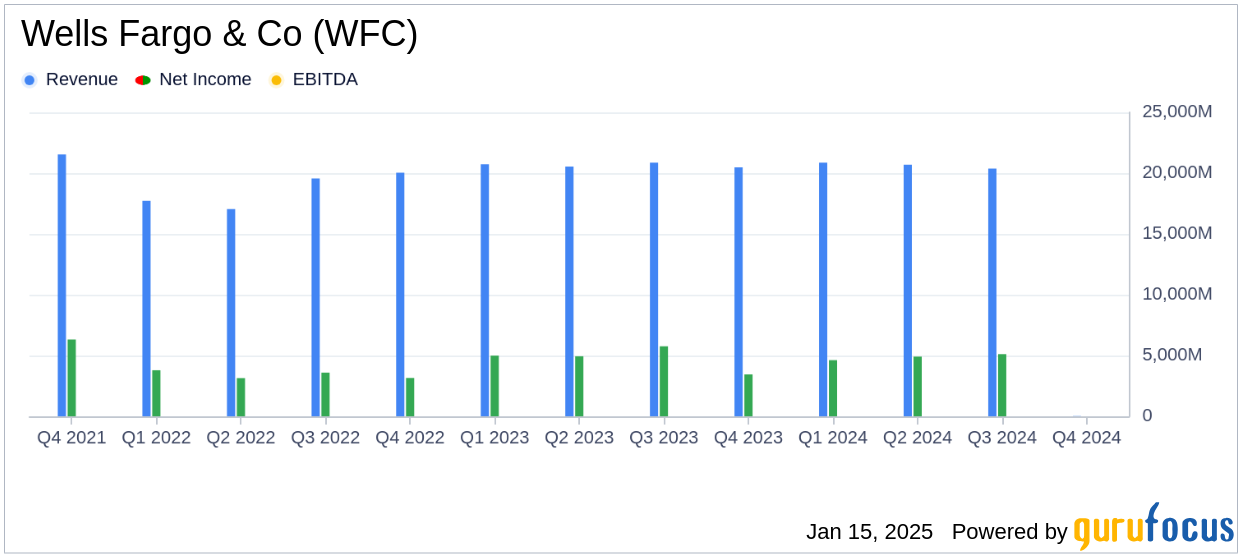

On January 15, 2025, Wells Fargo & Co (WFC, Financial) released its 8-K filing detailing the financial results for the fourth quarter of 2024. The company reported a net income of $5.1 billion, or $1.43 per diluted share, surpassing the analyst estimate of $1.34 per share. The full-year net income reached $19.7 billion, or $5.37 per diluted share, also exceeding the annual estimate of $5.29 per share. Wells Fargo, one of the largest banks in the United States with approximately $1.9 trillion in assets, operates primarily within the U.S. through its four main segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

Performance Highlights and Challenges

Wells Fargo's performance in the fourth quarter of 2024 reflects significant progress in its strategic initiatives. The company's total revenue for the quarter was $20,378 million, slightly below the estimated $20,584.81 million. Despite this, the bank managed to reduce noninterest expenses by 12% year-over-year, driven by lower Federal Deposit Insurance Corporation (FDIC) assessments and efficiency initiatives. The provision for credit losses decreased to $1,095 million from $1,282 million in the previous year, indicating stable credit trends.

However, the bank faced challenges with a 7% decrease in net interest income due to changes in deposit mix and pricing, as well as lower loan balances. These challenges underscore the importance of strategic adjustments in a fluctuating interest rate environment.

Financial Achievements and Industry Importance

Wells Fargo's financial achievements are noteworthy, particularly in the context of the banking industry. The company's return on equity (ROE) improved to 11.7% from 7.6% a year ago, and the return on tangible common equity (ROTCE) increased to 13.9% from 9.0%. These metrics are crucial for banks as they reflect the efficiency in generating profits from shareholders' equity.

The bank's capital position remains strong with a Common Equity Tier 1 (CET1) ratio of 11.1%, maintaining significant excess capital. This robust capital base is essential for sustaining growth and absorbing potential financial shocks.

Income Statement and Balance Sheet Overview

Wells Fargo's income statement reveals a solid performance with a net income increase to $5,079 million from $3,446 million in the fourth quarter of 2023. The balance sheet shows average loans of $906.4 billion, a decrease from $938.0 billion, while average deposits rose to $1,353.8 billion from $1,340.9 billion. These figures highlight the bank's ability to manage its assets and liabilities effectively.

| Metric | Q4 2024 | Q4 2023 |

|---|---|---|

| Total Revenue ($ millions) | 20,378 | 20,478 |

| Net Income ($ millions) | 5,079 | 3,446 |

| Diluted EPS ($) | 1.43 | 0.86 |

CEO Commentary and Strategic Outlook

"Our solid performance this quarter caps a year of significant progress for Wells Fargo. Our earnings profile continues to improve, we are seeing the benefit from investments we are making to increase our growth and improve how we serve our customers and communities," stated CEO Charlie Scharf.

CEO Charlie Scharf emphasized the company's strategic progress, highlighting the termination of a consent order related to sales practices as a significant milestone. The bank's focus on risk and control improvements, alongside investments in core businesses, positions it well for future growth.

Analysis and Conclusion

Wells Fargo's fourth-quarter results demonstrate resilience and strategic advancement amidst a challenging economic landscape. The bank's ability to exceed earnings estimates and maintain a strong capital position underscores its operational strength. However, the decrease in net interest income and loan balances indicates areas for continued focus and improvement. As Wells Fargo continues to navigate the evolving financial environment, its strategic initiatives and robust financial metrics provide a solid foundation for future success.

Explore the complete 8-K earnings release (here) from Wells Fargo & Co for further details.