On September 30, 2024, Barclays PLC executed a noteworthy transaction by acquiring a substantial number of shares in Anywhere Real Estate Inc. The firm added 7,280,767 shares at a price of $5.08 per share, bringing its total holdings to 7,454,759 shares. This strategic move highlights Barclays PLC's interest in the residential real estate sector, despite the challenges faced by Anywhere Real Estate Inc in recent times. The transaction reflects a calculated decision by Barclays PLC to potentially capitalize on future opportunities within the real estate market.

Barclays PLC: A Historical Financial Powerhouse

Barclays PLC is a distinguished British financial services company with a rich history dating back to 1690. The firm has evolved through numerous mergers and acquisitions, establishing a global presence with over 2 trillion in total assets. Operating in more than 50 countries, Barclays serves close to 50 million customers worldwide. The firm is listed on both the London Stock Exchange and the New York Stock Exchange. Barclays' investment portfolio is diverse, with top holdings in major technology companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), and Microsoft Corp (MSFT, Financial).

Anywhere Real Estate Inc: A Key Player in Residential Real Estate

Anywhere Real Estate Inc operates within the residential real estate sector, focusing on brokerage, relocation, and mortgage services. The company is renowned for its brands, including Better Homes and Gardens, CENTURY 21, and Coldwell Banker. Despite its strong brand presence, the company has faced financial challenges, with a current market capitalization of approximately $320.437 million. The stock is considered a possible value trap, with a GF Value of 6.81, indicating a price to GF Value ratio of 0.42.

Financial Metrics and Performance Indicators

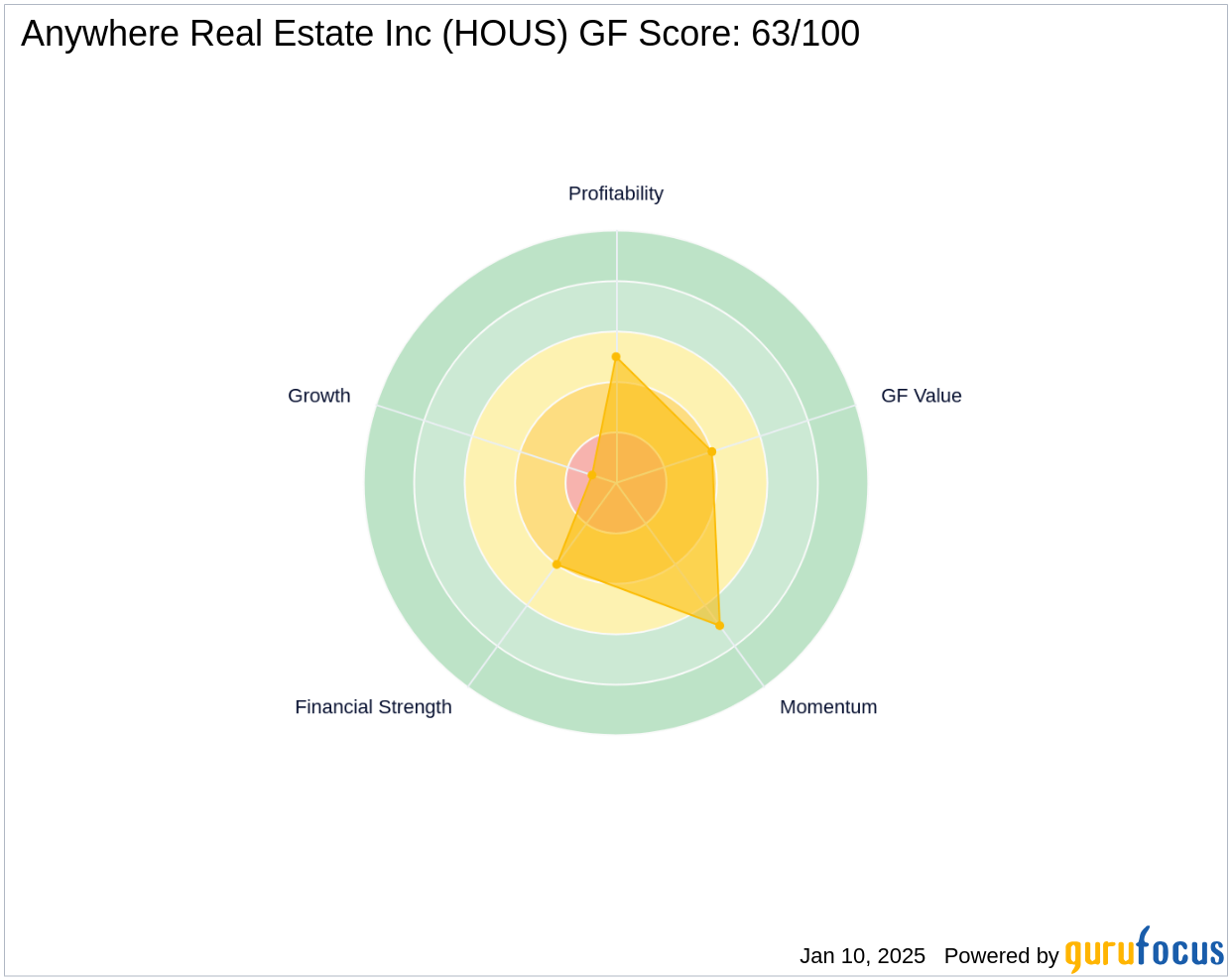

Anywhere Real Estate Inc has experienced a significant decline in stock performance, with a year-to-date price change of -11.11% and a price change since IPO of -91.23%. The company's GF Score is 63/100, suggesting poor future performance potential. The firm's Financial Strength and Profitability Rank are 4/10 and 5/10, respectively, indicating moderate financial health and profitability. The Altman Z score of 0.05 raises concerns about the company's financial stability.

Impact of the Transaction on Barclays PLC's Portfolio

The acquisition of Anywhere Real Estate Inc shares had a minimal impact on Barclays PLC's portfolio, with a trade impact of 0.01. The current position of Anywhere Real Estate Inc in Barclays PLC's portfolio is also 0.01, while the ratio of holdings in the traded stock is 6.71. This indicates that while the transaction is significant in terms of share volume, it represents a small fraction of Barclays PLC's overall investment strategy.

Other Notable Investors in Anywhere Real Estate Inc

In addition to Barclays PLC, Southeastern Asset Management holds the largest share percentage of Anywhere Real Estate Inc. Other notable investors include Barrow, Hanley, Mewhinney & Strauss. These investments by prominent financial entities suggest a continued interest in the potential recovery and growth of Anywhere Real Estate Inc, despite its current challenges.

In conclusion, Barclays PLC's acquisition of shares in Anywhere Real Estate Inc reflects a strategic decision to engage with the residential real estate sector. While the transaction's impact on Barclays' portfolio is minimal, it underscores the firm's interest in exploring opportunities within this industry. The involvement of other significant investors further highlights the potential for future developments in Anywhere Real Estate Inc's financial trajectory.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.