On November 30, 2024, renowned value investor Seth Klarman (Trades, Portfolio) received 9,341,051 shares of Sunrise Communications AG (SNRE, Financial) following the company's spinoff from Liberty Global (LBTYK, Financial). Sunrise Communications AG is thus a notable component of Klarman's portfolio, reflecting the firm's strategic interest in the telecommunications sector.

Understanding Seth Klarman (Trades, Portfolio)'s Investment Approach

Seth Klarman (Trades, Portfolio), the founder of The Baupost Group, is a distinguished figure in the investment world, known for a disciplined approach to value investing. With an economics degree from Cornell University and an MBA from Harvard University, Klarman has built a reputation for his cautious and calculated investment strategies. The firm's philosophy emphasizes risk management and the importance of maintaining a margin of safety, as outlined in the influential book "Margin of Safety." Klarman's portfolio is diverse, encompassing traditional value stocks and more complex investments such as distressed debt and foreign equities.

Overview of Sunrise Communications AG

Sunrise Communications AG is a prominent telecommunications company based in Switzerland, offering a wide range of services including mobile, landline, broadband, and TV services. The company caters to both residential and business customers, providing comprehensive communication solutions and integrated ICT services. Sunrise Communications AG is committed to advancing digitalization through its offerings, positioning itself as a key player in the Swiss telecommunications industry.

Impact of the Holding on Klarman's Portfolio

Sunrise Communications AG has a significant impact on Klarman's portfolio, with the stock now comprising 11.45% of the total holdings. This move underscores the firm's confidence in the telecommunications sector and the potential growth opportunities within Sunrise Communications AG. The stock represents 13.59% of Klarman's holdings, highlighting its strategic importance in the firm's investment strategy.

Financial Metrics and Market Performance

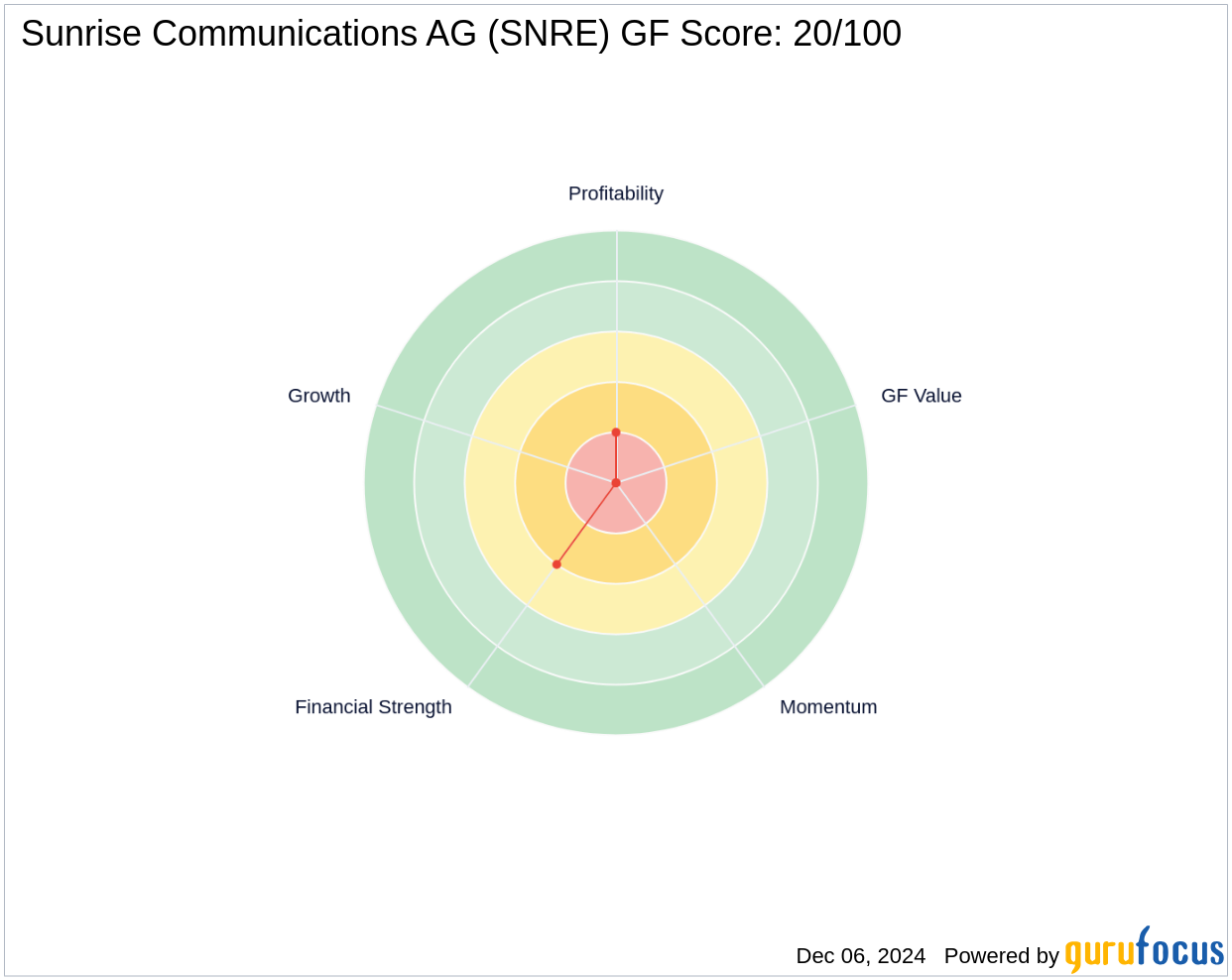

Sunrise Communications AG currently holds a market capitalization of $4.45 billion. Despite a recent decline in stock price to $46.98, the company has shown a modest 2.13% increase since its IPO on November 4, 2024. The stock's [GF-Score](https://www.gurufocus.com/term/gf-score/SNRE) is 20/100, indicating potential challenges in future performance. Additionally, the company's [Balance Sheet Rank](https://www.gurufocus.com/term/rank-balancesheet/SNRE) is 4/10, reflecting moderate financial strength.

Market Context and Other Influential Investors

Sunrise Communications AG has attracted interest from other notable investors, including David Einhorn (Trades, Portfolio) and Mario Gabelli (Trades, Portfolio). The company's recent IPO and subsequent market performance have positioned it as a stock of interest among value investors. The telecommunications sector's evolving landscape presents both opportunities and challenges, making it a focal point for strategic investments.

Conclusion: Strategic Implications for Value Investors

Seth Klarman (Trades, Portfolio)'s position in Sunrise Communications AG signifies a strategic move within the telecommunications sector. The holding reflects the firm's confidence in the company's potential for growth and its alignment with Klarman's value investing principles. For value investors, this position highlights the importance of identifying opportunities within established industries and underscores the potential benefits of a disciplined investment approach.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.