On December 31, 2024, BlackRock, Inc. (Trades, Portfolio) made a significant addition to its portfolio by acquiring 5,659,186 shares of the iShares Global Infrastructure ETF (IGF, Financial). This transaction was executed at a trade price of $52.27 per share, resulting in a 0.01% increase in the firm's portfolio. Post-transaction, BlackRock's total holdings in IGF amounted to 17,521,631 shares, representing 0.02% of its total portfolio. This strategic move underscores BlackRock's continued interest in diversifying its investment portfolio with infrastructure-focused assets.

BlackRock, Inc. (Trades, Portfolio): A Profile of the Investment Giant

BlackRock, Inc. (Trades, Portfolio), headquartered at 50 Hudson Yards, New York, NY, is a leading global investment management firm with a total equity of $4,761.03 trillion. While the firm's specific investment philosophy is not detailed, its top holdings include major technology and financial services companies such as Apple Inc (AAPL, Financial), Amazon.com Inc (AMZN, Financial), Meta Platforms Inc (META, Financial), Microsoft Corp (MSFT, Financial), and NVIDIA Corp (NVDA, Financial). These holdings reflect BlackRock's strategic focus on sectors with robust growth potential and technological innovation.

Understanding iShares Global Infrastructure ETF

The iShares Global Infrastructure ETF, currently priced at $52.74, boasts a market capitalization of $5 billion. With a price-to-earnings ratio of 15.02, the ETF is slightly overvalued compared to its GF Value of $47.75, resulting in a price to GF Value ratio of 1.10. This ETF is designed to provide exposure to global infrastructure companies, which are essential for economic development and growth. The ETF's GF Score of 78/100 suggests it is likely to deliver average performance in the long term.

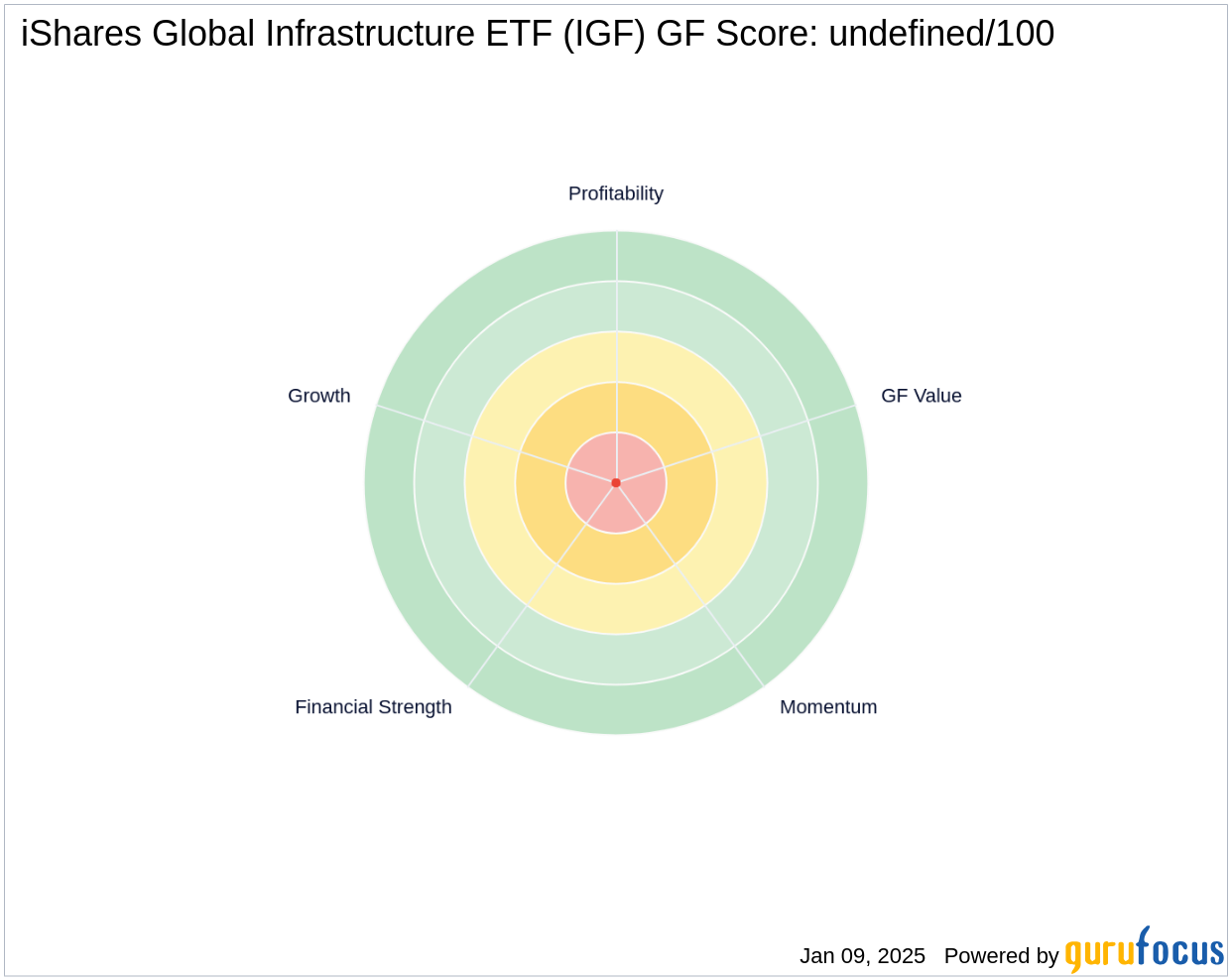

Performance Metrics and Valuation of IGF

iShares Global Infrastructure ETF's performance metrics reveal a mixed picture. The ETF has a balance sheet rank of 4.1/10, indicating some financial challenges, while its profitability rank is a solid 7/10. The growth rank stands at 6/10, and the momentum rank is 8/10, reflecting positive investor sentiment and market momentum.

Financial Health Indicators

Examining the financial health of IGF, the interest coverage ratio is 5.05, suggesting the ETF can comfortably meet its interest obligations. The cash to debt ratio is 0.33, indicating a moderate level of liquidity. The return on equity (ROE) is a robust 27.08%, while the return on assets (ROA) is 9.60%, both of which highlight the ETF's efficiency in generating returns from its investments.

Growth and Profitability Trends

Over the past three years, IGF has demonstrated impressive growth metrics, with revenue growth at 16.73%, EBITDA growth at 29.49%, and earnings growth at a remarkable 92.12%. The operating margin growth is 1.76%, indicating a steady improvement in operational efficiency. These trends suggest a positive outlook for the ETF's future profitability and growth potential.

Market Sentiment and Momentum

Market sentiment for IGF is reflected in its relative strength index (RSI) values, with a 5-day RSI of 62.98, a 9-day RSI of 52.52, and a 14-day RSI of 48.14. The momentum index for the 6-1 month period is 12.62, and for the 12-1 month period, it is 15.95. These indicators suggest a bullish trend, with investors showing increasing interest in the ETF.

Transaction Analysis

The acquisition of additional shares in IGF by BlackRock, Inc. (Trades, Portfolio) is a strategic move that aligns with the firm's broader investment strategy. By increasing its stake in the ETF, BlackRock is positioning itself to benefit from the potential growth in global infrastructure investments. This transaction, while representing a small portion of BlackRock's vast portfolio, underscores the firm's commitment to diversifying its holdings and capitalizing on emerging market opportunities.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.