increase from the fourth quarter of 2023.

On the balance sheet front, Nucor maintained a strong financial position with $4.14 billion in cash and cash equivalents at the end of the fourth quarter. The company's revolving credit facility of $1.75 billion remains undrawn, providing additional financial flexibility.

Segment Performance

| Segment | Q4 2024 Earnings (in millions) | Q4 2023 Earnings (in millions) |

|---|---|---|

| Steel Mills | $169 | $588 |

| Steel Products | $329 | $656 |

| Raw Materials | $57 | $(14) |

Analysis and Outlook

Nucor Corp's performance in 2024 reflects its strategic positioning and operational strength in the steel industry. The company's ability to exceed earnings expectations despite market headwinds is a testament to its robust business model. Looking ahead, Nucor anticipates improved market conditions in 2025, driven by several steel-intensive megatrends in the U.S. economy. The company's commitment to returning capital to stockholders, evidenced by its ongoing dividend payments and share repurchase program, further enhances its appeal to value investors.

While steel demand softened throughout 2024, market conditions are starting to improve and should gain momentum as we work our way into 2025," said Leon Topalian, Chair, President, and Chief Executive Officer.

Explore the complete 8-K earnings release (here) from Nucor Corp for further details.