Overview of the Recent Transaction

On September 30, 2024, RiverNorth Capital Management, LLC made a significant addition to its investment portfolio by acquiring 1,379,762 shares of Pioneer Muni High Income Advantage Trust (MAV, Financial). This transaction, executed at a price of $8.84 per share, represents a notable increase of 341,293 shares, enhancing the firm's stake by 32.87%. This move has increased the firm's total holdings in MAV to 5.77% of their portfolio, reflecting a strategic emphasis on this asset.

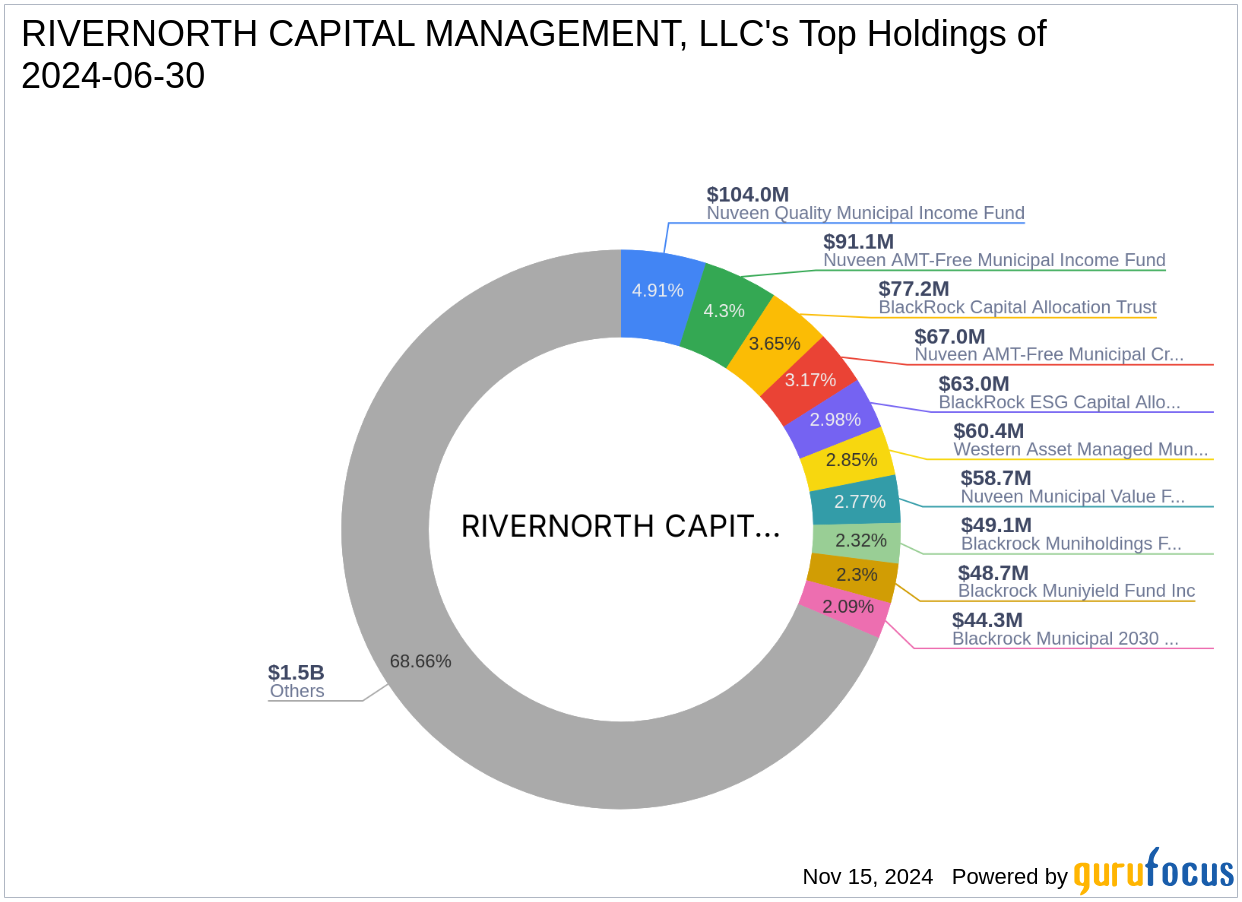

Insight into RiverNorth Capital Management, LLC

Located at 325 N. LaSalle Street, Chicago, IL, RiverNorth Capital Management, LLC is a prominent investment firm known for its dynamic and opportunistic approach to investing. With a focus primarily on financial services and basic materials, the firm manages an equity portfolio worth approximately $2.12 billion, comprising 443 stocks. Their top holdings include a variety of municipal income funds, highlighting a strategic preference for income-generating assets.

Understanding Pioneer Muni High Income Advantage Trust (MAV, Financial)

MAV operates as a closed-end fund aiming to provide high current income exempt from regular federal income tax, with a secondary objective of capital appreciation. It invests mainly in municipal debt securities within the United States. Despite a challenging market, MAV maintains a market capitalization of $208.296 million, with a current stock price of $8.71, reflecting a slight decline of 1.47% since the transaction date.

Impact of the Trade on RiverNorth's Portfolio

The recent acquisition has a moderate impact on RiverNorth's portfolio, with a 0.14% change in position. This adjustment signifies a deeper commitment to MAV, aligning with RiverNorth's investment philosophy of prioritizing high-yield opportunities within the municipal bond sector.

Market Performance and Strategic Significance

MAV's current market valuation and its year-to-date performance increase of 7.8% suggest a stabilizing trend in its market activities. The strategic acquisition by RiverNorth could be driven by MAV's consistent income generation and its potential for capital appreciation, fitting well within RiverNorth's top sector holdings in financial services.

Future Prospects and Comparative Analysis

Despite its challenges, including a significant revenue decline over the past three years, MAV holds a Piotroski F-Score of 7, indicating a relatively healthy financial condition. The fund's focus on tax-exempt income may offer a resilient investment option during volatile market conditions. Comparatively, MAV's performance within the asset management industry appears aligned with sector averages, though its growth and profitability ranks suggest areas for potential improvement.

Conclusion: Evaluating the Transaction's Broader Implications

RiverNorth's increased investment in MAV reflects a calculated strategy to enhance its portfolio's income potential through tax-advantaged municipal bonds. This move not only diversifies RiverNorth's holdings but also capitalizes on MAV's stable income generation capabilities. As the market continues to evolve, this strategic positioning might yield significant returns, aligning with RiverNorth's broader investment objectives.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.