Overview of the Recent Transaction

On September 30, 2024, Jane Street Group, LLC made a significant addition to its investment portfolio by acquiring 6,533,731 shares of MicroStrategy Inc (MSTR, Financial), a prominent enterprise analytics and mobility software provider. This transaction increased Jane Street's total holdings in MicroStrategy to 9,550,491 shares, reflecting a substantial commitment to the company. The shares were purchased at a price of $168.60 each, marking a notable investment move by the firm.

Profile of Jane Street Group, LLC

Jane Street Group operates as a global trading powerhouse, renowned for its secretive operations and technological prowess. Founded in 2000 by Tim Reynolds and three partners, the firm has grown to handle daily trading volumes between $4 and $8 billion, representing nearly 2% of all U.S. stock trades. With over 400 employees, Jane Street has established itself as a major player in the trading of a diverse range of financial products across more than 200 electronic exchanges worldwide. The firm's significant focus on technology and in-house software development, particularly using the OCaml programming language, underscores its innovative approach to trading.

Insight into MicroStrategy Inc

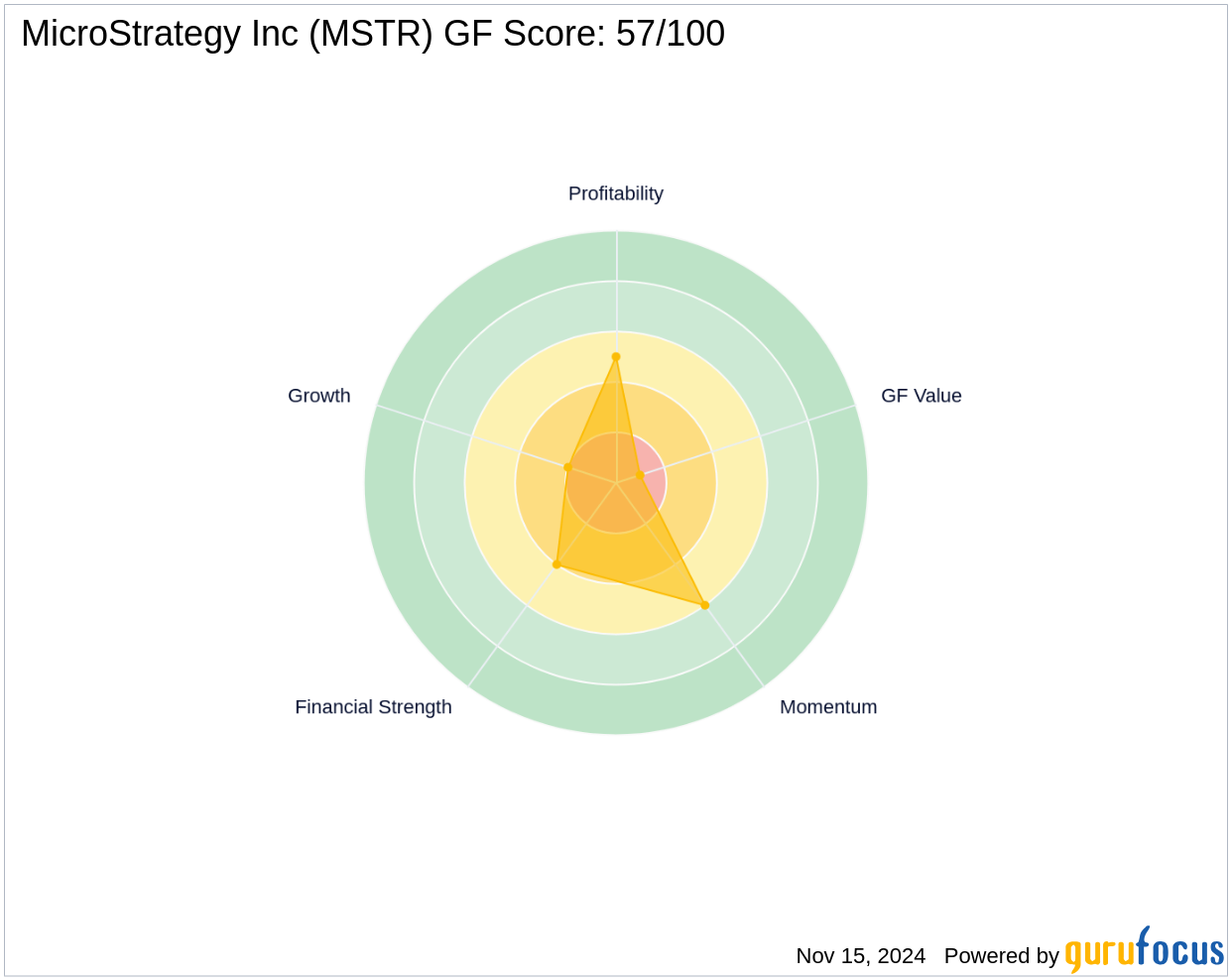

MicroStrategy Inc, listed under the ticker MSTR, operates primarily in the software industry, offering advanced analytics and mobility solutions. Since its IPO on June 11, 1998, the company has focused on developing its MicroStrategy Analytics platform, among other services. Despite its innovative offerings, the company's financial metrics such as a GF Score of 57/100 and a significantly overvalued GF Value status present a mixed financial picture. The company's market capitalization stands at $69.07 billion, with a current stock price of $327.67, which is considerably higher than its GF Value of $21.18.

Detailed Transaction Analysis

The acquisition by Jane Street Group has not only increased its stake in MicroStrategy but also raised its position in the firm's portfolio to 0.37%, with a significant impact of 0.25% on the portfolio. This move aligns with Jane Street's strategic focus on technology and high-value stocks, as evidenced by its top holdings which include major names like Apple Inc and Amazon.com Inc.

Market Performance and Strategic Implications

MicroStrategy's stock has shown remarkable growth with a year-to-date increase of 378.25%, and a staggering 3010.59% rise since its IPO. The recent transaction by Jane Street could be seen as a strategic alignment with MicroStrategy's growth trajectory despite its current overvaluation. This acquisition not only diversifies Jane Street's portfolio but also positions it to capitalize on potential future growth in the technology sector.

Future Prospects and Market Movements

Looking ahead, the implications of this substantial investment by Jane Street in MicroStrategy are multifaceted. It reflects a strong confidence in the future of enterprise software solutions and may influence other investors' perceptions of MicroStrategy. As the market continues to evolve, the strategic moves by influential trading firms like Jane Street will undoubtedly play a critical role in shaping the dynamics within the technology sector.

Concluding Thoughts

The recent acquisition of MicroStrategy shares by Jane Street Group underscores a significant endorsement of the software company's market position and future potential. This move not only enhances Jane Street's portfolio but also sets a robust foundation for its strategic interests in the technology domain, marking a noteworthy moment in the financial markets.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.