On January 8, 2025, TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio) executed a significant transaction involving Compass Therapeutics Inc (CMPX, Financial). The firm added 5,587,005 shares to its holdings, increasing its total position to 7,400,000 shares. This move highlights the firm's strategic interest in Compass Therapeutics, a company focused on developing innovative treatments for cancer. The transaction was executed at a price of $1.86 per share, resulting in a 0.74% impact on the firm's portfolio. Currently, Compass Therapeutics Inc represents 0.98% of the firm's portfolio and 5.40% of its total holdings.

About TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio)

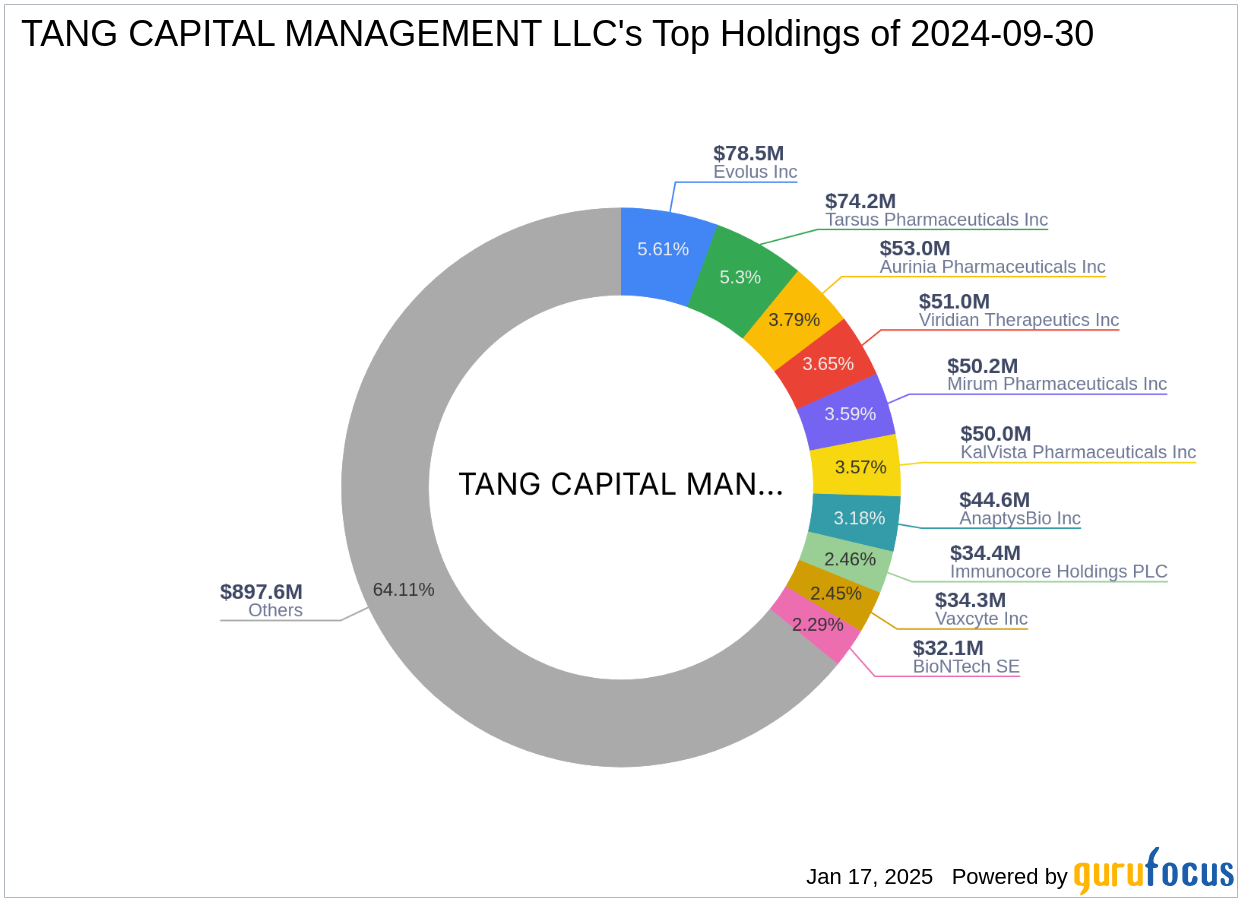

TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio) is a prominent investment firm based in San Diego, California, with a focus on the healthcare and technology sectors. The firm manages an equity portfolio valued at approximately $1.4 billion. Its top holdings include companies such as Aurinia Pharmaceuticals Inc (AUPH, Financial) and Viridian Therapeutics Inc (VRDN, Financial). The firm's investment philosophy centers around identifying and investing in companies with strong growth potential in its preferred sectors. This strategic approach has positioned TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio) as a key player in the investment landscape.

Compass Therapeutics Inc: Company Profile

Compass Therapeutics Inc is a clinical-stage biopharmaceutical company based in the USA, focusing on developing antibody therapeutics for cancer treatment. The company, which went public on November 13, 2020, has a market capitalization of $343.97 million. Compass Therapeutics is engaged in drug discovery by leveraging its proprietary antibody discovery engine to engage the immune system and identify optimal therapeutic combinations. Its pipeline includes product candidates such as CTX-009, CTX-471, and CTX-8371, which are designed to treat both solid tumors and hematological malignancies.

Financial and Market Performance

Since the transaction, Compass Therapeutics Inc's stock has experienced a 34.41% gain, currently trading at $2.50. Despite a year-to-date price increase of 78.57%, the stock has seen a 70.59% decline since its IPO. The company's financial health is reflected in its GF Score of 41/100, indicating potential challenges in future performance. Key financial metrics include a cash-to-debt ratio of 19.69 and a balance sheet rank of 7/10. However, its profitability and growth ranks are notably low, suggesting areas for improvement.

Implications for Value Investors

The addition of shares by TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio) may signal confidence in Compass Therapeutics Inc's long-term potential. For value investors, this transaction could be an indicator of the firm's belief in the company's future growth prospects. When evaluating potential opportunities, investors should consider the firm's investment philosophy and the stock's current valuation metrics. Despite the challenges indicated by the company's GF Score, the strategic increase in holdings by a reputable investment firm could suggest underlying potential that may not be immediately apparent.

Transaction Analysis

This transaction has a notable influence on both the stock and TANG CAPITAL MANAGEMENT LLC (Trades, Portfolio)'s portfolio. The increase in shares suggests a strategic move to capitalize on potential growth in Compass Therapeutics Inc. The firm's decision to enhance its position in the company, despite the stock's historical volatility, may reflect a calculated risk based on anticipated advancements in the company's pipeline. For investors, this move could serve as a cue to further investigate Compass Therapeutics Inc's potential as a viable investment opportunity.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.