Overview of Recent Transaction

On September 30, 2024, First Trust Capital Management L.P. (Trades, Portfolio) made a significant addition to its investment portfolio by acquiring 506,244 shares of Investcorp Europe Acquisition Corp I (IVCB, Financial). This transaction, executed at a price of $11.79 per share, reflects a strategic move by the firm to bolster its holdings in the diversified financial services sector. The addition has increased the firm's total shares in IVCB to 506,244, representing a 2.81% stake in the company and accounting for 0.54% of First Trust's portfolio.

First Trust Capital Management L.P. (Trades, Portfolio) at a Glance

Located at 225 W. Wacker Drive, Chicago, IL, First Trust Capital Management L.P. (Trades, Portfolio) is a prominent investment firm known for its strategic portfolio management. The firm manages an equity portfolio worth approximately $1.5 billion, with a strong focus on financial services and technology sectors. Its top holdings include notable companies such as Stericycle Inc (SRCL, Financial), Avangrid Inc (AGR, Financial), and Marathon Oil Corp (MRO, Financial). The firm's investment philosophy emphasizes long-term growth and stability, aligning with its choice of investments across various sectors.

Investcorp Europe Acquisition Corp I: Company Profile

Investcorp Europe Acquisition Corp I, symbolized as IVCB and based in the Cayman Islands, was established as a blank check company. Since its IPO on February 3, 2022, IVCB has been actively involved in various acquisition, merger, and business restructuring activities within the diversified financial services industry. With a current market capitalization of approximately $207.48 million, the company plays a pivotal role in its sector.

