Overview of the Recent Transaction

On September 30, 2024, ORION RESOURCE PARTNERS (USA) LP, a prominent investment firm, executed a significant transaction by acquiring an additional 39,057,356 shares of i-80 Gold Corp (IAUX, Financial). This strategic move increased the firm's total holdings in the company to 60,857,356 shares, marking a substantial impact on its portfolio with an 11.97% trade impact. The shares were purchased at a price of $1.16 each, reflecting the firm's confidence in the potential of i-80 Gold Corp despite recent market fluctuations.

Profile of ORION RESOURCE PARTNERS (USA) LP

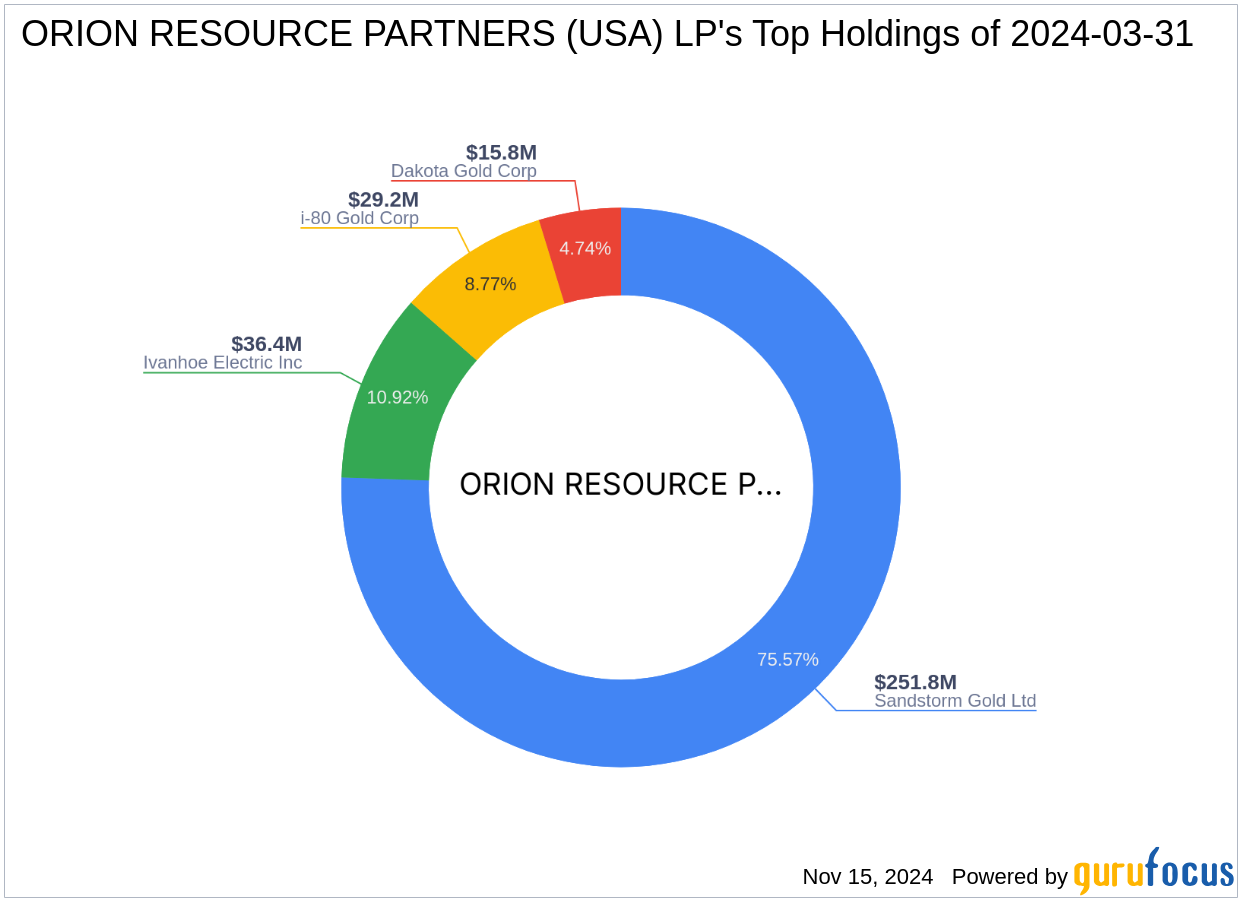

ORION RESOURCE PARTNERS (USA) LP is based at 1045 Avenue of the Americas, New York, NY. As an investment entity, the firm focuses on significant, value-driven opportunities primarily within the mining and metals sector. With a portfolio that includes top holdings such as Sandstorm Gold Ltd (SAND, Financial), Dakota Gold Corp (DC, Financial), and Ivanhoe Electric Inc (IE, Financial), ORION RESOURCE PARTNERS is known for its strategic investments in resource-rich companies. The firm currently manages an equity portfolio valued at approximately $333 million across four main holdings.

Detailed Analysis of the Trade

The recent acquisition by ORION RESOURCE PARTNERS significantly alters its stake in i-80 Gold Corp, bringing its portfolio position in the company to 18.65% and its holdings ratio to 13.90%. This move not only underscores the firm's commitment to i-80 Gold Corp but also reflects a strategic positioning within the mining sector, aiming to capitalize on the eventual market rebound.

Introduction to i-80 Gold Corp

i-80 Gold Corp, headquartered in Canada, is a dynamic player in the metals and mining industry, focusing on the exploration and production of gold, silver, and poly-metallic deposits. Its key assets include the Ruby Hill Mine and the Granite Creek Mine among others, primarily located in Nevada. Despite challenging market conditions, the company continues to push forward with its production and development projects.

Financial and Market Analysis of i-80 Gold Corp

As of the latest data, i-80 Gold Corp holds a market capitalization of $151.295 million but has been facing significant market challenges, with its stock price currently at $0.3915, reflecting a 66.25% decline since the transaction date. The company's financial health shows signs of strain, with a Financial Strength rank of 4/10 and a Profitability Rank of 2/10. The GF Score of 36/100 indicates poor future performance potential.

Strategic Importance of the Trade

The decision by ORION RESOURCE PARTNERS to increase its stake in i-80 Gold Corp at a time of low stock prices could be seen as a counter-cyclical investment with the expectation of long-term gains. This aligns with the firm's investment philosophy of focusing on value and long-term growth potential within the mining sector.

Performance Metrics and Future Outlook

The future of i-80 Gold Corp hinges on its ability to efficiently manage its assets and navigate the volatile gold market. For ORION RESOURCE PARTNERS, the increased stake in i-80 Gold Corp could either be a strategic masterstroke or a high-stakes gamble, depending on how gold prices and mining operations evolve in the coming years.

Conclusion

In conclusion, ORION RESOURCE PARTNERS (USA) LP's recent acquisition of shares in i-80 Gold Corp represents a significant enhancement to its investment portfolio and reflects a deep conviction in the future prospects of the mining sector. This move could potentially yield substantial returns, depending on market conditions and the company's operational success.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.