On November 19, 2024, Bracebridge Capital, LLC (Trades, Portfolio) executed a noteworthy transaction by acquiring 355,449 shares of Mallinckrodt PLC. This acquisition marks a new holding in the firm's portfolio, reflecting its strategic investment approach. The transaction was completed at a price of $0.12 per share, indicating a calculated move by the firm to potentially capitalize on the undervaluation of Mallinckrodt PLC. This purchase represents 0.02% of Bracebridge Capital's portfolio, while constituting 1.80% of the firm's holdings in Mallinckrodt PLC.

About Bracebridge Capital, LLC (Trades, Portfolio)

Bracebridge Capital, LLC (Trades, Portfolio) is a prominent investment firm headquartered in Boston, Massachusetts. Known for its strategic investments, the firm manages a portfolio equity of $275 million, with a particular focus on the Healthcare and Financial Services sectors. Bracebridge Capital's investment philosophy emphasizes identifying undervalued opportunities and leveraging them for long-term growth. The firm's top holdings include Uniti Group Inc (UNIT, Financial), Genworth Financial Inc (GNW, Financial), and Altice USA Inc (ATUS, Financial), among others.

Overview of Mallinckrodt PLC

Mallinckrodt PLC, based in Ireland, is a specialty pharmaceutical company that develops, manufactures, and distributes a range of pharmaceutical products and therapies. The company operates through two main segments: Specialty Brands and Specialty Generics. Mallinckrodt's focus areas include autoimmune and rare diseases, with significant revenue generated from the United States. Despite its broad product range, the company faces financial challenges, as reflected in its current market capitalization of $2.364 million and a stock price of $0.12.

Financial Metrics and Valuation

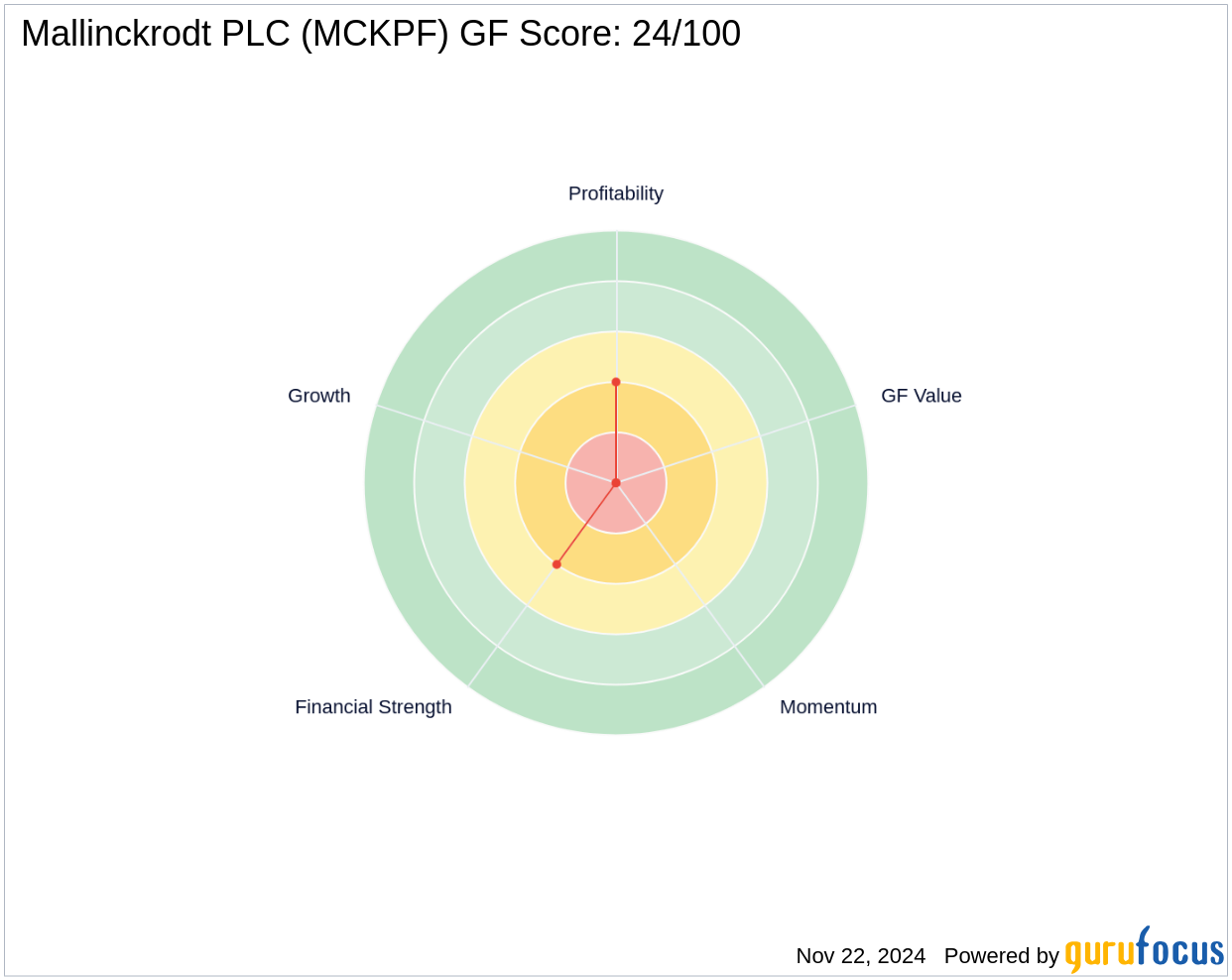

Mallinckrodt PLC's financial metrics reveal a complex picture. The company's market capitalization stands at $2.364 million, with a current stock price of $0.12. The estimated GF Value of the stock is $2.04, suggesting a significant undervaluation with a price to GF Value ratio of 0.06. However, the company's [GF Score](https://www.gurufocus.com/term/gf-score/MCKPF) is 24/100, indicating a poor future performance potential. Key financial ratios include a negative ROE of -20.88% and ROA of -3.48%, alongside a cash to debt ratio of 0.24, highlighting potential liquidity concerns.

Strategic Implications for Bracebridge Capital, LLC (Trades, Portfolio)

The acquisition of Mallinckrodt PLC shares aligns with Bracebridge Capital's investment strategy, potentially leveraging the stock's undervaluation. Despite the company's challenging financial outlook, the firm may view this as a long-term strategic play, banking on the potential for recovery or restructuring within Mallinckrodt PLC. This move could also reflect Bracebridge Capital's confidence in the company's ability to navigate its current financial difficulties and capitalize on its specialty pharmaceutical focus.

Transaction Analysis

This transaction by Bracebridge Capital, LLC (Trades, Portfolio) is a calculated risk, given Mallinckrodt PLC's current financial standing and market valuation. The firm's decision to invest in a company with a [Profitability Rank](https://www.gurufocus.com/term/rank-profitability/MCKPF) of 4/10 and a [Financial Strength](https://www.gurufocus.com/term/rank-balancesheet/MCKPF) rank of 4/10 suggests a belief in the potential for turnaround or strategic value. The [Altman Z score](https://www.gurufocus.com/term/zscore/MCKPF) of 0.79 indicates financial distress, yet Bracebridge Capital's investment could be a strategic move to gain from any future positive developments in Mallinckrodt PLC's business operations.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.