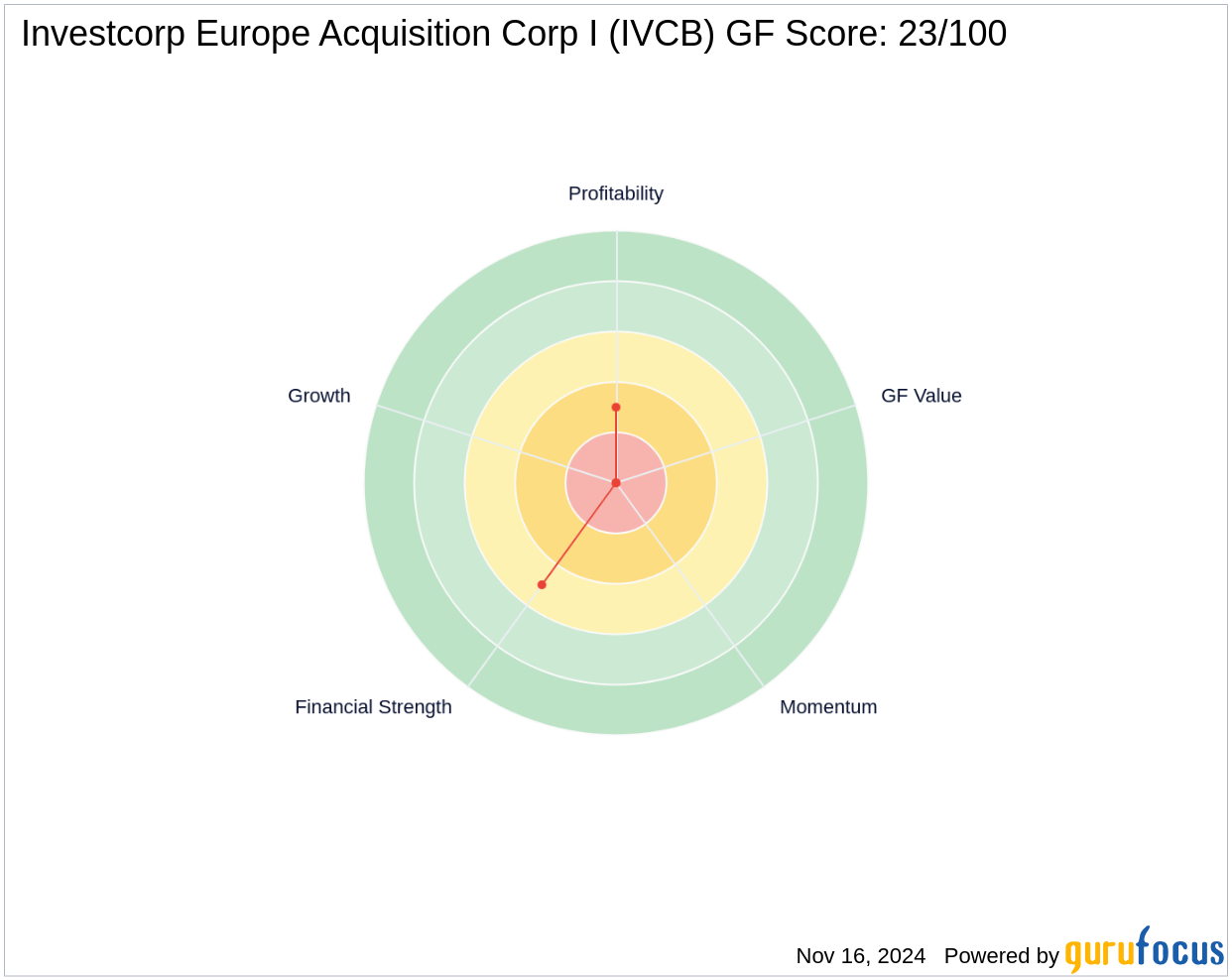

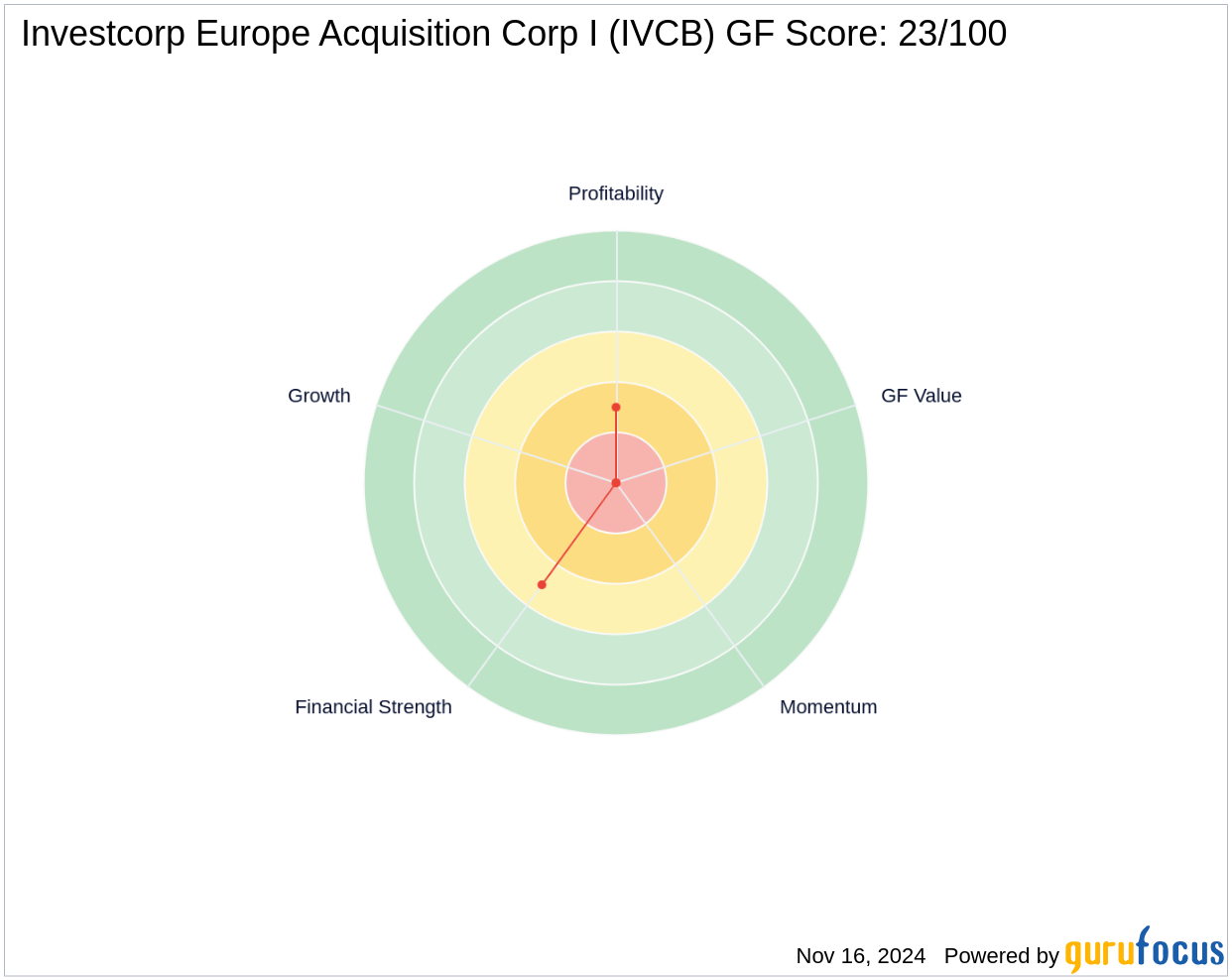

Financial Metrics and Market Performance

As of the latest data, IVCB's stock price stands at $11.52, reflecting a slight decline of 2.29% since the transaction date. Despite this, the stock has shown a year-to-date increase of 4.54% and an overall growth of 16.95% since its IPO. The company's PE ratio is notably high at 411.43, indicating potential investor optimism about future earnings. However, the GF Score of 23/100 suggests caution, as it points towards a lower future performance potential.

Impact on First Trust's Portfolio

The recent acquisition of IVCB shares has slightly adjusted the composition of First Trust's portfolio. Holding a 2.81% stake in IVCB now marks a strategic emphasis on the diversified financial services sector, aligning with the firm's broader investment goals. This move could potentially enhance the firm's market position by diversifying its investment base and leveraging growth in this sector.

Market and Sector Insights

The diversified financial services industry is currently experiencing dynamic changes, with companies like IVCB at the forefront of mergers and acquisitions. This sector's performance is crucial for investors looking for growth and stability in volatile markets. IVCB's role as a blank check company offers unique opportunities for strategic investments and partnerships, which could influence sector trends significantly.

Investment Considerations and Future Outlook

First Trust Capital Management L.P. (Trades, Portfolio)'s decision to increase its stake in IVCB may be driven by the potential for significant strategic acquisitions and mergers that IVCB could facilitate in the near future. Given the company's substantial PE ratio and its strategic position within the financial services sector, investors should closely monitor its performance. The future outlook for IVCB will likely depend on its ability to capitalize on market opportunities and navigate the complexities of financial services effectively.

For more detailed analysis and updates on IVCB and other investment opportunities, stay tuned to GuruFocus.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.