On January 15, 2025, Interval Partners, LP (Trades, Portfolio) made a significant move by acquiring an additional 1,822,182 shares in Camping World Holdings Inc (CWH, Financial). This transaction increased the firm's position in the company by 0.93%, bringing the total number of shares held to 3,495,769. The acquisition was executed at a price of $22.89 per share, reflecting a strategic addition to Interval Partners' diverse investment portfolio. This move positions Camping World Holdings as 1.78% of the firm's portfolio and represents 5.80% of the total shares of Camping World Holdings Inc.

Profile of Interval Partners, LP (Trades, Portfolio)

Interval Partners, LP (Trades, Portfolio) is a prominent investment firm located at 575 Lexington Avenue, New York, NY 10022. While the firm's specific investment philosophy is not disclosed, it is known for holding a diverse portfolio comprising 331 stocks with a total equity value of $4.45 billion. The firm's top holdings include C.H. Robinson Worldwide Inc (CHRW, Financial), FedEx Corp (FDX, Financial), Norfolk Southern Corp (NSC, Financial), Vulcan Materials Co (VMC, Financial), and Core & Main Inc (CNM, Financial). The firm's investment focus is primarily on the Industrials and Financial Services sectors.

Camping World Holdings Inc: Company Overview

Camping World Holdings Inc is a leading retailer of recreational vehicles (RVs) and related products and services. The company operates through two main segments: Good Sam Services and Plans, and Recreational Vehicle (RV) and Outdoor Retail. With a market capitalization of $1.37 billion, Camping World Holdings is a significant player in the Vehicles & Parts industry. As of the latest data, the company's stock is priced at $22.72. However, the company's financial metrics indicate challenges, with a Price-to-Earnings Ratio of 0.00, suggesting a loss, and a GF Valuation indicating the stock is significantly overvalued with a GF Value of $13.91.

Financial Metrics and Valuation

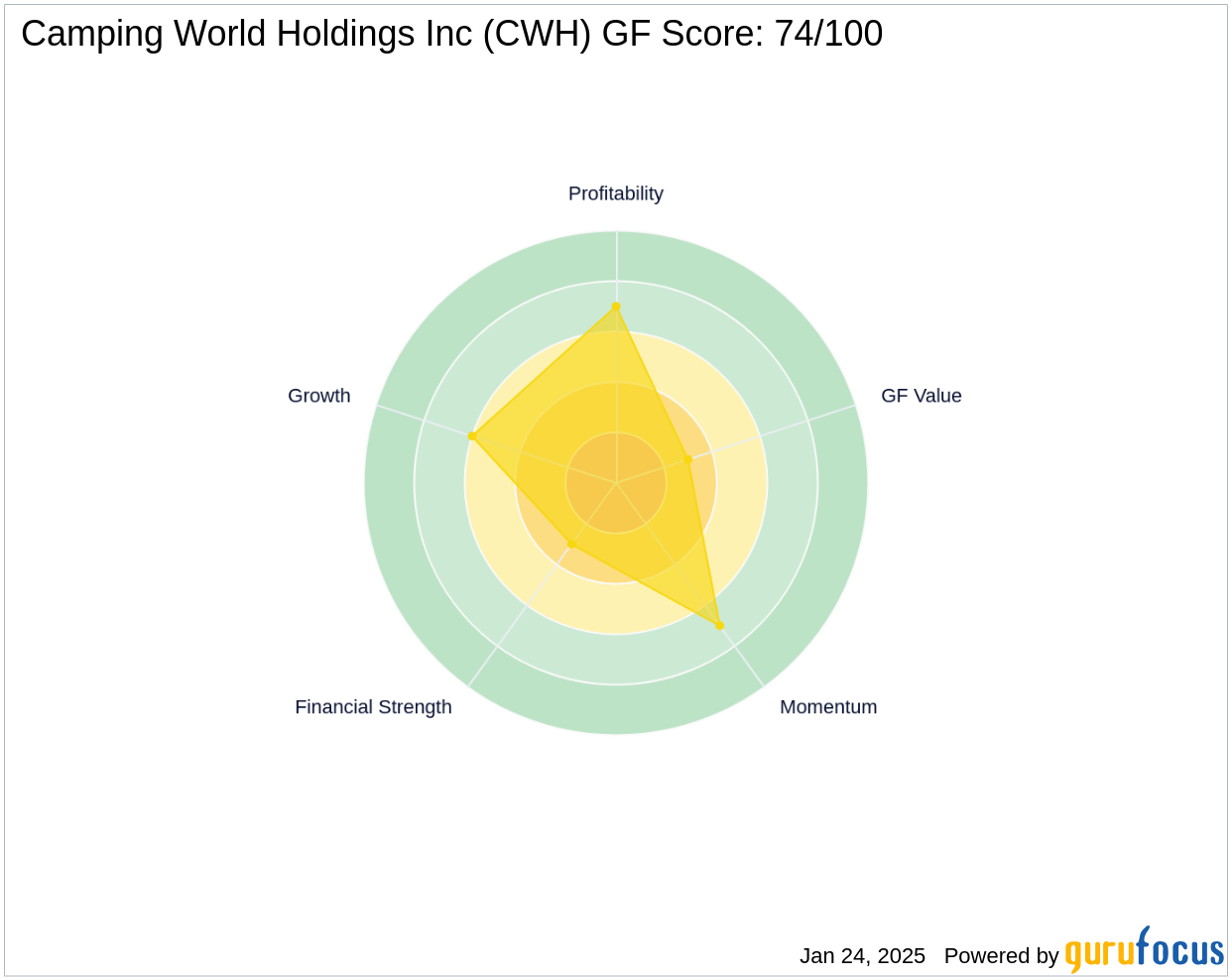

Camping World Holdings Inc's financial health presents a mixed picture. The company's Balance Sheet Rank is 3/10, indicating potential financial challenges. The Profitability Rank is more favorable at 7/10, while the Growth Rank stands at 6/10. The company's GF Score is 74/100, suggesting likely average performance. The Piotroski F-Score is 3, and the Altman Z score is 1.73, indicating potential financial distress. The company's Operating Margin growth is 12.50%, but the cash to debt ratio is a concerning 0.01.

Market Sentiment and Momentum

The market sentiment for Camping World Holdings Inc is reflected in its Relative Strength Index (RSI) of 46.82, indicating a neutral position. The Momentum Index over the past month shows a slight positive trend at 1.48, but a negative trend over the past year at -18.26. These metrics suggest a cautious market outlook, with potential volatility in the stock's performance.

Other Notable Gurus Holding the Stock

In addition to Interval Partners, LP (Trades, Portfolio), other prominent investment firms hold shares in Camping World Holdings Inc. The largest holder is Soros Fund Management LLC. Other notable investors include Joel Greenblatt (Trades, Portfolio) and Barrow, Hanley, Mewhinney & Strauss, indicating a level of confidence in the company's potential despite its current financial challenges.

Transaction Analysis

The recent acquisition by Interval Partners, LP (Trades, Portfolio) highlights a strategic decision to increase its stake in Camping World Holdings Inc. This move suggests confidence in the company's long-term potential, despite current financial challenges and a valuation that indicates the stock is significantly overvalued. The transaction has increased the firm's position in the stock to 1.78% of its portfolio, reflecting a calculated risk in the firm's investment strategy. As the market continues to evolve, the performance of Camping World Holdings Inc will be closely monitored by investors and analysts alike.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.