On January 23, 2025, Five Point Holdings LLC (FPH, Financial) released its 8-K filing detailing the financial results for the fourth quarter and full year of 2024. Five Point Holdings LLC, a prominent developer of mixed-use, master-planned communities in California, reported significant achievements in land sales and net income, despite challenges posed by the current interest rate environment.

Company Overview

Five Point Holdings LLC is engaged in developing large-scale communities that integrate residential, commercial, retail, educational, and recreational elements. The company operates through four segments: Valencia, San Francisco, Great Park, and Commercial, with the Great Park segment being the primary revenue driver.

Performance Highlights

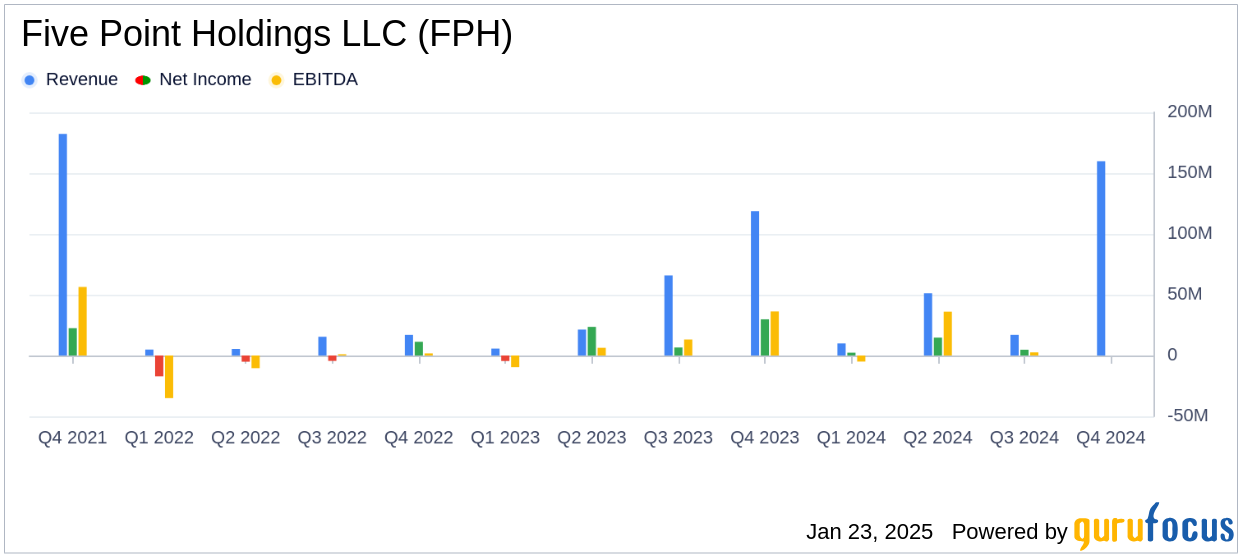

In the fourth quarter of 2024, Five Point Holdings LLC reported consolidated revenues of $159.8 million, primarily driven by land sales in the Valencia segment. The company achieved a consolidated net income of $121.0 million for the quarter, marking its seventh consecutive quarter of profitability. For the full year, consolidated revenues reached $237.9 million, with a net income of $177.6 million.

The Great Park Venture, a significant contributor to the company's earnings, sold 372 homesites for $309.3 million during the quarter. Additionally, the Valencia segment sold 493 homesites for $137.9 million. These sales underscore the strong demand for residential land, despite the uncertain interest rate environment.

Financial Achievements and Metrics

Five Point Holdings LLC's financial achievements are noteworthy, particularly in the real estate industry, where land sales and liquidity are critical. The company ended the year with cash and cash equivalents of $430.9 million and total liquidity of $555.9 million. The debt to total capitalization ratio stood at 19.6%, reflecting a solid financial position.

Key metrics from the financial statements include:

| Metric | Q4 2024 | Full Year 2024 |

|---|---|---|

| Revenues | $159.8 million | $237.9 million |

| Net Income | $121.0 million | $177.6 million |

| Cash and Cash Equivalents | $430.9 million | |

| Debt to Total Capitalization | 19.6% | |

Challenges and Strategic Outlook

Despite the positive financial results, Five Point Holdings LLC faces challenges due to the uncertain interest rate environment, which could impact future land sales and development activities. However, the company's strong liquidity position and successful execution of key operating priorities provide a solid foundation for pursuing new growth opportunities in 2025.

Dan Hedigan, Chief Executive Officer, stated, "I am pleased to report that we finished 2024 strong, with consolidated net income for the quarter of $121.0 million, giving us consolidated net income for the year of $177.6 million and total cash and cash equivalents of $430.9 million and total liquidity of $555.9 million as of year-end. This is our seventh consecutive quarter reporting net income, and the net income numbers for the quarter and the full year represent new high-water marks for the Company."

Conclusion

Five Point Holdings LLC's robust financial performance in 2024, driven by strategic land sales and effective management, positions the company well for future growth. As the company navigates the challenges of the interest rate environment, its focus on expanding its community developments and leveraging its financial strength will be crucial for sustaining its growth trajectory in the competitive real estate market.

Explore the complete 8-K earnings release (here) from Five Point Holdings LLC for further details.