On December 5, 2024, Malka Meyer (Trades, Portfolio), a recognized market expert, executed a significant transaction involving Robinhood Markets Inc (HOOD, Financial). This transaction marked a substantial reduction of 11,440,862 shares, representing a 56.94% decrease in the firm's holdings of the stock. The decision to reduce the stake in Robinhood Markets Inc is noteworthy, given the firm's previous substantial investment in the company. This move has sparked interest among investors and analysts, prompting a closer examination of the underlying factors influencing this decision.

Profile of Malka Meyer (Trades, Portfolio)

Malka Meyer (Trades, Portfolio) operates from Palo Alto, California, and is known for a focused investment strategy. The firm's portfolio is primarily concentrated in Nu Holdings Ltd (NU, Financial), reflecting a strong emphasis on value investing principles. With an equity portfolio valued at approximately $9 million, the firm has demonstrated a commitment to identifying undervalued opportunities in the market. This strategic approach has positioned Malka Meyer (Trades, Portfolio) as a respected figure in the investment community, with a reputation for making calculated and informed investment decisions.

Overview of Robinhood Markets Inc

Robinhood Markets Inc, a USA-based company, went public on July 29, 2021, and has since become known for its modern financial services platform. The company offers a range of services, including cryptocurrency trading and fractional shares, and earns revenue primarily through transaction-based activities. Robinhood's innovative approach to financial services has attracted a significant user base, contributing to its rapid growth and market presence. As of the transaction date, Robinhood's market capitalization stood at $36.84 billion, with a current stock price of $41.67.

Financial Metrics and Valuation

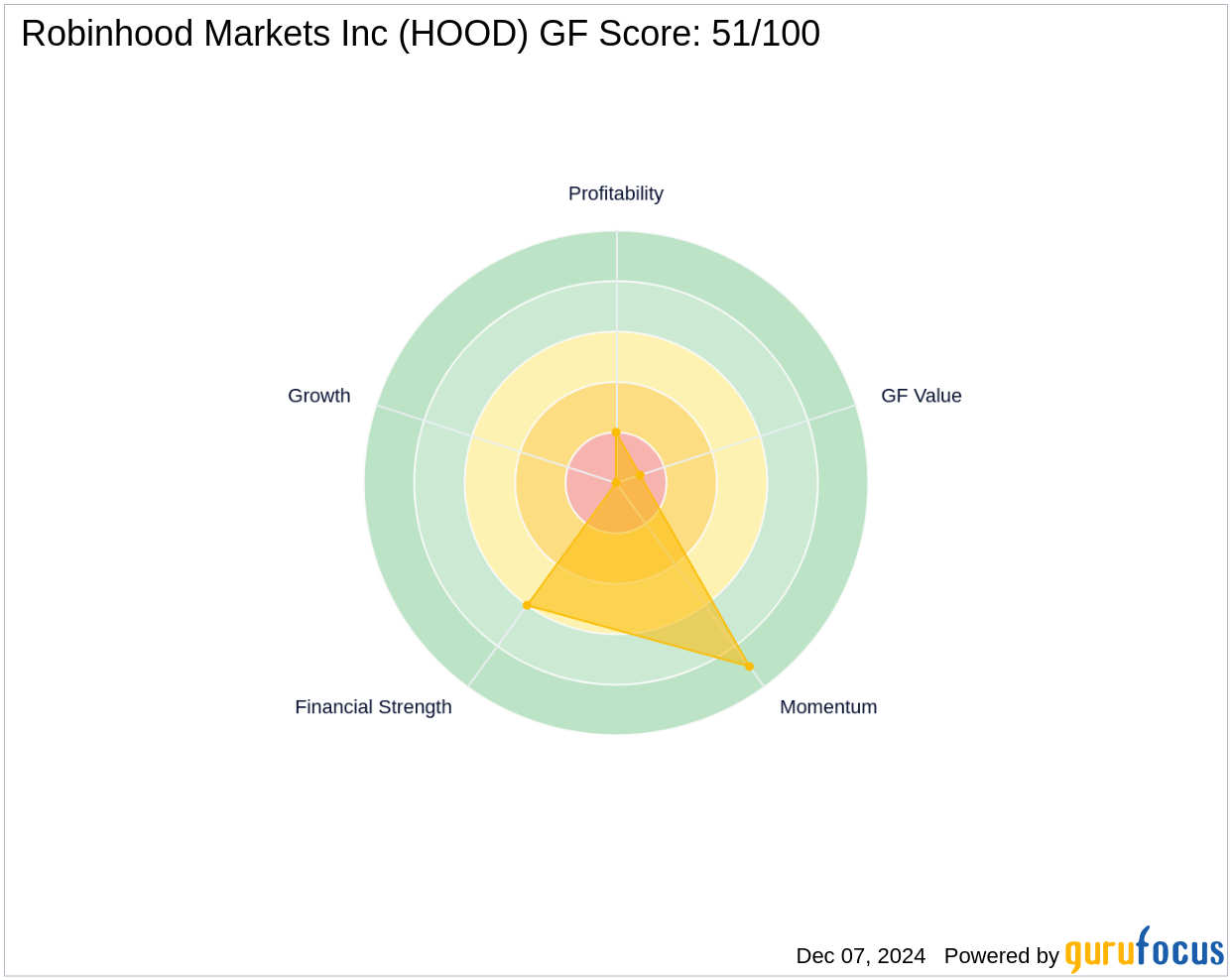

Despite its impressive market capitalization, Robinhood Markets Inc is considered significantly overvalued, with a GF Value of $17.22, indicating a price to GF Value ratio of 2.42. This suggests that the stock is trading at a premium compared to its intrinsic value, raising concerns about its long-term investment potential. The company's financial metrics further highlight these concerns, with a GF Score of 51/100, suggesting poor future performance potential. Investors should carefully consider these valuation metrics when evaluating the stock's investment prospects.

Performance and Growth Indicators

Robinhood has shown a year-to-date price change of 236.86% and a 9.66% increase since its IPO. These gains reflect the company's strong market momentum and investor interest. However, the company's financial health and profitability metrics paint a less optimistic picture. With a balance sheet rank of 6/10 and notably low profitability and growth ranks of 2/10 and 0/10, respectively, Robinhood's financial stability remains a concern. The company's cash to debt ratio of 1.51 and an interest coverage rank of 7 indicate a moderate level of financial stability.

Market Sentiment and Momentum

The stock's RSI values indicate strong momentum, with a 14-day RSI of 75.07, placing it in the overbought category. The momentum index over the past 6 to 12 months shows significant upward movement, reflecting positive market sentiment. This momentum has contributed to the stock's recent price gains, but it also raises questions about the sustainability of this trend. Investors should be cautious of potential volatility and consider the broader market conditions when assessing Robinhood's investment potential.

Conclusion and Implications for Investors

Malka Meyer (Trades, Portfolio)'s decision to reduce holdings in Robinhood Markets Inc may reflect concerns over the stock's valuation and future performance potential. The firm's strategic move highlights the importance of evaluating a company's financial metrics and market conditions when making investment decisions. Value investors should consider these factors, along with Robinhood's current financial health and market sentiment, to make informed investment choices. As the market continues to evolve, staying informed and adaptable will be key to navigating the complexities of investing in Robinhood Markets Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.