On December 31, 2024, Bank of New York Mellon Corp (Trades, Portfolio) executed a noteworthy transaction by acquiring an additional 876,399 shares of Voya Financial Inc. This acquisition was made at a trade price of $68.83 per share, reflecting the firm's strategic interest in expanding its holdings in Voya Financial. This move increased the firm's total holdings in Voya Financial to 6,472,277 shares, marking a 15.66% change in its position. The transaction impacts 0.01% of the firm's extensive portfolio, showcasing its calculated approach to investment management.

Bank of New York Mellon Corp (Trades, Portfolio): A Historical Financial Powerhouse

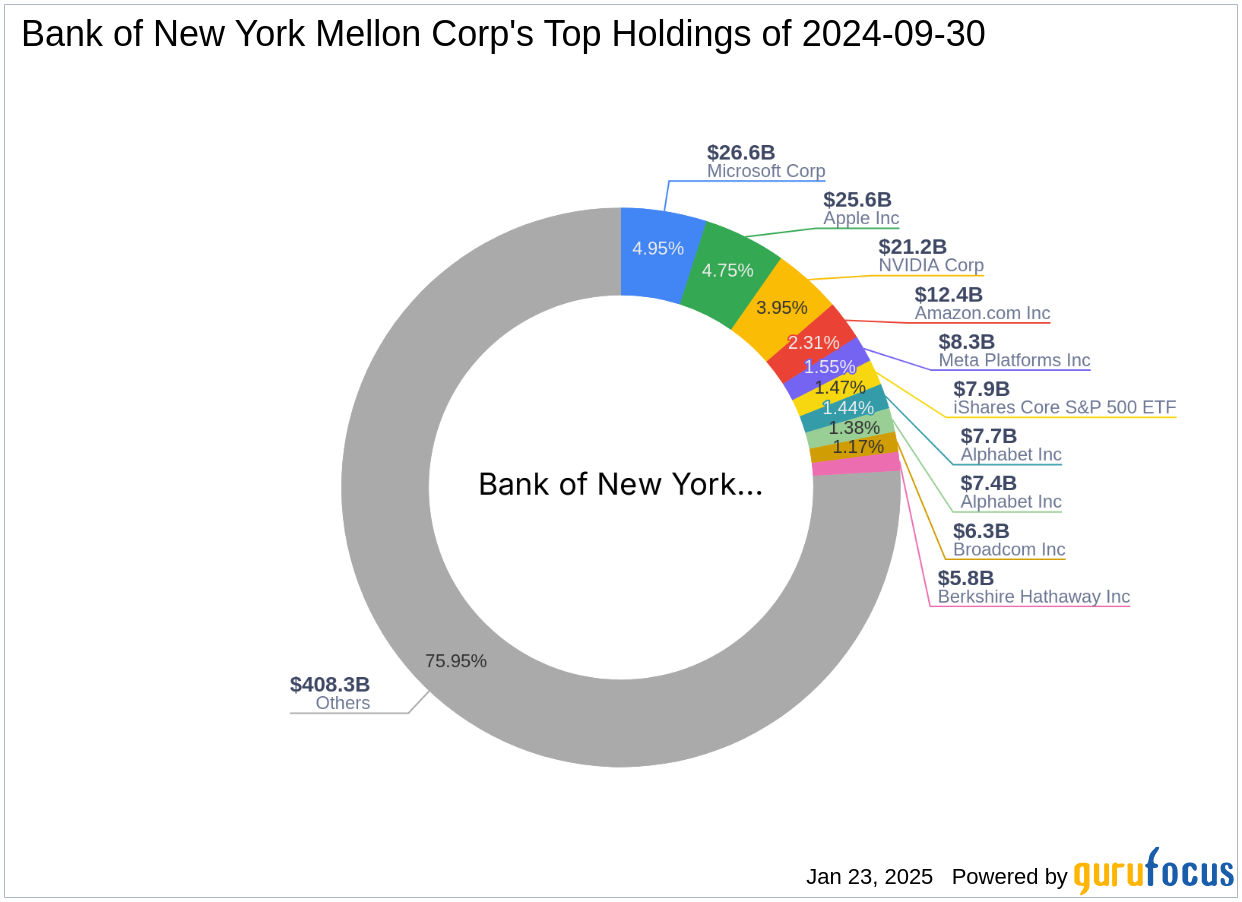

Bank of New York Mellon Corp (Trades, Portfolio), with a storied history dating back to 1784, is a global leader in financial services and investment management. The firm, known for its robust financial infrastructure, operates in 35 countries and manages $1.7 trillion in assets. As the largest deposit bank in the world, it has a significant influence in the financial sector. The firm's top holdings include major technology companies such as Apple Inc, Amazon.com Inc, and Microsoft Corp, reflecting its strategic focus on high-growth sectors.

Voya Financial Inc: A Diversified Financial Services Provider

Voya Financial Inc is a prominent player in the U.S. financial services industry, offering a range of investment, insurance, and retirement solutions. The company operates through three main segments: Wealth Solutions, Investment Management, and Health Solutions. With a market capitalization of $6.73 billion, Voya Financial is well-positioned in the diversified financial services sector. The company's stock is currently trading at $69.98, with a price-to-earnings (PE) ratio of 11.14, indicating a modest undervaluation according to GuruFocus valuation metrics.

Transaction Details and Portfolio Impact

The recent acquisition by Bank of New York Mellon Corp (Trades, Portfolio) increased its total holdings in Voya Financial Inc to 6,472,277 shares. This strategic addition represents a 15.66% change in the firm's position in Voya Financial, impacting 0.01% of its portfolio. The firm's current position in Voya Financial stands at 0.08% of its overall portfolio, reflecting a calculated diversification strategy. This transaction underscores the firm's confidence in Voya Financial's growth potential and market position.

Financial Metrics and Valuation Insights

Voya Financial Inc is currently trading at $69.98, with a PE ratio of 11.14, suggesting it is modestly undervalued. The GF Value of the stock is $86.93, indicating a price to GF Value ratio of 0.81, which implies potential undervaluation. The company's [GF Score](https://www.gurufocus.com/term/gf-score/VOYA) of 75/100 suggests likely average performance, with significant growth in EBITDA and earnings over the past three years. These metrics highlight Voya Financial's potential for future growth and profitability.

Performance and Growth Indicators

Since the transaction, Voya Financial Inc has shown a 1.67% gain, with a remarkable 263.53% increase since its IPO in 2013. The company's [Revenue Growth](https://www.gurufocus.com/term/rank-growth/VOYA) over the past three years stands at 5.60%, with an impressive EBITDA growth of 30.00% and earnings growth of 81.60%. These indicators reflect the company's robust financial health and growth trajectory, making it an attractive investment for value investors.

Other Notable Investors in Voya Financial Inc

In addition to Bank of New York Mellon Corp (Trades, Portfolio), other prominent investors in Voya Financial Inc include Keeley-Teton Advisors, LLC (Trades, Portfolio), and Jefferies Group (Trades, Portfolio). Pzena Investment Management LLC holds the largest share percentage among gurus, indicating strong institutional interest in the company. This collective investment interest underscores Voya Financial's potential as a valuable asset in diversified portfolios.

Transaction Analysis and Conclusion

The strategic acquisition of additional shares in Voya Financial Inc by Bank of New York Mellon Corp (Trades, Portfolio) reflects the firm's confidence in the company's growth potential and market position. This transaction not only enhances the firm's portfolio diversification but also aligns with its long-term investment strategy. As Voya Financial continues to demonstrate strong financial performance and growth, it remains a compelling investment opportunity for value investors seeking exposure to the diversified financial services sector.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

Also check out: